Question: In its annual report, WIL Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the

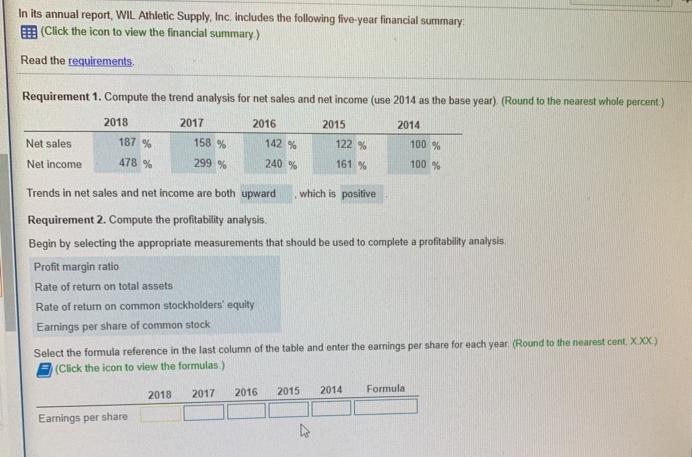

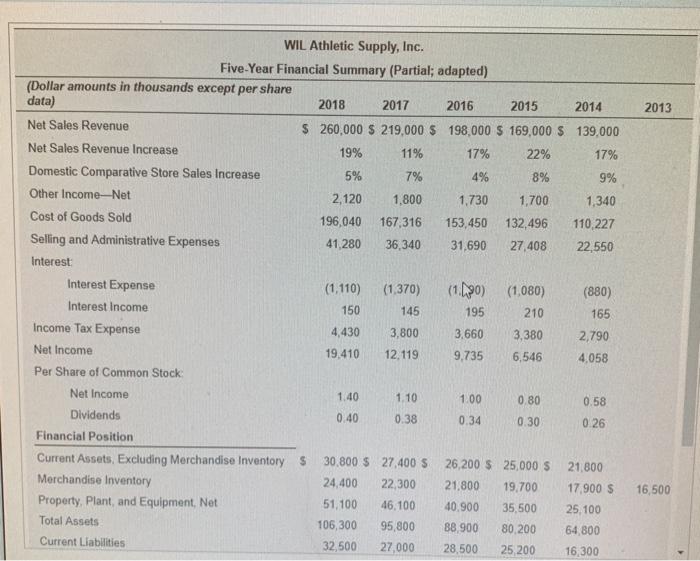

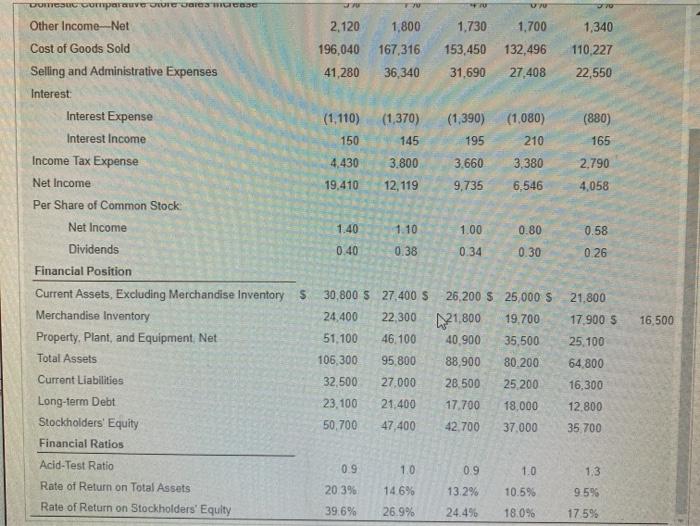

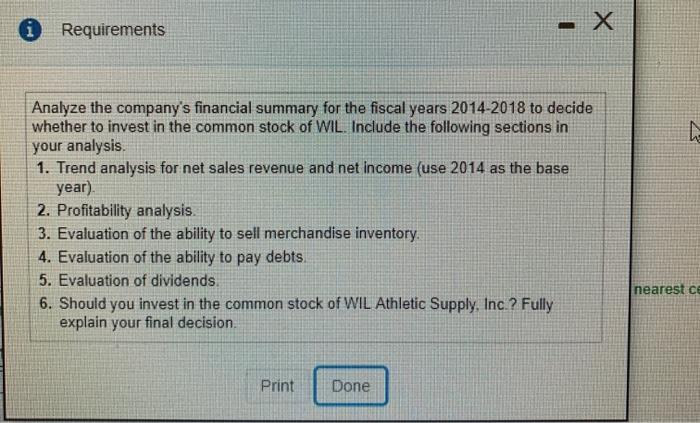

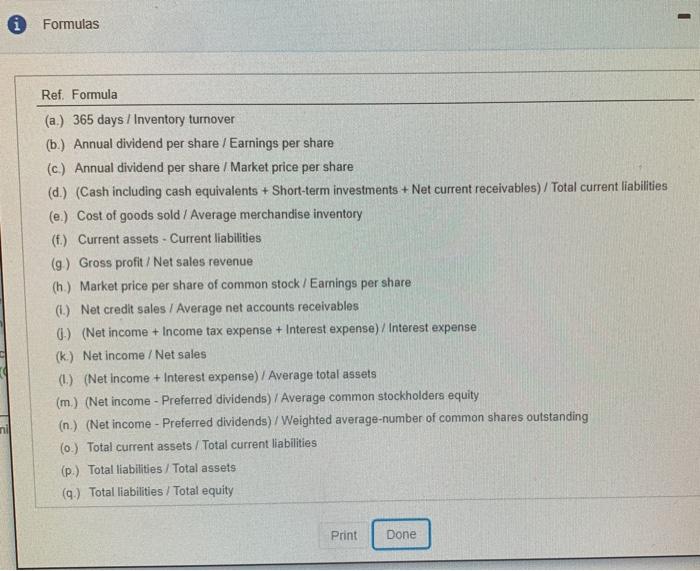

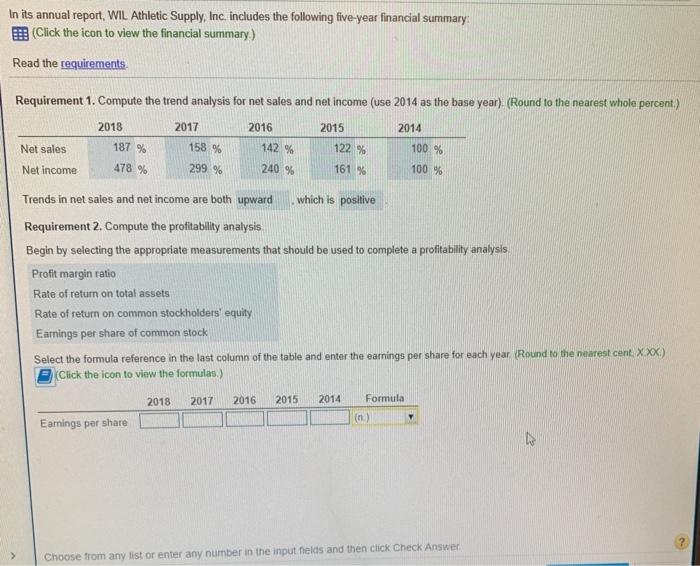

In its annual report, WIL Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the requirements. Requirement 1. Compute the trend analysis for net sales and net income (use 2014 as the base year). (Round to the nearest whole percent) 2016 2014 Net sales Net income 2018 187% 478 % 2017 158 % 299 % Profit margin ratio Rate of return on total assets Rate of return on common stockholders' equity Earnings per share of common stock Earnings per share 2018 Trends in net sales and net income are both upward Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis 142 % 240 % 2017 2016 Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent. X.XX.) (Click the icon to view the formulas) 2015 122 % 161 % which is positive 2015 4 100 % 100 % 2014 Formula (Dollar amounts in thousands except per share data) Net Sales Revenue Net Sales Revenue Increase WIL Athletic Supply, Inc. Five-Year Financial Summary (Partial; adapted) Domestic Comparative Store Sales Increase Other Income-Net Cost of Goods Sold Selling and Administrative Expenses Interest: Interest Expense Interest Income Income Tax Expense Merchandise Inventory Property, Plant, and Equipment, Net Total Assets Current Liabilities 2018 2017 2016 2015 $ 260,000 $ 219,000 $ 198,000 $ 169,000 $ 139,000 19% 11% 17% 22% 17% 5% 7% 4% 8% 9% 2,120 1,800 1,730 1,700 196,040 167,316 153,450 132,496 41,280 36,340 31,690 27,408 Net Income Per Share of Common Stock: Net Income Dividends Financial Position Current Assets, Excluding Merchandise Inventory S (1,110) (1,370) (1.90) (1,080) 150 145 195 210 4,430 3,800 3.660 19,410 12,119 9,735 1.40 0.40 1.10 0.38 30,800 $ 27,400 S 24,400 22,300 51,100 46,100 106,300 95,800 32,500 27,000 1.00 0.34 3,380 6,546 0.80 0.30 26,200 $25,000 $ 21,800 19,700 40,900 35,500 88,900 80,200 28,500 25,200 2014 1,340 110,227 22,550 (880) 165 2,790 4,058 0.58 0.26 21,800 17,900 S 25,100 64,800 16,300 2013 16,500 Domestic Comparauveure area trase Other Income-Net Cost of Goods Sold Selling and Administrative Expenses Interest: Interest Expense Interest Income Income Tax Expense Net Income Per Share of Common Stock: Net Income Dividends Financial Position Current Assets, Excluding Merchandise Inventory S Merchandise Inventory Property, Plant, and Equipment, Net Total Assets Current Liabilities Long-term Debt Stockholders' Equity Financial Ratios Acid-Test Ratio Rate of Return on Total Assets Rate of Return on Stockholders' Equity (1,110) 150 4,430 19,410 2,120 1,800 1,340 196,040 167,316 153,450 132,496 110,227 41,280 36,340 31,690 27,408 22,550 1.40 0.40 0.9 20.3% 39.6% (1,370) (1,390) 145 195 3.800 3.660 12,119 9,735 1.10 0.38 30,800 $ 27,400 S 24,400 22,300 51,100 46,100 106,300 95,800 32,500 27,000 23,100 21,400 50,700 U 1,730 1,700 1.0 14.6% 26.9% 1.00 0.34 26,200 $ 25,000 $ 21,800 19.700 40,900 35,500 88,900 80.200 28.500 25,200 17,700 18,000 47,400 42,700 37,000 (1.080) 210 3,380 6,546 0.9 13.2% 24.4% 0.80 0.30 370 1.0 10.5% 18.0% (880) 165 2,790 4,058 0.58 0.26 21,800 17,900 S 25,100 64,800 16,300 12,800 35,700 1.3 9.5% 17.5% 16,500 Requirements Analyze the company's financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of WIL. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2014 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WIL Athletic Supply, Inc.? Fully explain your final decision. - X Print Done nearest ce Formulas Ref. Formula (a.) 365 days / Inventory turnover (b.) Annual dividend per share / Earnings per share (c) Annual dividend per share / Market price per share (d.) (Cash including cash equivalents + Short-term investments + Net current receivables)/ Total current liabilities (e.) Cost of goods sold / Average merchandise inventory (f.) Current assets Current liabilities (g) Gross profit/ Net sales revenue (h.) Market price per share of common stock/Earnings per share. (i.) Net credit sales / Average net accounts receivables () (Net income + Income tax expense + Interest expense) / Interest expense (k.) Net income / Net sales (1.) (Net income + Interest expense) / Average total assets (m.) (Net income - Preferred dividends) / Average common stockholders equity (n.) (Net income - Preferred dividends)/ Weighted average-number of common shares outstanding (0) Total current assets/Total current liabilities (p.) Total liabilities/Total assets (q.) Total liabilities/Total equity Print Done I In its annual report, WIL Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the requirements. Requirement 1. Compute the trend analysis for net sales and net income (use 2014 as the base year). (Round to the nearest whole percent.) 2016 2014 Net sales Net income 2018 187 % 478 % 2017 158 % 299 % Profit margin ratio Rate of return on total assets Rate of return on common stockholders' equity Earnings per share of common stock Earnings per share 2018 142 % 240 % 2015 Trends in net sales and net income are both upward Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis. 122 % 161 % which is positive Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent, XXX) Click the icon to view the formulas.) 2017 2016 2015 2014 100 % 100 % Formula (n.) Choose from any list or enter any number in the input fields and then click Check Answer 4

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Answer Part 1 Net Sales Trend 204 168 152 132 100 Net Income Trend 960 625 486 356 100 year 2018 2017 2016 2015 2014 Net Sales 265000 218000 198000 171000 130000 Net Sales Trend 204 168 152 132 100 Ne... View full answer

Get step-by-step solutions from verified subject matter experts