Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In February 2003 Converse, makers of the distinctive Chuck Taylor All Star high-top sneaker, were preparing for the company's initial public offering. The deal

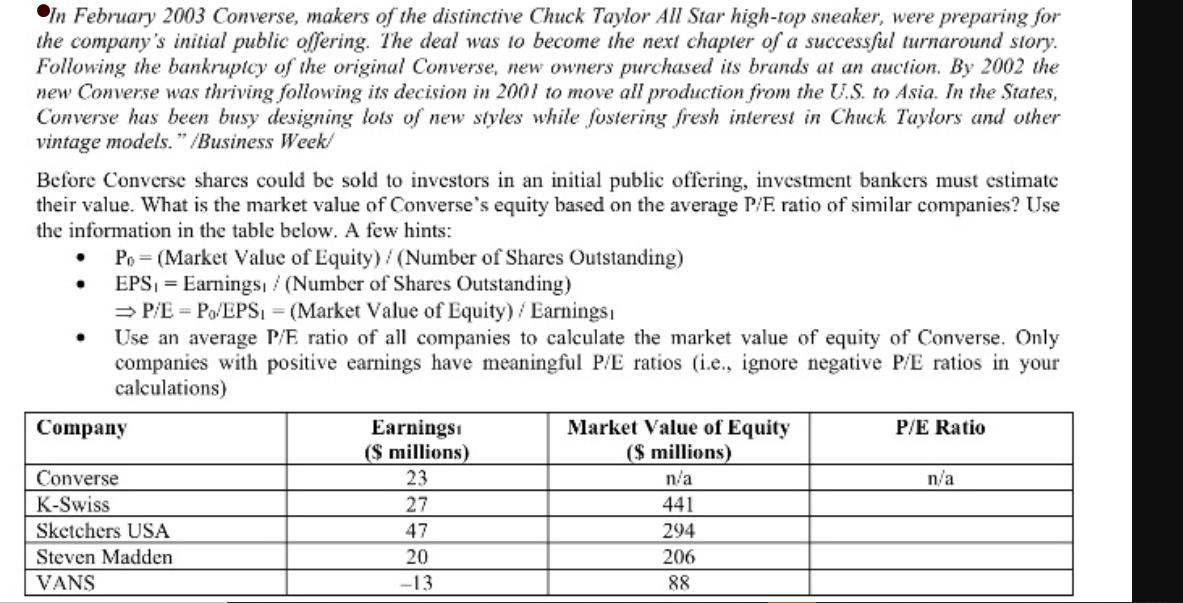

In February 2003 Converse, makers of the distinctive Chuck Taylor All Star high-top sneaker, were preparing for the company's initial public offering. The deal was to become the next chapter of a successful turnaround story. Following the bankruptcy of the original Converse, new owners purchased its brands at an auction. By 2002 the new Converse was thriving following its decision in 2001 to move all production from the U.S. to Asia. In the States, Converse has been busy designing lots of new styles while fostering fresh interest in Chuck Taylors and other vintage models." /Business Week/ Before Converse shares could be sold to investors in an initial public offering, investment bankers must estimate their value. What is the market value of Converse's equity based on the average P/E ratio of similar companies? Use the information in the table below. A few hints: Po = (Market Value of Equity) / (Number of Shares Outstanding) EPS = Earnings (Number of Shares Outstanding) P/E = Po/EPS = (Market Value of Equity) / Earnings Use an average P/E ratio of all companies to calculate the market value of equity of Converse. Only companies with positive earnings have meaningful P/E ratios (i.e., ignore negative P/E ratios in your calculations) Company Converse K-Swiss Sketchers USA Steven Madden VANS Earnings ($ millions) 23 27 47 20 -13 Market Value of Equity ($ millions) n/a 441 294 206 88 P/E Ratio n/a

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started