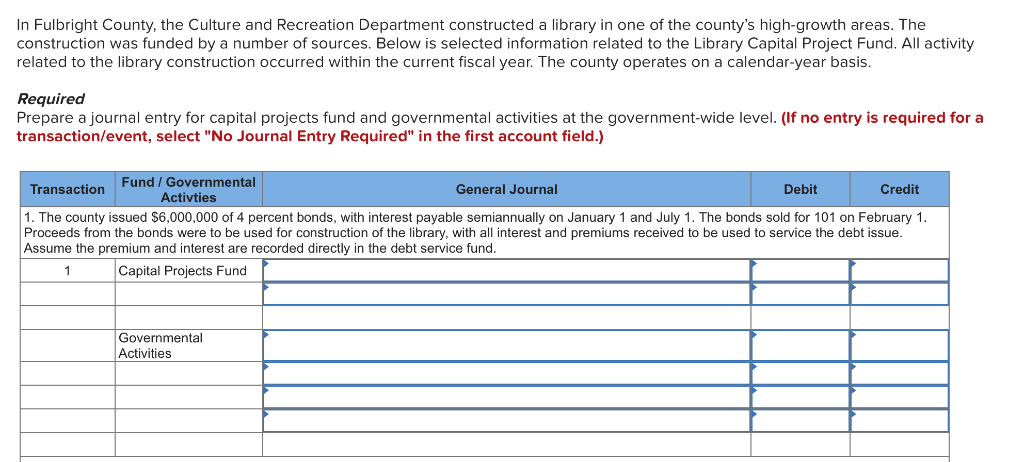

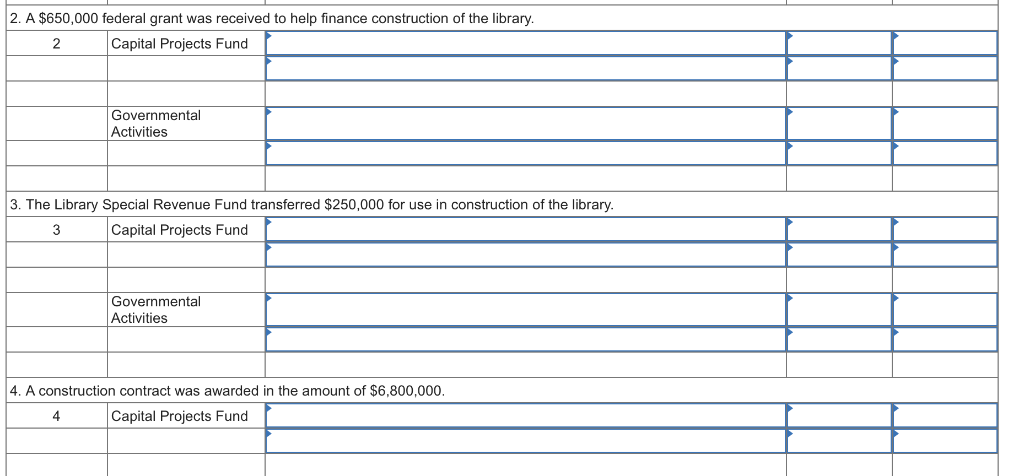

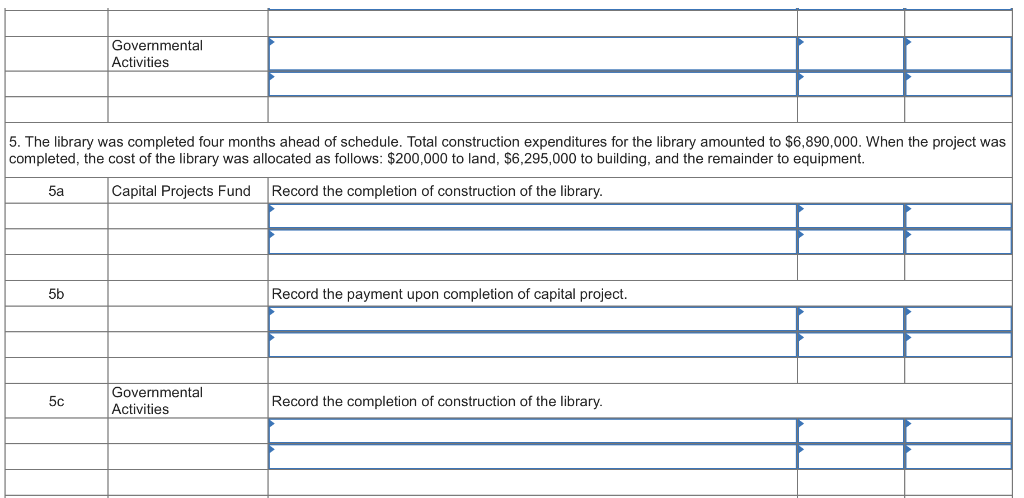

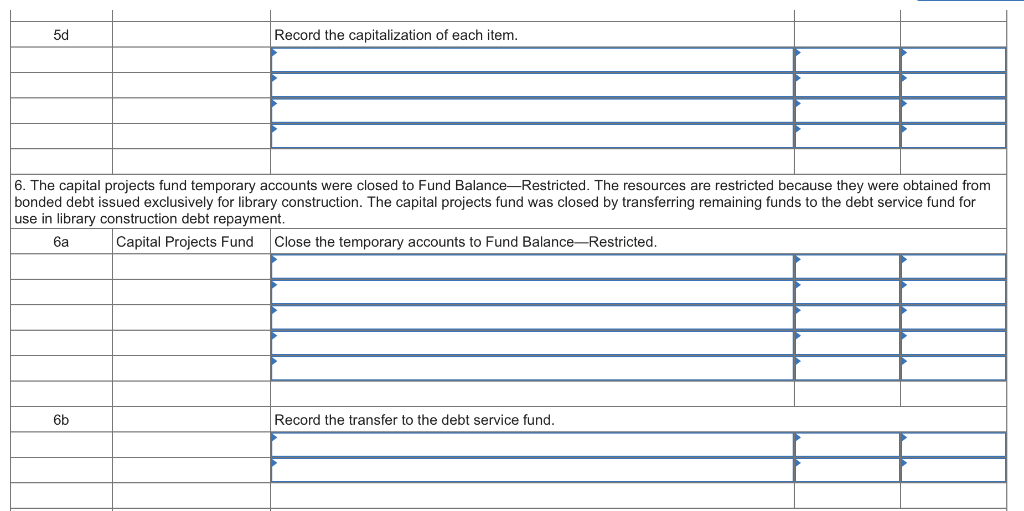

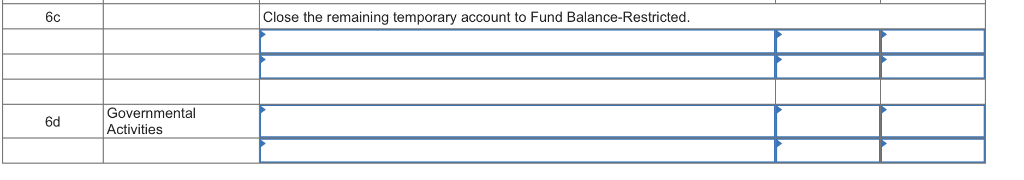

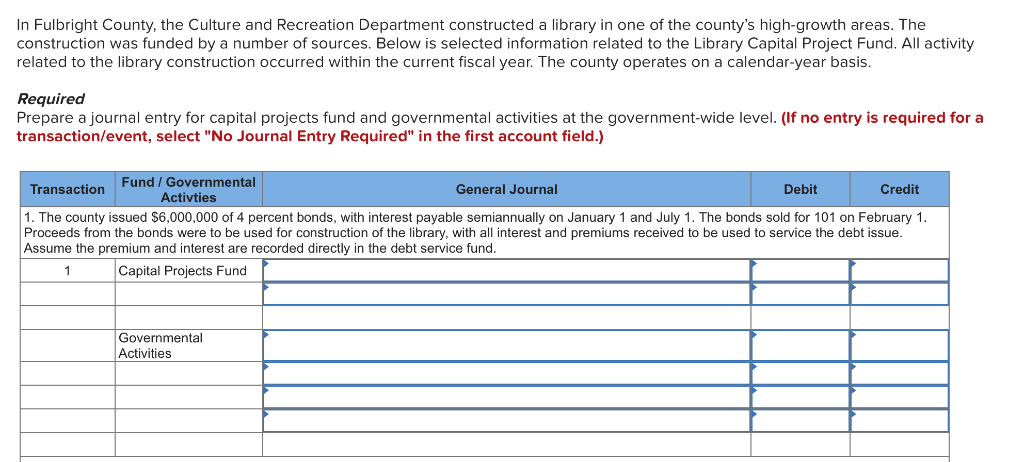

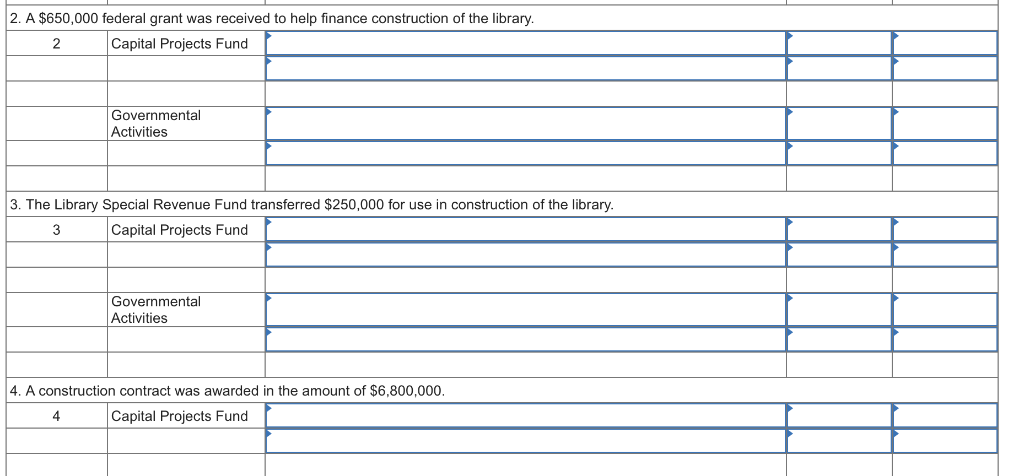

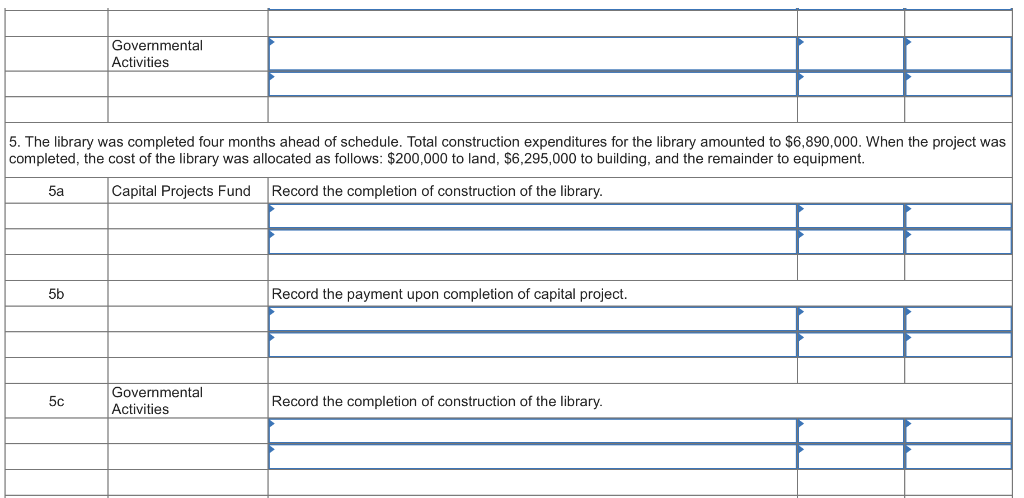

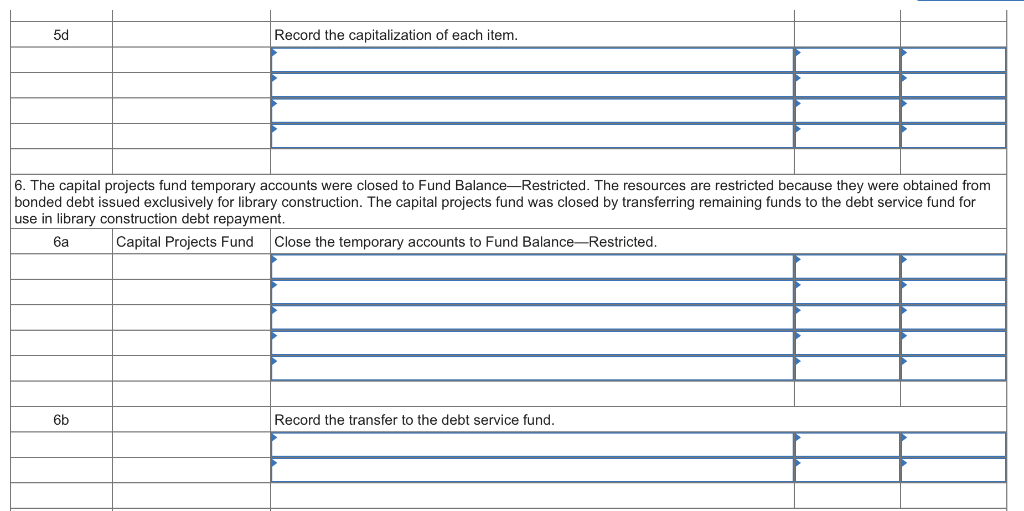

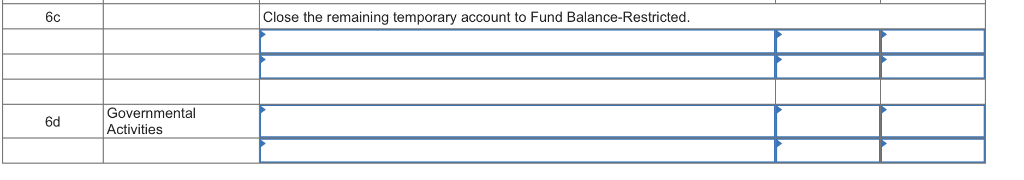

In Fulbright County, the Culture and Recreation Department constructed a library in one of the county's high-growth areas. The construction was funded by a number of sources. Below is selected information related to the Library Capital Project Fund. All activity related to the library construction occurred within the current fiscal year. The county operates on a calendar-year basis Required Prepare a journal entry for capital projects fund and governmental activities at the government-wide level. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Fund Governmental Activties Debit Transaction General Journal Credit 1. The county issued $6,000,000 of 4 percent bonds, with interest payable semiannually on January 1 and July 1. The bonds sold for 101 on February 1 Proceeds from the bonds were to be used for construction of the library, with all interest and premiums received to be used to service the debt issue. Assume the premium and interest are recorded directly in the debt service fund Capital Projects Fund Governmental Activities 2. A $650,000 federal grant was received to help finance construction of the library. 2Capital Projects Fund Governmental Activities 3. The Library Special Revenue Fund transferred $250,000 for use in construction of the library. 3 Capital Projects Fund Governmental Activities 4. A construction contract was awarded in the amount of $6,800,000. 4 Capital Projects Fund Governmental Activities 5. The library was completed four months ahead of schedule. Total construction expenditures for the library amounted to $6,890,000. When the project was completed, the cost of the library was allocated as follows: $200,000 to land, S6,295,000 to building, and the remainder to equipment. 5a Capital Projects Fund Record the completion of construction of the library. 5b Record the payment upon completion of capital project. Governmental Activities 5c Record the completion of construction of the library. 5d Record the capitalization of each item 6. The capital projects fund temporary accounts were closed to Fund Balance-Restricted. The resources are restricted because they were obtained from bonded debt issued exclusively for library construction. The capital projects fund was closed by transferring remaining funds to the debt service fund for use in library construction debt repayment 6a Capital Projects FundClose the temporary accounts to Fund Balance Restricted. 6b Record the transfer to the debt service fund. Close the remaining temporary account to Fund Balance-Restricted 6c Governmental Activities 6d