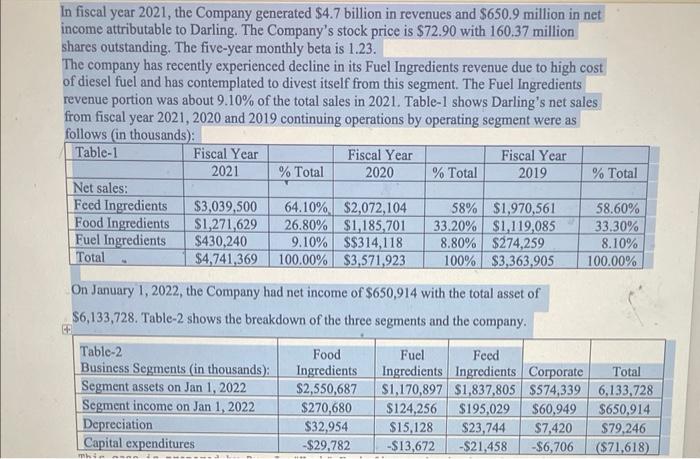

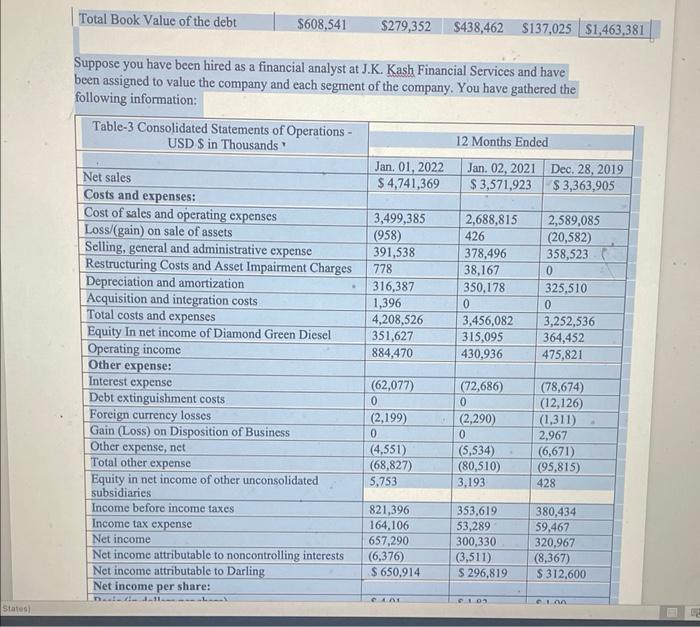

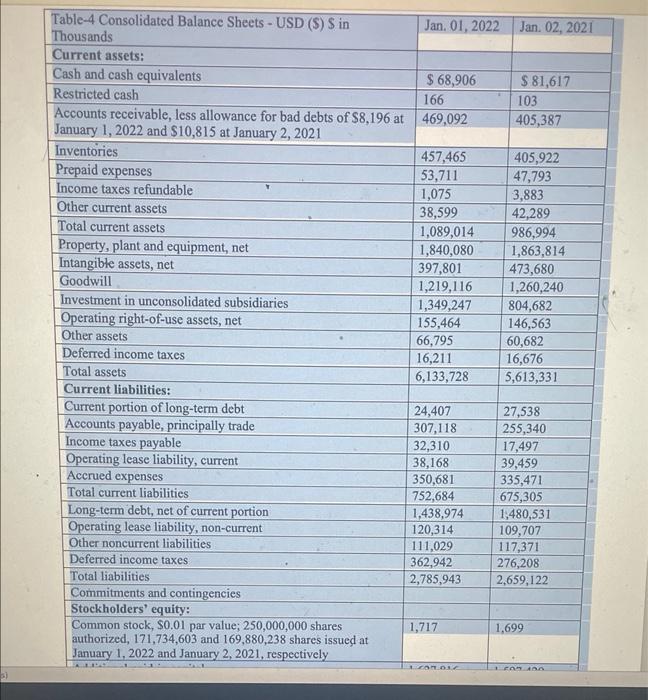

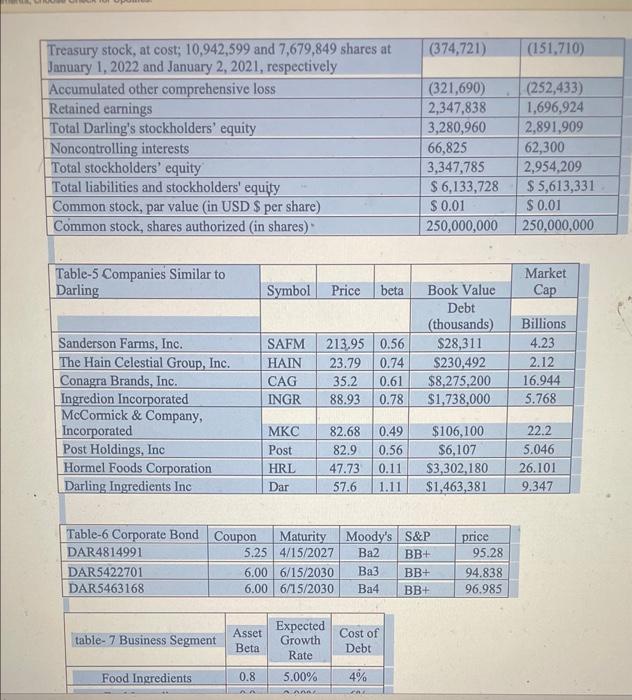

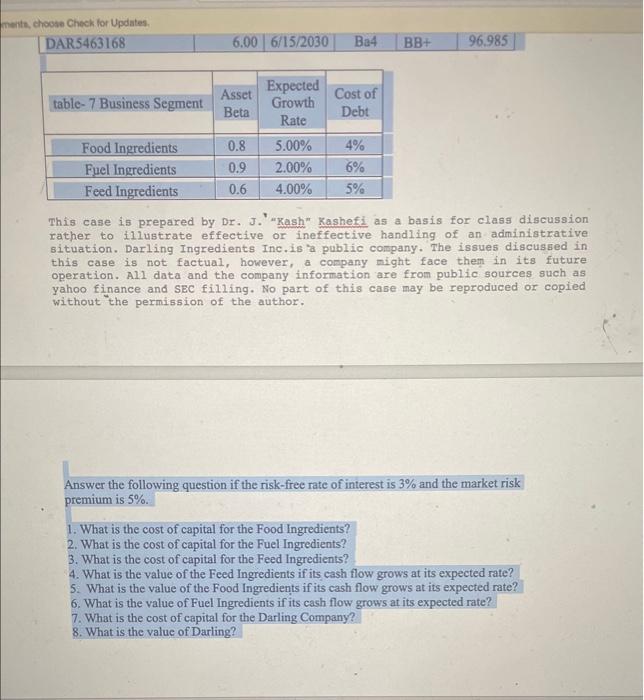

In fiscal year 2021, the Company generated $4.7 billion in revenues and $650.9 million in net income attributable to Darling. The Company's stock price is $72.90 with 160.37 million shares outstanding. The five-year monthly beta is 1.23. The company has recently experienced decline in its Fuel Ingredients revenue due to high cost of diesel fuel and has contemplated to divest itself from this segment. The Fuel Ingredients revenue portion was about 9.10% of the total sales in 2021. Table-1 shows Darling's net sales from fiscal year 2021, 2020 and 2019 continuing operations by operating segment were as follows (in thousands): On January 1, 2022, the Company had net income of $650,914 with the total asset of \$6,133,728. Table-2 shows the breakdown of the three segments and the company. Suppose you have been hired as a financial analyst at J.K. Kash Financial Services and have seen assigned to value the company and each segment of the company. You have gathered the following information: \begin{tabular}{|l|l|l|} \hline Treasury stock, at cost; 10,942,599 and 7,679,849 shares at January 1, 2022 and January 2, 2021, respectively & (374,721) & (151,710) \\ \hline Accumulated other comprehensive loss & (321,690) & (252,433) \\ \hline Retained earnings & 2,347,838 & 1,696,924 \\ \hline Total Darling's stockholders' equity & 3,280,960 & 2,891,909 \\ \hline Noncontrolling interests & 66,825 & 62,300 \\ \hline Total stockholders' equity & 3,347,785 & 2,954,209 \\ \hline Total liabilities and stockholders' equity & $6,133,728 & $5,613,331 \\ \hline Common stock, par value (in USD \$ per share) & $0.01 & $0.01 \\ \hline Common stock, shares authorized (in shares) & 250,000,000 & 250,000,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|c|c|} \hline Table-5 Companies Similar to Darling & Symbol & Price & beta & Book Value & Market Cap \\ \hline & \multicolumn{2}{|l|}{} & & Debt (thousands) & Billions \\ \hline Sanderson Farms, Inc. & SAFM & 213.95 & 0.56 & $28,311 & 4.23 \\ \hline The Hain Celestial Group, Inc. & HAIN & 23.79 & 0.74 & $230,492 & 2.12 \\ \hline Conagra Brands, Inc. & CAG & 35.2 & 0.61 & $8,275,200 & 16.944 \\ \hline Ingredion Incorporated & INGR & 88.93 & 0.78 & $1,738,000 & 5.768 \\ \hline McCormick \& Company, Incorporated & MKC & 82.68 & 0.49 & $106,100 & 22.2 \\ \hline Post Holdings, Inc & Post & 82.9 & 0.56 & $6,107 & 5.046 \\ \hline Hormel Foods Corporation & HRL & 47.73 & 0.11 & $3,302,180 & 26.101 \\ \hline Darling Ingredients Inc & Dar & 57.6 & 1.11 & $1,463,381 & 9.347 \\ \hline \end{tabular} \begin{tabular}{|l|r|l|l|l|l|} \hline Table-6 Corporate Bond & Coupon & Maturity & Moody's & S\&P & price \\ \hline DAR4814991 & 5.25 & 4/15/2027 & Ba2 & BB+ & 95.28 \\ \hline DAR5422701 & 6.00 & 6/15/2030 & Ba3 & BB+ & 94.838 \\ \hline DAR5463168 & 6.00 & 6/15/2030 & Ba4 & BB+ & 96.985 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline table-7 Business Segment & Asset Beta & Expected Growth Rate & Cost of Debt \\ \hline Food Ingredients & 0.8 & 5.00% & 4% \\ \hline \end{tabular} This case is prepared by Dr. J. "Kash" Kashefi as a basis for class discussion rather to 1 llustrate effective or ineffective handling of an administrative situation. Darling Ingredients Inc. is a public company. The issues discussed in this case is not factual, however, a company might face them in its future operation. All data and the company information are from public sources such as yahoo finance and SEC filling. No part of this case may be reproduced or copied without the permission of the author. Answer the following question if the risk-free rate of interest is 3% and the market risk premium is 5%. 1. What is the cost of capital for the Food Ingredients? 2. What is the cost of capital for the Fuel Ingredients? 3. What is the cost of capital for the Feed Ingredients? 4. What is the value of the Feed Ingredients if its cash flow grows at its expected rate? 5. What is the value of the Food Ingredients if its cash flow grows at its expected rate? 6. What is the value of Fuel Ingredients if its cash flow grows at its expected rate? 7. What is the cost of capital for the Darling Company? 8. What is the value of Darling