Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In excel or Word doc please You are evaluating the following project. All $ are in millions Initial cost of the project at t-0 is

In excel or Word doc please

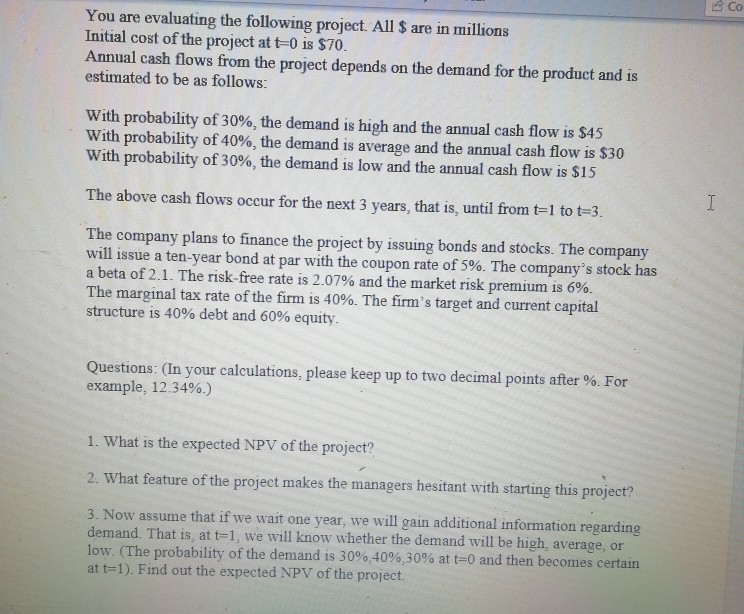

You are evaluating the following project. All $ are in millions Initial cost of the project at t-0 is $70. Annual cash flows from the project depends on the demand for the product and is estimated to be as follows: With probability of 30%, the demand is high and the annual cash flow is $45 With probability of 40%, the demand is average and the annual cash flow is $30 With probability of 30%, the demand is low and the annual cash flow is $15 The above cash flows occur for the next 3 years, that is, until from t-1 to t-3. The company plans to finance the project by issuing bonds and stocks. The company will issue a ten-year bond at par with the coupon rate of 5%. The company's stock has a beta of 2.1. The risk-free rate is 2.07% and the market risk premium is 6%. The marginal tax rate of the firm is 40%. The firm's target and current capital structure is 40% debt and 60% equity. Questions: (in your calculations, please keep up to two decimal points after 90 For example, 12.34%.) 1. What is the expected NPV of the project? 2. What feature of the project makes the managers hesitant with starting this project? 3. Now assume that if we wait one year, we will gain additional information regarding demand. That is, at t-1, we will know whether the demand will be high, average, or low. (The probability of the demand is 30%,40%,30% at t-0 and then becomes certain at t=1). Find out the expected NPV of the proiectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started