Answered step by step

Verified Expert Solution

Question

1 Approved Answer

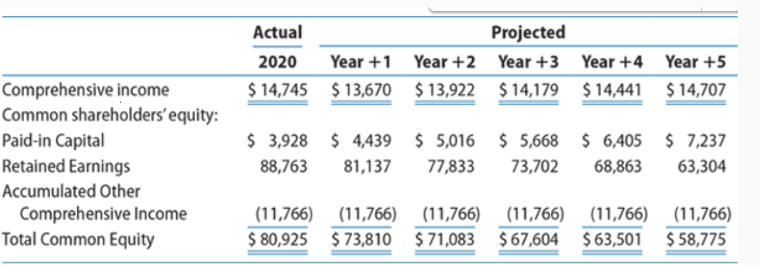

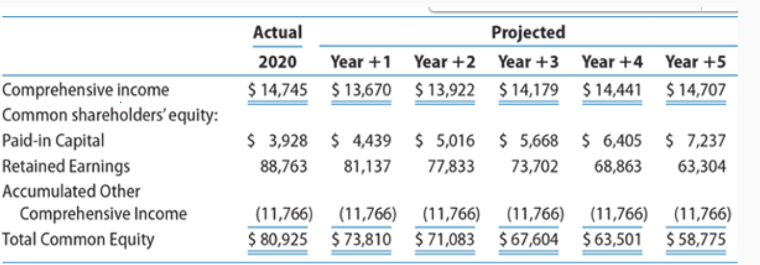

In Integrative Case 1 0 . 1 , we projected financial statements for Walmart Stores, Inc. ( Walmart ) , for Years 1 1 through

In Integrative Case we projected financial statements for Walmart Stores, Inc. Walmart for

Years through The data in Chapter s Exhibits and pages include

the actual amounts for fiscal and the projected amounts for Year to Year for the income

statements, balance sheets, and statements of cash flows, respectively, for Walmart. The market equity

beta for Walmart at the end of fiscal was Assume that the riskfree interest rate was

and the market risk premium was Walmart had million shares outstanding at the end of

fiscal and a share price of $

REQUIRED

Part IComputing Walmarts Share Value Using the Residual Income Valuation Approach

a Use the CAPM to compute the required rate of return on common equity capital for Walmart.

b Derive the projected residual income for Walmart for Years through based on the projected

financial statements.

c Using the required rate of return on common equity from Requirement a as a discount rate, compute

the sum of the present value of residual income for Walmart for Years through

d Using the required rate of return on common equity from Requirement a as a discount rate, and

assuming a longrun growth rate, compute the continuing value of Walmart as of the start

of Year based on Walmarts continuing residual income in Year and beyond. After comput

ing continuing value as of the start of Year discount it to present value at the start of Year

e Compute the value of a share of Walmart common stock.

Compute the total sum of the present value of all future residual income from Requirements

c and d

Add the book value of equity as of the beginning of the valuation that is as of the end of fiscal

or the start of Year

Adjust the total sum of the present value of residual income plus book value of common equity

using the midyear discounting adjustment factor.

Compute the pershare value estimate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started