Answered step by step

Verified Expert Solution

Question

1 Approved Answer

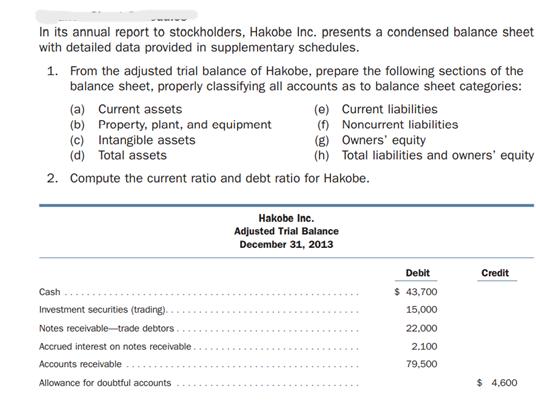

In its annual report to stockholders, Hakobe Inc. presents a condensed balance sheet with detailed data provided in supplementary schedules. 1. From the adjusted

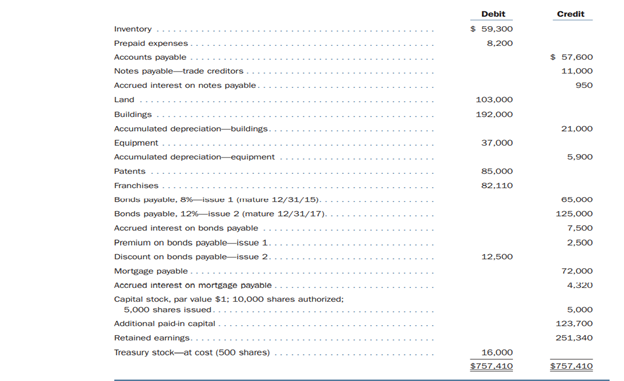

In its annual report to stockholders, Hakobe Inc. presents a condensed balance sheet with detailed data provided in supplementary schedules. 1. From the adjusted trial balance of Hakobe, prepare the following sections of the balance sheet, properly classifying all accounts as to balance sheet categories: (a) Current assets (e) Current liabilities (b) Property, plant, and equipment (f) Noncurrent liabilities (c) Intangible assets (d) Total assets 2. Compute the current ratio and debt ratio for Hakobe. (g) Owners' equity (h) Total liabilities and owners' equity Cash Investment securities (trading).. Notes receivable-trade debtors. Accrued interest on notes receivable. Accounts receivable Allowance for doubtful accounts Hakobe Inc. Adjusted Trial Balance December 31, 2013 Debit $ 43,700 Credit 15,000 22,000 2.100 79,500 $ 4,600 Inventory Prepaid expenses Accounts payable Notes payable-trade creditors. Accrued interest on notes payable. Land Buildings Accumulated depreciation-buildings. Equipment. Accumulated depreciation-equipment Patents Franchises. Bonds payable, 8%-issue 1 (mature 12/31/15). Bonds payable, 12 %-issue 2 (mature 12/31/17). Accrued interest on bonds payable.. Premium on bonds payable-issue 1. Discount on bonds payable-issue 2. Mortgage payable........ Accrued interest on mortgage payable Capital stock, par value $1; 10,000 shares authorized; 5,000 shares issued. Additional paid-in capital Retained earnings... Treasury stock-at cost (500 shares) Debit $ 59,300 8,200 Credit $ 57,600 11,000 950 103,000 192,000 21,000 37,000 5,900 85,000 82,110 65,000 125,000 7,500 2,500 12,500 72,000 4.320 5,000 123,700 251,340 16,000 $757,410 $757.410

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started