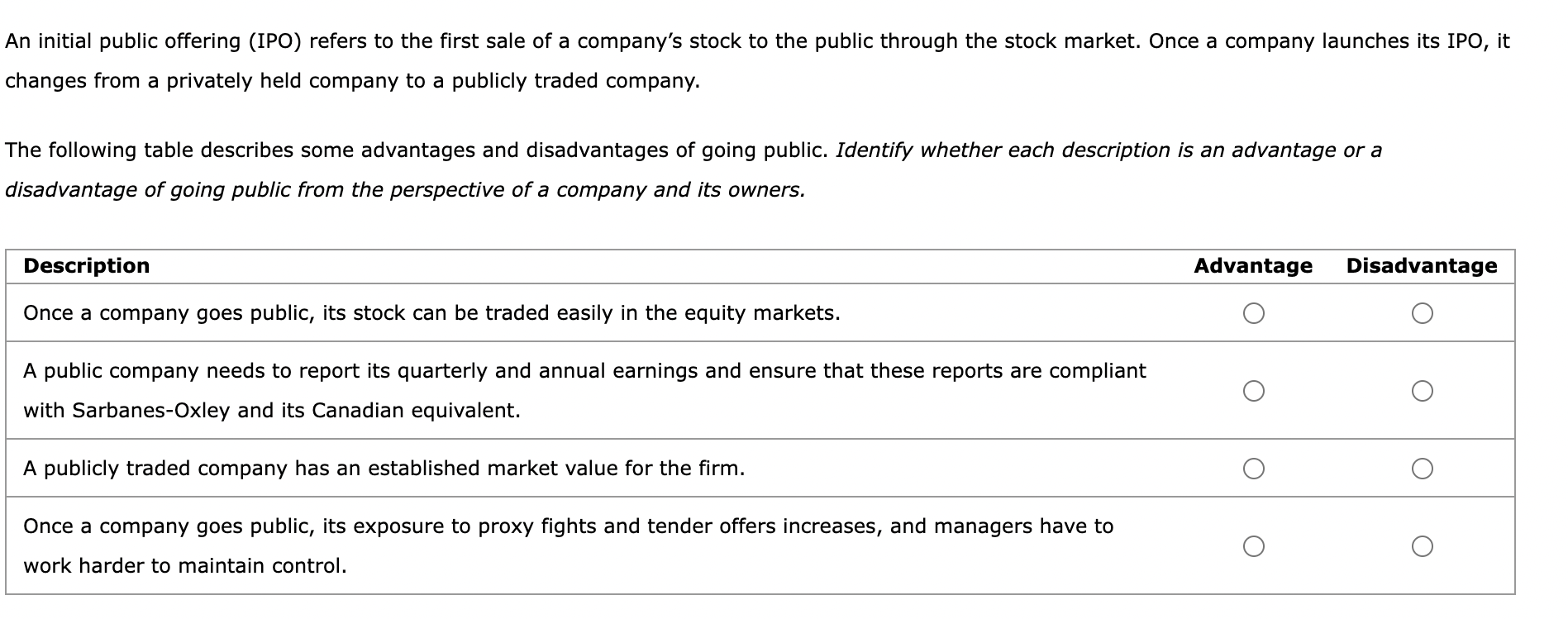

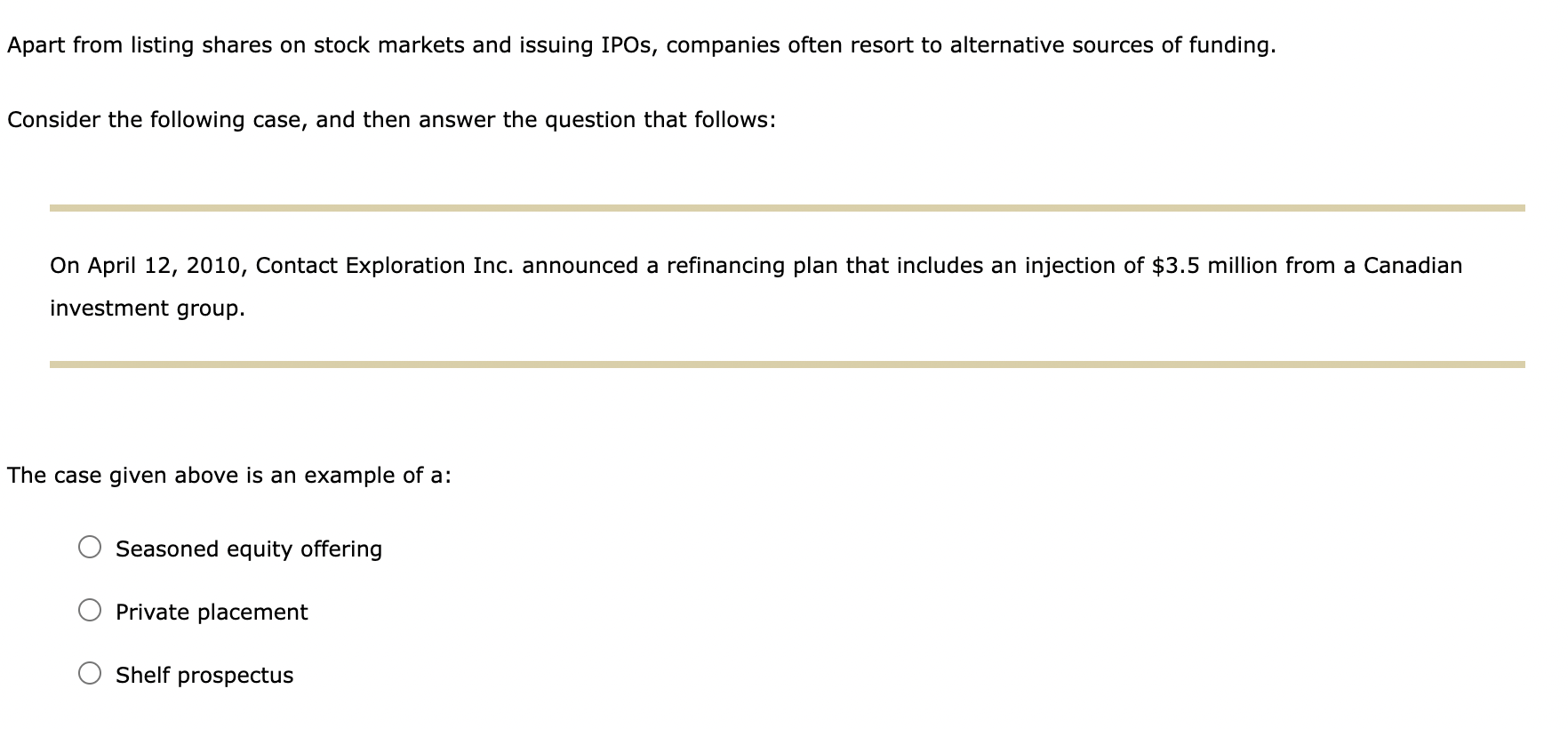

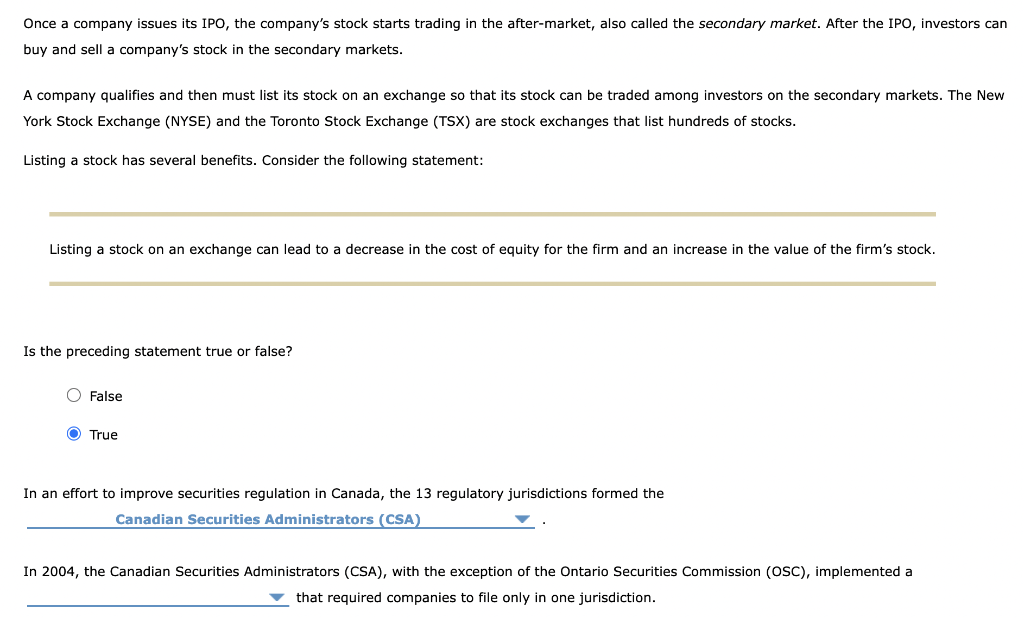

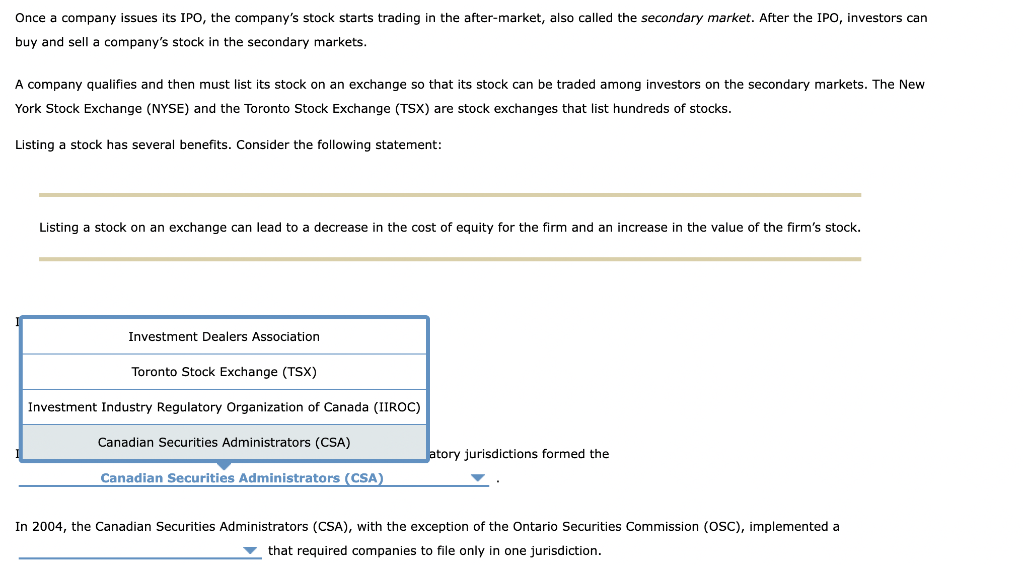

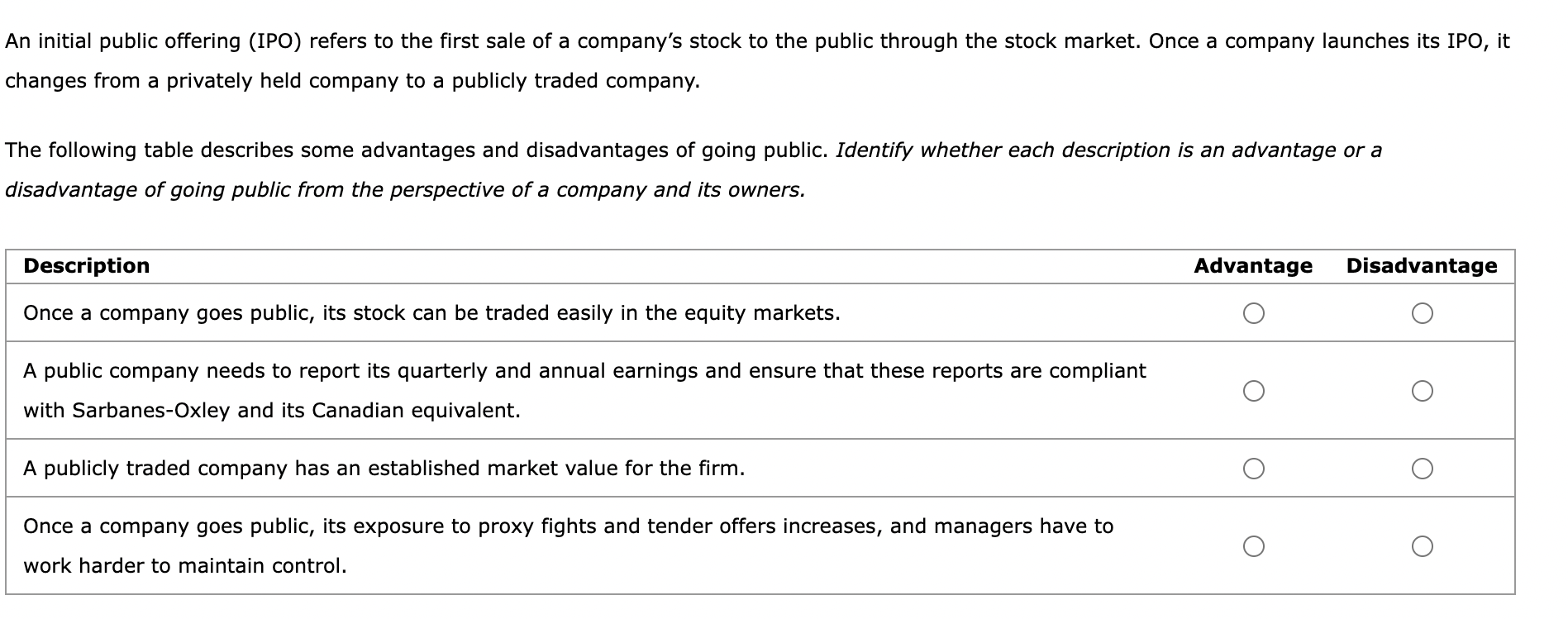

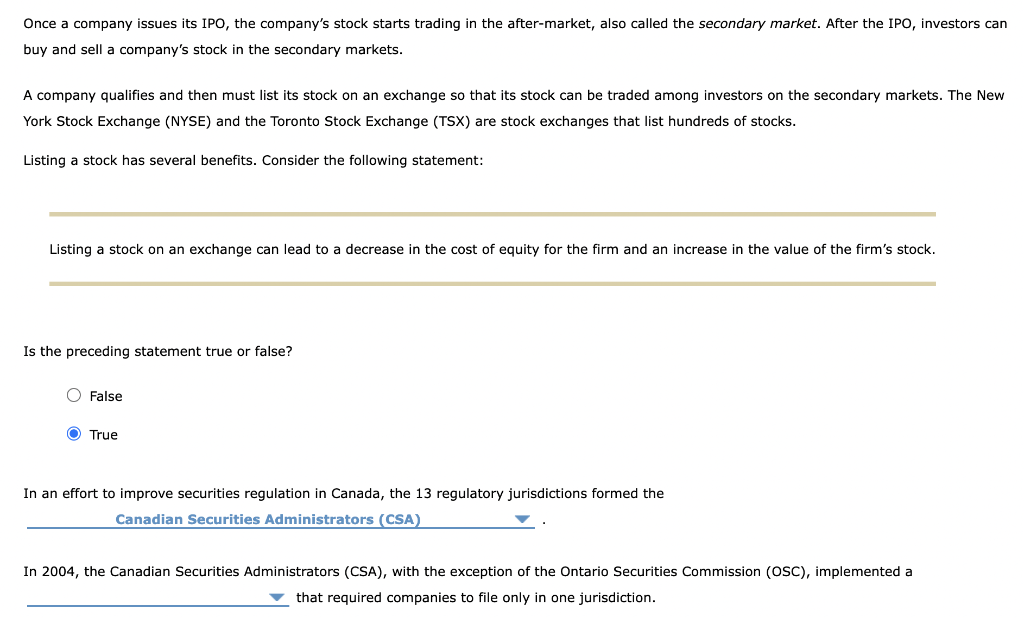

In initial public offering (IPO) refers to the first sale of a company's stock to the public through the stock market. Once a company launches its IPO, hanges from a privately held company to a publicly traded company. The following table describes some advantages and disadvantages of going public. Identify whether each description is an advantage or a lisadvantage of going public from the perspective of a company and its owners. Apart from listing shares on stock markets and issuing IPOs, companies often resort to alternative sources of funding. Consider the following case, and then answer the question that follows: On April 12, 2010, Contact Exploration Inc. announced a refinancing plan that includes an injection of $3.5 million from a Canadian investment group. The case given above is an example of Seasoned equity offering Private placement Shelf prospectus Once a company issues its IPO, the company's stock starts trading in the after-market, also called the secondary market. After the IPO, investors can buy and sell a company's stock in the secondary markets. A company qualifies and then must list its stock on an exchange so that its stock can be traded among investors on the secondary markets. The New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) are stock exchanges that list hundreds of stocks. Listing a stock has several benefits. Consider the following statement: Listing a stock on an exchange can lead to a decrease in the cost of equity for the firm and an increase in the value of the firm's stock. Is the preceding statement true or false? False True In an effort to improve securities regulation in Canada, the 13 regulatory jurisdictions formed the Canadian Securities Administrators (CSA) In 2004, the Canadian Securities Administrators (CSA), with the exception of the Ontario Securities Commission (OSC), implemented a that required companies to file only in one jurisdiction. Once a company issues its IPO, the company's stock starts trading in the after-market, also called the secondary market. After the IPO, investors can buy and sell a company's stock in the secondary markets. A company qualifies and then must list its stock on an exchange so that its stock can be traded ameng investors on the secondary York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) are stock exchanges that list hundreds of stocks. Listing a stock has several benefits. Consider the following statement: Listing a stock on an exchange can lead to a decrease in the cost of equity for the firm and an increase in the value of the firm's stock. tory jurisdictions formed the In 2004, the Canadian Securities Administrators (CSA), with the exception of the Ontario Securities Commission (OSC), implemented a that required companies to file only in one jurisdiction. Once a company issues its IPO, the company's stock starts trading in the after-market, also called the secondary market. After the IPO, investors can buy and sell a company's stock in the secondary markets. York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) are stock exchanges that list hundreds of stocks. Listing a stock has several benefits. Consider the following statement: Listing a stock on an exchange can lead to a decrease in the cost of equity for the firm and an increase in the value of the firm's stock. Is the preceding statement true or false? False In initial public offering (IPO) refers to the first sale of a company's stock to the public through the stock market. Once a company launches its IPO, hanges from a privately held company to a publicly traded company. The following table describes some advantages and disadvantages of going public. Identify whether each description is an advantage or a lisadvantage of going public from the perspective of a company and its owners. Apart from listing shares on stock markets and issuing IPOs, companies often resort to alternative sources of funding. Consider the following case, and then answer the question that follows: On April 12, 2010, Contact Exploration Inc. announced a refinancing plan that includes an injection of $3.5 million from a Canadian investment group. The case given above is an example of Seasoned equity offering Private placement Shelf prospectus Once a company issues its IPO, the company's stock starts trading in the after-market, also called the secondary market. After the IPO, investors can buy and sell a company's stock in the secondary markets. A company qualifies and then must list its stock on an exchange so that its stock can be traded among investors on the secondary markets. The New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) are stock exchanges that list hundreds of stocks. Listing a stock has several benefits. Consider the following statement: Listing a stock on an exchange can lead to a decrease in the cost of equity for the firm and an increase in the value of the firm's stock. Is the preceding statement true or false? False True In an effort to improve securities regulation in Canada, the 13 regulatory jurisdictions formed the Canadian Securities Administrators (CSA) In 2004, the Canadian Securities Administrators (CSA), with the exception of the Ontario Securities Commission (OSC), implemented a that required companies to file only in one jurisdiction. Once a company issues its IPO, the company's stock starts trading in the after-market, also called the secondary market. After the IPO, investors can buy and sell a company's stock in the secondary markets. A company qualifies and then must list its stock on an exchange so that its stock can be traded ameng investors on the secondary York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) are stock exchanges that list hundreds of stocks. Listing a stock has several benefits. Consider the following statement: Listing a stock on an exchange can lead to a decrease in the cost of equity for the firm and an increase in the value of the firm's stock. tory jurisdictions formed the In 2004, the Canadian Securities Administrators (CSA), with the exception of the Ontario Securities Commission (OSC), implemented a that required companies to file only in one jurisdiction. Once a company issues its IPO, the company's stock starts trading in the after-market, also called the secondary market. After the IPO, investors can buy and sell a company's stock in the secondary markets. York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) are stock exchanges that list hundreds of stocks. Listing a stock has several benefits. Consider the following statement: Listing a stock on an exchange can lead to a decrease in the cost of equity for the firm and an increase in the value of the firm's stock. Is the preceding statement true or false? False