Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In finance, VaR does not stand for variance but for value at risk. It is another measure of risk. It was introduced by J.P.

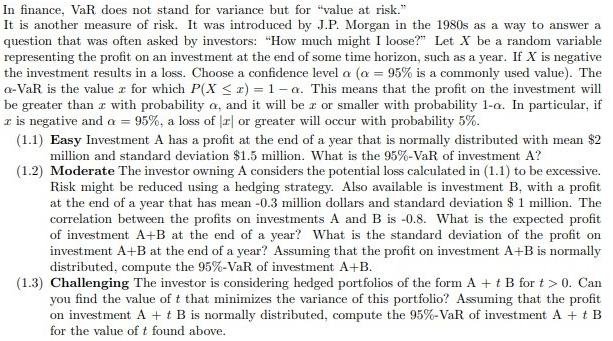

In finance, VaR does not stand for variance but for "value at risk." It is another measure of risk. It was introduced by J.P. Morgan in the 1980s as a way to answer a question that was often asked by investors: "How much might I loose?" Let X be a random variable representing the profit on an investment at the end of some time horizon, such as a year. If X is negative the investment results in a loss. Choose a confidence level a (a = 95% is a commonly used value). The a-VaR is the value z for which P(X z) = 1-a. This means that the profit on the investment will be greater than a with probability a, and it will be r or smaller with probability 1-a. In particular, if z is negative and a = 95%, a loss of r or greater will occur with probability 5%. (1.1) Easy Investment A has a profit at the end of a year that is normally distributed with mean $2 million and standard deviation $1.5 million. What is the 95%-VaR of investment A? (1.2) Moderate The investor owning A considers the potential loss calculated in (1.1) to be excessive. Risk might be reduced using a hedging strategy. Also available is investment B, with a profit at the end of a year that has mean -0.3 million dollars and standard deviation $ 1 million. The correlation between the profits on investments A and B is -0.8. What is the expected profit of investment A+B at the end of a year? What is the standard deviation of the profit on investment A+B at the end of a year? Assuming that the profit on investment A+B is normally distributed, compute the 95%-VaR of investment A+B. (1.3) Challenging The investor is considering hedged portfolios of the form A + t B for t> 0. Can you find the value of t that minimizes the variance of this portfolio? Assuming that the profit on investment A + t B is normally distributed, compute the 95%-VaR of investment A + t B for the value of t found above.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

11 What is the 95VaR of investment A ANSWER The 95VaR of investment A is 05 million COMPUTATION We are given that X N215 so we have PX 05 1PX 05 1PZ 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started