Answered step by step

Verified Expert Solution

Question

1 Approved Answer

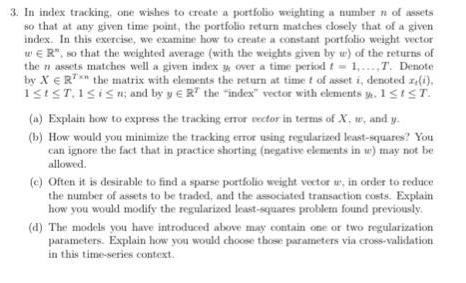

3. In index tracking, one wishes to create a portfolio weighting a number n of assets so that at any given time point, the

3. In index tracking, one wishes to create a portfolio weighting a number n of assets so that at any given time point, the portfolio return matches closely that of a given index. In this exercise, we examine how to create a constant portfolio weight vector wER", so that the weighted average (with the weights given by w) of the returns of then assets matches well a given index over a time period t= 1,....T. Denote by XR the matrix with elements the return at time t of asset i, denoted r(i). 1stT, 1 i n; and by y ER the "index" vector with elements . 1S1ST. (a) Explain how to express the tracking error vector in terms of X, w, and y. (b) How would you minimize the tracking error using regularized least-squares? You can ignore the fact that in practice shorting (negative elements in w) may not be allowed. (c) Often it is desirable to find a sparse portfolio weight vector w, in order to reduce the number of assets to be traded, and the associated transaction costs. Explain how you would modify the regularized least-squares problem found previously. (d) The models you have introduced above may contain one or two regularization parameters. Explain how you would choose those parameters via cross-validation in this time-series context.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The tracking error vector can be expressed as TE X w y b The tracking error can be minimiz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started