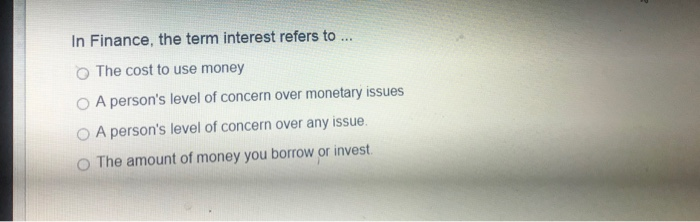

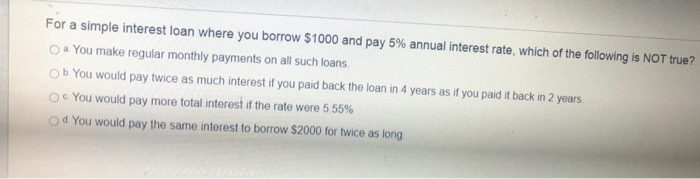

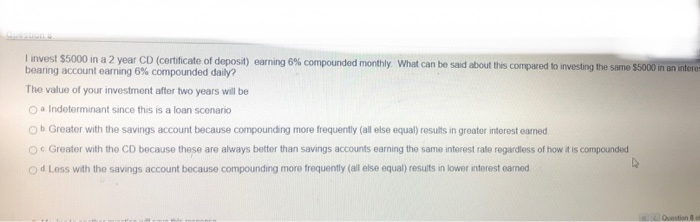

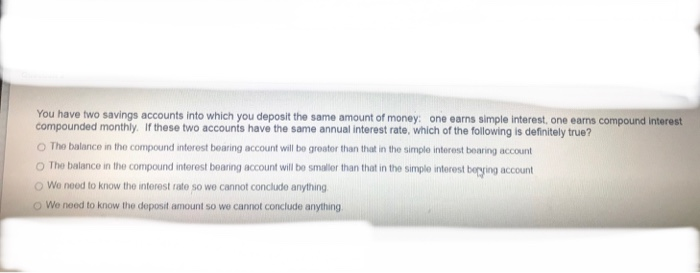

In Finance, the term interest refers to ... The cost to use money A person's level of concern over monetary issues A person's level of concern over any issue. The amount of money you borrow or invest. For a simple interest loan where you borrow $1000 and pay 5% annual interest rate, which of the following is NOT true? Da You make regular monthly payments on all such loans. Ob You would pay twice as much interest if you paid back the loan in 4 years as if you paid it back in 2 years Oc You would pay more total interest if the rate were 5.55% d. You would pay the same interest to borrow $2000 for twice as long invest $5000 in a 2 year CD (certificate of deposit) earning 6% compounded monthly. What can be said about this compared to investing the same $5000 in an interes bearing account earning 6% compounded daily? The value of your investment after two years will be O a Indeterminant since this is a loan scenario Ob Greater with the savings account because compounding more frequently (all else equal results in greater interest earned. Oc Greater with the CD because these are always better than savings accounts earning the same interest rate regardless of how it is compounded Od Less with the savings account because compounding more frequently (all else equal) results in lower interest earned Question You have two savings accounts into which you deposit the same amount of money: one earns simple interest, one earns compound interest compounded monthly. If these two accounts have the same annual interest rate, which of the following is definitely true? The balance in the compound interest bearing account will be greater than that in the simple interest bearing account The balance in the compound interest bearing account will be smaller than that in the simple interest berying account We nood to know the interest rate so we cannot conclude anything o We need to know the deposit amount so we cannot conclude anything My friend" Joe loans me $1000 and says you owe me $1500 that you can pay me back with S150 a month for 10 months. This is an example of A simple compound amortized loan Ob An irregular type loan that cannot be analyzed by formulasiscussed in this class. OCA simple interest loan since he defined the payoff and payments Od A basic amortized loan since he defined the payoff and payments You deposit $1000 into a CD earning 1.1% annual interest compounded daily for one year. If you deposited $10.000 into the same type of CD (1.1% annual compound dailly) you would earn 10 times as much total interest after one year. False Moving to another question will save this response Questions Mary loans Juan an amount of money at 12% simple interest Mary borrows that same amount of money from Jacqueline at 10% interest compounded weekly What can we say about Mary's financial situation? a If both loans settle in a short time, it is possible that Mary makes money b. Mary will make money so long as the amount of money is high c. Mary will be out money from day one no matter what d. Mary makes money only in the long run regardless of the loan amount You borrow $500 from a friend and he says "just pay me back the $500 whenever you can" The term for this type of loan would be Interest free Simplest interest Simplest compound interest None of the other descriptions, this is not a loan