Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In February 2001 Turkey's rapidly escalating economic kriz, or crisis, forced the devaluation of the Turkish Lira. The Turkish government has successfully waged war

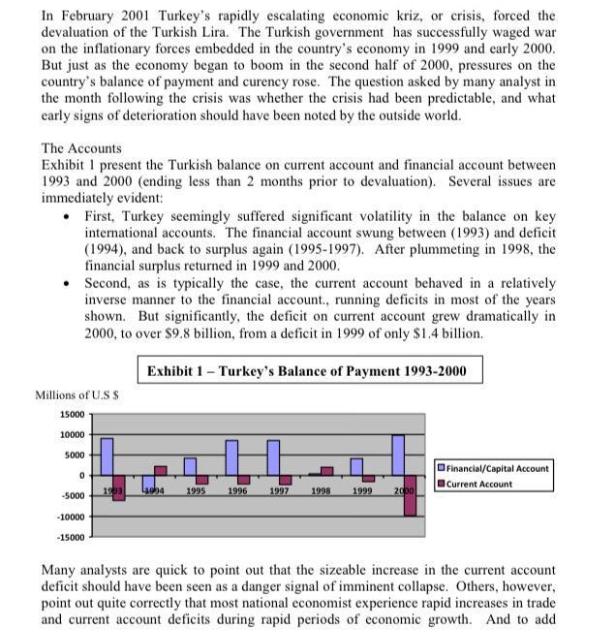

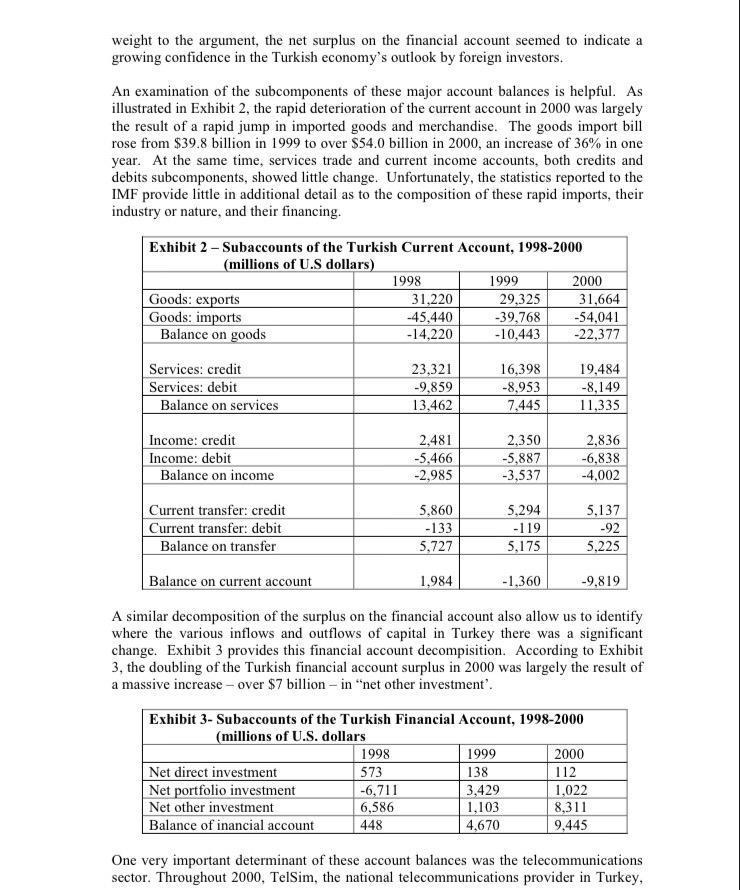

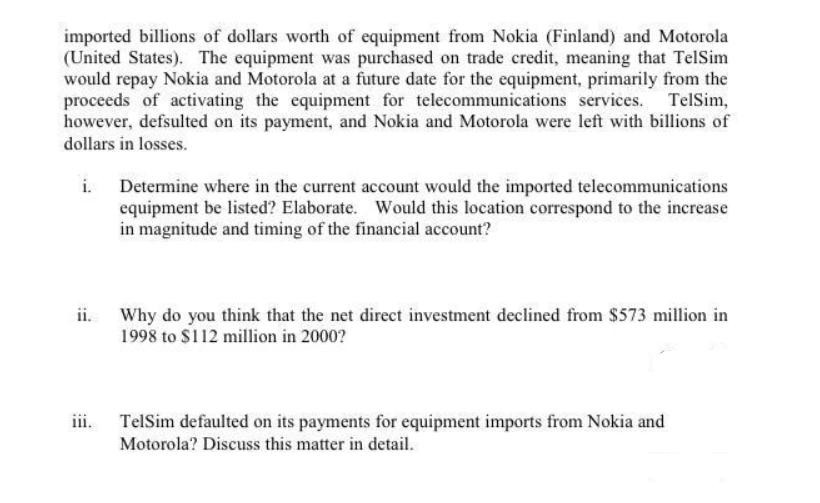

In February 2001 Turkey's rapidly escalating economic kriz, or crisis, forced the devaluation of the Turkish Lira. The Turkish government has successfully waged war on the inflationary forces embedded in the country's economy in 1999 and early 2000. But just as the economy began to boom in the second half of 2000, pressures on the country's balance of payment and curency rose. The question asked by many analyst in the month following the crisis was whether the crisis had been predictable, and what early signs of deterioration should have been noted by the outside world. The Accounts Exhibit 1 present the Turkish balance on current account and financial account between 1993 and 2000 (ending less than 2 months prior to devaluation). Several issues are immediately evident: . First, Turkey seemingly suffered significant volatility in the balance on key international accounts. The financial account swung between (1993) and deficit (1994), and back to surplus again (1995-1997). After plummeting in 1998, the financial surplus returned in 1999 and 2000. . Second, as is typically the case, the current account behaved in a relatively inverse manner to the financial account., running deficits in most of the years shown. But significantly, the deficit on current account grew dramatically in 2000, to over $9.8 billion, from a deficit in 1999 of only $1.4 billion. Exhibit 1 - Turkey's Balance of Payment 1993-2000 Millions of U.S S 15000 10000 5000 0 -5000 -10000 -15000 1903 054 1995 1996 1997 1998 1999 2000 Financial/Capital Account Current Account Many analysts are quick to point out that the sizeable increase in the current account deficit should have been seen as a danger signal of imminent collapse. Others, however, point out quite correctly that most national economist experience rapid increases in trade and current account deficits during rapid periods of economic growth. And to add weight to the argument, the net surplus on the financial account seemed to indicate a growing confidence in the Turkish economy's outlook by foreign investors. An examination of the subcomponents of these major account balances is helpful. As illustrated in Exhibit 2, the rapid deterioration of the current account in 2000 was largely the result of a rapid jump in imported goods and merchandise. The goods import bill rose from $39.8 billion in 1999 to over $54.0 billion in 2000, an increase of 36% in one year. At the same time, services trade and current income accounts, both credits and debits subcomponents, showed little change. Unfortunately, the statistics reported to the IMF provide little in additional detail as to the composition of these rapid imports, their industry or nature, and their financing. Exhibit 2 - Subaccounts of the Turkish Current Account, 1998-2000 (millions of U.S dollars) Goods: exports Goods: imports Balance on goods Services: credit Services: debit Balance on services Income: credit Income: debit Balance on income 1998 Net direct investment Net portfolio investment Net other investment Balance of inancial account 1998 573 31,220 -45,440 -14,220 23,321 -9,859 13,462 -6,711 6,586 448 2,481 -5,466 -2,985 5,860 -133 5,727 1999 1,984 29,325 31,664 -39,768 -54,041 -10,443 -22,377 Current transfer: credit Current transfer: debit Balance on transfer Balance on current account A similar decomposition of the surplus on the financial account also allow us to identify where the various inflows and outflows of capital in Turkey there was a significant change. Exhibit 3 provides this financial account decompisition. According to Exhibit 3, the doubling of the Turkish financial account surplus in 2000 was largely the result of a massive increase - over $7 billion in "net other investment'. 16,398 -8,953 7,445 2,350 -5,887 -3,537 1999 138 3,429 1,103 4,670 2000 5,294 -119 5,175 -1,360 19,484 -8,149 11,335 Exhibit 3- Subaccounts of the Turkish Financial Account, 1998-2000 (millions of U.S. dollars 2,836 -6,838 -4,002 5,137 -92 5,225 -9,819 2000 112 1,022 8,311 9,445 One very important determinant of these account balances was the telecommunications sector. Throughout 2000, TelSim, the national telecommunications provider in Turkey, imported billions of dollars worth of equipment from Nokia (Finland) and Motorola (United States). The equipment was purchased on trade credit, meaning that TelSim would repay Nokia and Motorola at a future date for the equipment, primarily from the proceeds of activating the equipment for telecommunications services. TelSim, however, defsulted on its payment, and Nokia and Motorola were left with billions of dollars in losses. i. Determine where in the current account would the imported telecommunications equipment be listed? Elaborate. Would this location correspond to the increase in magnitude and timing of the financial account? ii. Why do you think that the net direct investment declined from $573 million in 1998 to $112 million in 2000? iii. TelSim defaulted on its payments for equipment imports from Nokia and Motorola? Discuss this matter in detail.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started