Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in IFRS [59] YES began the year, 2019 with 200,000 shares of common stock and 30,000 shares of 7%, $100 par value, cumulative, nonconvertible preferred

in IFRS

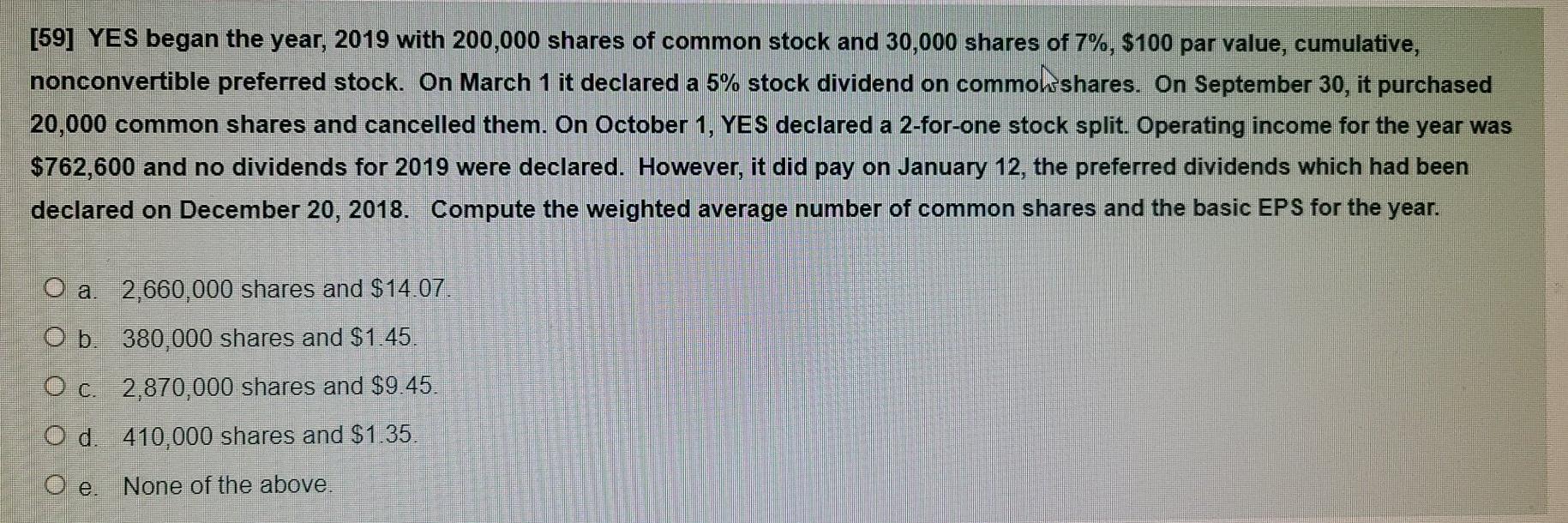

[59] YES began the year, 2019 with 200,000 shares of common stock and 30,000 shares of 7%, $100 par value, cumulative, nonconvertible preferred stock. On March 1 it declared a 5% stock dividend on commohdshares. On September 30, it purchased 20,000 common shares and cancelled them. On October 1, YES declared a 2-for-one stock split. Operating income for the year was $762,600 and no dividends for 2019 were declared. However, it did pay on January 12, the preferred dividends which had been declared on December 20, 2018. Compute the weighted average number of common shares and the basic EPS for the year. O a. 2,660,000 shares and $14.07. O b. 380,000 shares and $1.45. O c. 2,870,000 shares and $9.45. O d. 410,000 shares and $1.35. O e. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started