Answered step by step

Verified Expert Solution

Question

1 Approved Answer

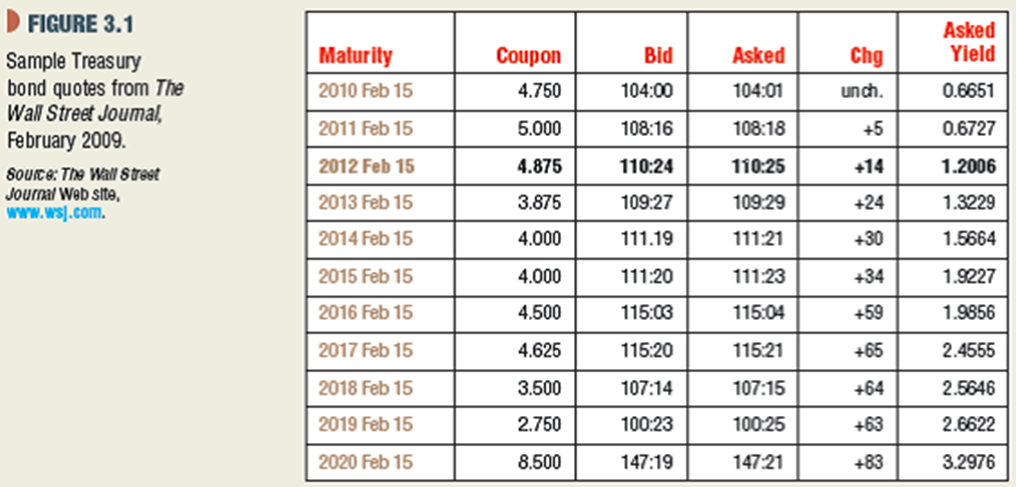

In February 2009, Treasury 8.5s of 2020 yielded 3.2976% (see Figure 3.1). What was their price? If the yield rose to 4%, what would happen

In February 2009, Treasury 8.5s of 2020 yielded 3.2976% (see Figure 3.1). What was their price? If the yield rose to 4%, what would happen to the price?

FIGURE 3.1 Sample Treasury bond quotes from The Wall Street Joumal, February 2009. Source: The Wall Street Journal Web site, www.wsj.com. Maturity 2010 Feb 15 2011 Feb 15 2012 Feb 15 2013 Feb 15 2014 Feb 15 2015 Feb 15 2016 Feb 15 2017 Feb 15 2018 Feb 15 2019 Feb 15 2020 Feb 15 Coupon 4.750 5.000 4.875 3.875 4.000 4.000 4.500 4.625 3.500 2.750 8.500 Bid 104:00 108:16 110:24 109:27 111.19 111:20 115:03 115:20 107:14 100:23 147:19 Asked 104:01 108:18 110:25 109:29 111:21 111:23 115:04 115:21 107:15 100:25 147:21 Chg unch. +5 +14 +24 +30 +34 +59 +65 +64 +63 +83 Asked Yield 0.6651 0.6727 1.2006 1.3229 1.5664 1.9227 1.9856 2.4555 2.5646 2.6622 3.2976

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Treasury 85s is yielding 32976 on February 2009 It matures on February 2020 Assume the face value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started