Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In her study abroad program, Mava learned about different type of investment vehicles or funds. An important actor in this market is Private Equity (PE)

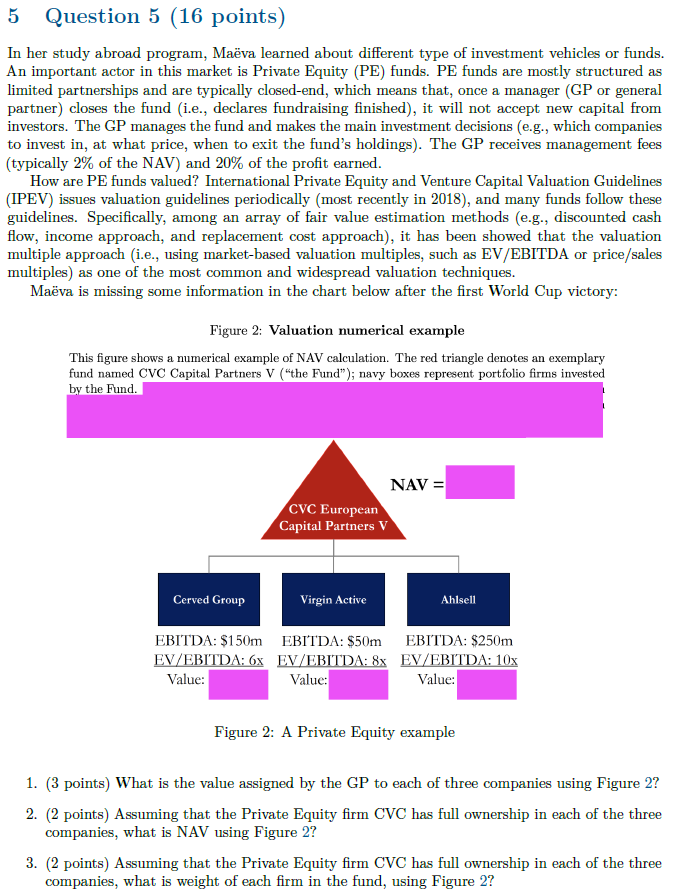

In her study abroad program, Mava learned about different type of investment vehicles or funds. An important actor in this market is Private Equity (PE) funds. PE funds are mostly structured as limited partnerships and are typically closed-end, which means that, once a manager (GP or general partner) closes the fund (i.e., declares fundraising finished), it will not accept new capital from investors. The GP manages the fund and makes the main investment decisions (e.g., which companies to invest in, at what price, when to exit the fund's holdings). The GP receives management fees (typically 2% of the NAV) and 20% of the profit earned. How are PE funds valued? International Private Equity and Venture Capital Valuation Guidelines (IPEV) issues valuation guidelines periodically (most recently in 2018), and many funds follow these guidelines. Specifically, among an array of fair value estimation methods (e.g., discounted cash flow, income approach, and replacement cost approach), it has been showed that the valuation multiple approach (i.e., using market-based valuation multiples, such as EV/EBITDA or price/sales multiples) as one of the most common and widespread valuation techniques. Mava is missing some information in the chart below after the first World Cup victory: Figure 2: Valuation numerical example This figure shows a numerical example of NAV calculation. The red triangle denotes an exemplary fund named CVC Capital Partners V ("the Fund"); navy boxes represent portfolio firms invested by the Fund. Figure 2: A Private Equity example 1. (3 points) What is the value assigned by the GP to each of three companies using Figure 2? 2. (2 points) Assuming that the Private Equity firm CVC has full ownership in each of the three companies, what is NAV using Figure 2? 3. (2 points) Assuming that the Private Equity firm CVC has full ownership in each of the three companies, what is weight of each firm in the fund, using Figure 2

In her study abroad program, Mava learned about different type of investment vehicles or funds. An important actor in this market is Private Equity (PE) funds. PE funds are mostly structured as limited partnerships and are typically closed-end, which means that, once a manager (GP or general partner) closes the fund (i.e., declares fundraising finished), it will not accept new capital from investors. The GP manages the fund and makes the main investment decisions (e.g., which companies to invest in, at what price, when to exit the fund's holdings). The GP receives management fees (typically 2% of the NAV) and 20% of the profit earned. How are PE funds valued? International Private Equity and Venture Capital Valuation Guidelines (IPEV) issues valuation guidelines periodically (most recently in 2018), and many funds follow these guidelines. Specifically, among an array of fair value estimation methods (e.g., discounted cash flow, income approach, and replacement cost approach), it has been showed that the valuation multiple approach (i.e., using market-based valuation multiples, such as EV/EBITDA or price/sales multiples) as one of the most common and widespread valuation techniques. Mava is missing some information in the chart below after the first World Cup victory: Figure 2: Valuation numerical example This figure shows a numerical example of NAV calculation. The red triangle denotes an exemplary fund named CVC Capital Partners V ("the Fund"); navy boxes represent portfolio firms invested by the Fund. Figure 2: A Private Equity example 1. (3 points) What is the value assigned by the GP to each of three companies using Figure 2? 2. (2 points) Assuming that the Private Equity firm CVC has full ownership in each of the three companies, what is NAV using Figure 2? 3. (2 points) Assuming that the Private Equity firm CVC has full ownership in each of the three companies, what is weight of each firm in the fund, using Figure 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started