Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Holiday Village (Fed. Cir.1985), a corporation liquidated limited partnership that held 1250 property. On the facts, 751 did n a distribution of the

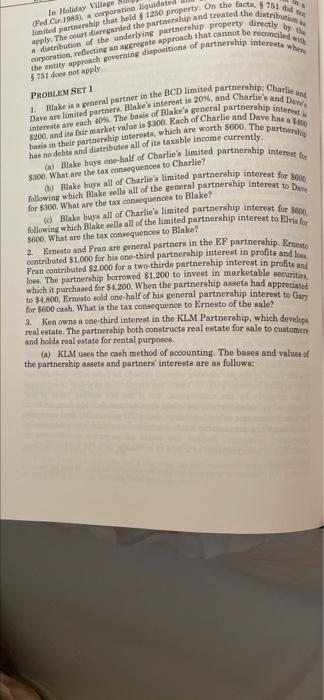

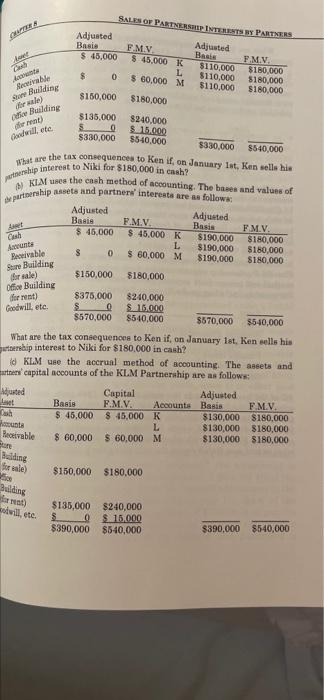

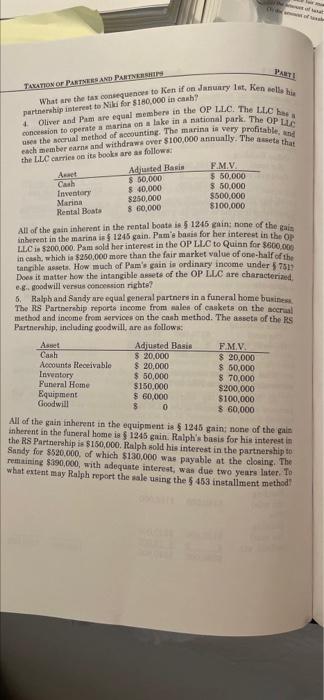

In Holiday Village (Fed. Cir.1985), a corporation liquidated limited partnership that held 1250 property. On the facts, 751 did n a distribution of the underlying partnership property directly by the corporation, reflecting an aggregate approach that cannot be reconciled with apply. The court disregarded the partnership and treated the distribution the entity approach governing dispositions of partnership interests when $751 does not apply. PROBLEM SET 1 1. Blake is a general partner in the BCD limited partnership: Charlie and Dave are limited partners. Blake's interest is 20%, and Charlie's and Dan's $200, and its fair market value is $300. Each of Charlie and Dave has a $400 interests are each 40%. The basis of Blake's general partnership interest baris in their partnership interests, which are worth $600. The partnership has no debts and distributes all of its taxable income currently. (a) Blake buys one-half of Charlie's limited partnership interest for $300. What are the tax consequences to Charlie? (b) Blake buys all of Charlie's limited partnership interest for $600, following which Blake sells all of the general partnership interest to Dave for $300. What are the tax consequences to Blake? (c) Blake buys all of Charlie's limited partnership interest for $600, following which Blake sells all of the limited partnership interest to Elvis for $600. What are the tax consequences to Blake? 2. Ernesto and Fran are general partners in the EF partnership. Ernesto contributed $1,000 for his one-third partnership interest in profite and lo Fran contributed $2,000 for a two-thirds partnership interest in profits and loss. The partnership borrowed $1,200 to invest in marketable securities which it purchased for $4,200. When the partnership assets had appreciated to $4,800, Ernesto sold one-half of his general partnership interest to Gary for $600 cash. What is the tax consequence to Ernesto of the sale? 3. Ken owns a one-third interest in the KLM Partnership, which develops real estate. The partnership both constructs real estate for sale to customers and holds real estate for rental purposes. (a) KLM uses the cash method of accounting. The bases and values of the partnership assets and partners' interests are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started