Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In its 2021 annual report to shareholders, Health Foods, Inc., disclosed the following information about some of its indebtedness: The fair value of convertible

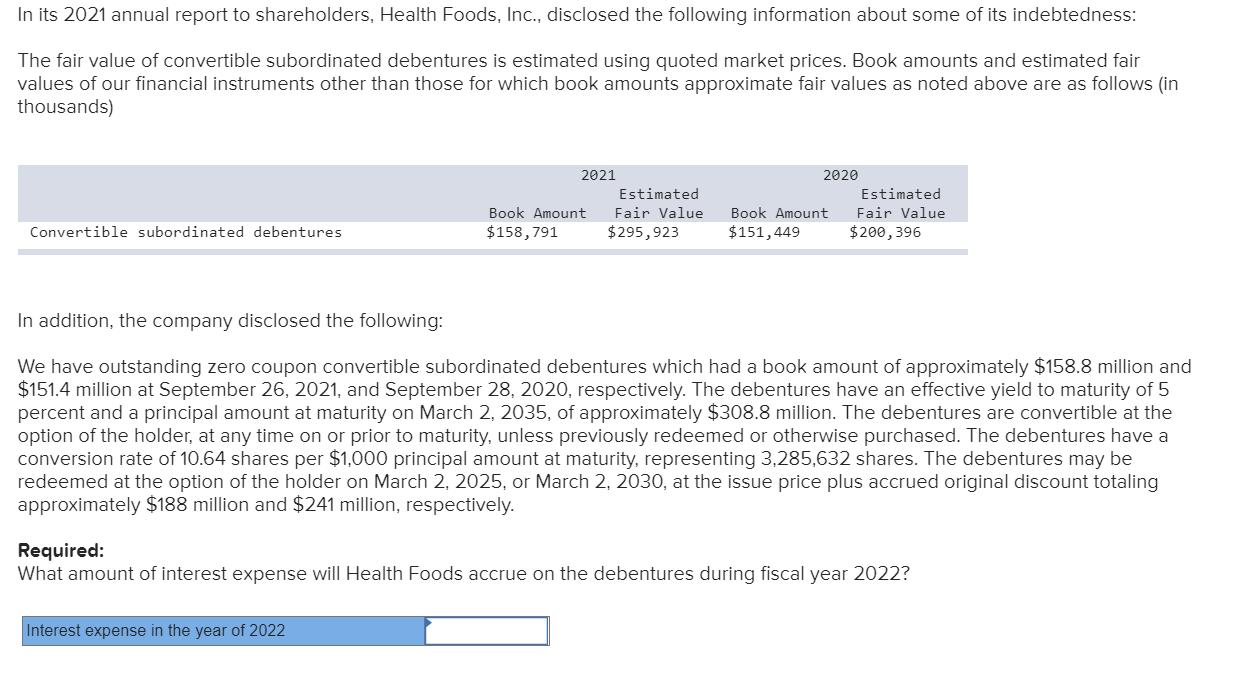

In its 2021 annual report to shareholders, Health Foods, Inc., disclosed the following information about some of its indebtedness: The fair value of convertible subordinated debentures is estimated using quoted market prices. Book amounts and estimated fair values of our financial instruments other than those for which book amounts approximate fair values as noted above are as follows (in thousands) 2021 2020 Estimated Fair Value $295,923 Estimated Fair Value Book Amount Book Amount Convertible subordinated debentures $158,791 $151,449 $200, 396 In addition, the company disclosed the following: We have outstanding zero coupon convertible subordinated debentures which had a book amount of approximately $158.8 million and $151.4 million at September 26, 2021, and September 28, 2020, respectively. The debentures have an effective yield to maturity of 5 percent and a principal amount at maturity on March 2, 2035, of approximately $308.8 million. The debentures are convertible at the option of the holder, at any time on or prior to maturity, unless previously redeemed or otherwise purchased. The debentures have a conversion rate of 10.64 shares per $1,000 principal amount at maturity, representing 3,285,632 shares. The debentures may be redeemed at the option of the holder on March 2, 2025, or March 2, 2030, at the issue price plus accrued original discount totaling approximately $188 million and $241 million, respectively. Required: What amount of interest expense will Health Foods accrue on the debentures during fiscal year 2022? Interest expense in the year of 2022

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Ques Interest expense accrue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started