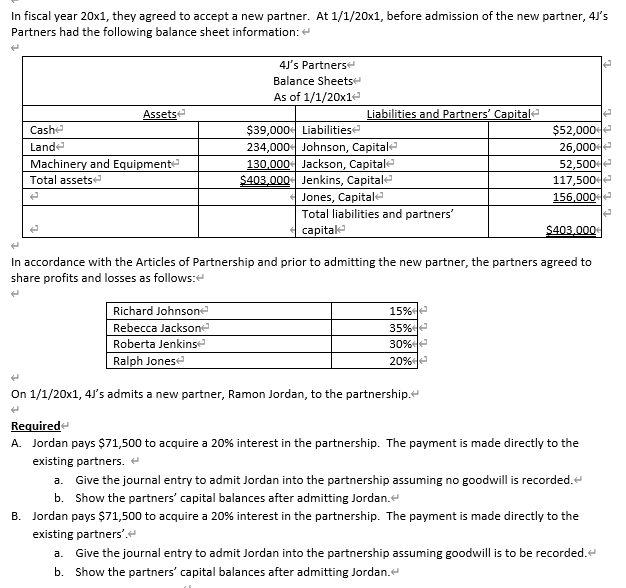

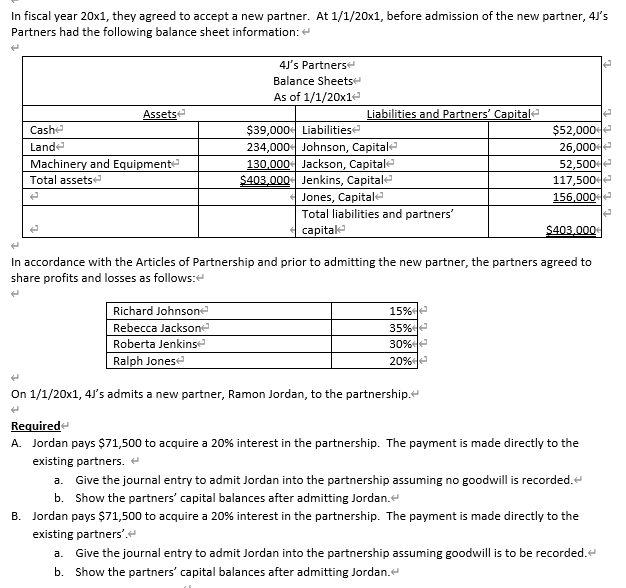

In fiscal year 20x1, they agreed to accept a new partner. At 1/1/20x1, before admission of the new partner, 43's Partners had the following balance sheet information: Assets Cashe Lande Machinery and Equipment Total assetse 4's Partners Balance Sheets As of 1/1/20x1e Liabilities and Partners' Capitale $39,000 Liabilitiese 234,000 Johnson, Capitale 130,000 Jackson, Capitale $403.000 Jenkins, Capitale Jones, Capitale Total liabilities and partners' capitale $52,000 e 26,000 52,500 117,500 156,000 $403.000 In accordance with the Articles of Partnership and prior to admitting the new partner, the partners agreed to share profits and losses as follows: Richard Johnsone Rebecca Jackson Roberta Jenkinse Ralph Jonese 15% e 35% e 30% le 20% On 1/1/20x1, 43's admits a new partner, Ramon Jordan, to the partnership. Required A. Jordan pays $71,500 to acquire a 20% interest in the partnership. The payment is made directly to the existing partners. a. Give the journal entry to admit Jordan into the partnership assuming no goodwill is recorded. b. Show the partners' capital balances after admitting Jordan.. B. Jordan pays $71,500 to acquire a 20% interest in the partnership. The payment is made directly to the existing partners'. a. Give the journal entry to admit Jordan into the partnership assuming goodwill is to be recorded. b. Show the partners' capital balances after admitting Jordan. In fiscal year 20x1, they agreed to accept a new partner. At 1/1/20x1, before admission of the new partner, 43's Partners had the following balance sheet information: Assets Cashe Lande Machinery and Equipment Total assetse 4's Partners Balance Sheets As of 1/1/20x1e Liabilities and Partners' Capitale $39,000 Liabilitiese 234,000 Johnson, Capitale 130,000 Jackson, Capitale $403.000 Jenkins, Capitale Jones, Capitale Total liabilities and partners' capitale $52,000 e 26,000 52,500 117,500 156,000 $403.000 In accordance with the Articles of Partnership and prior to admitting the new partner, the partners agreed to share profits and losses as follows: Richard Johnsone Rebecca Jackson Roberta Jenkinse Ralph Jonese 15% e 35% e 30% le 20% On 1/1/20x1, 43's admits a new partner, Ramon Jordan, to the partnership. Required A. Jordan pays $71,500 to acquire a 20% interest in the partnership. The payment is made directly to the existing partners. a. Give the journal entry to admit Jordan into the partnership assuming no goodwill is recorded. b. Show the partners' capital balances after admitting Jordan.. B. Jordan pays $71,500 to acquire a 20% interest in the partnership. The payment is made directly to the existing partners'. a. Give the journal entry to admit Jordan into the partnership assuming goodwill is to be recorded. b. Show the partners' capital balances after admitting Jordan