Answered step by step

Verified Expert Solution

Question

1 Approved Answer

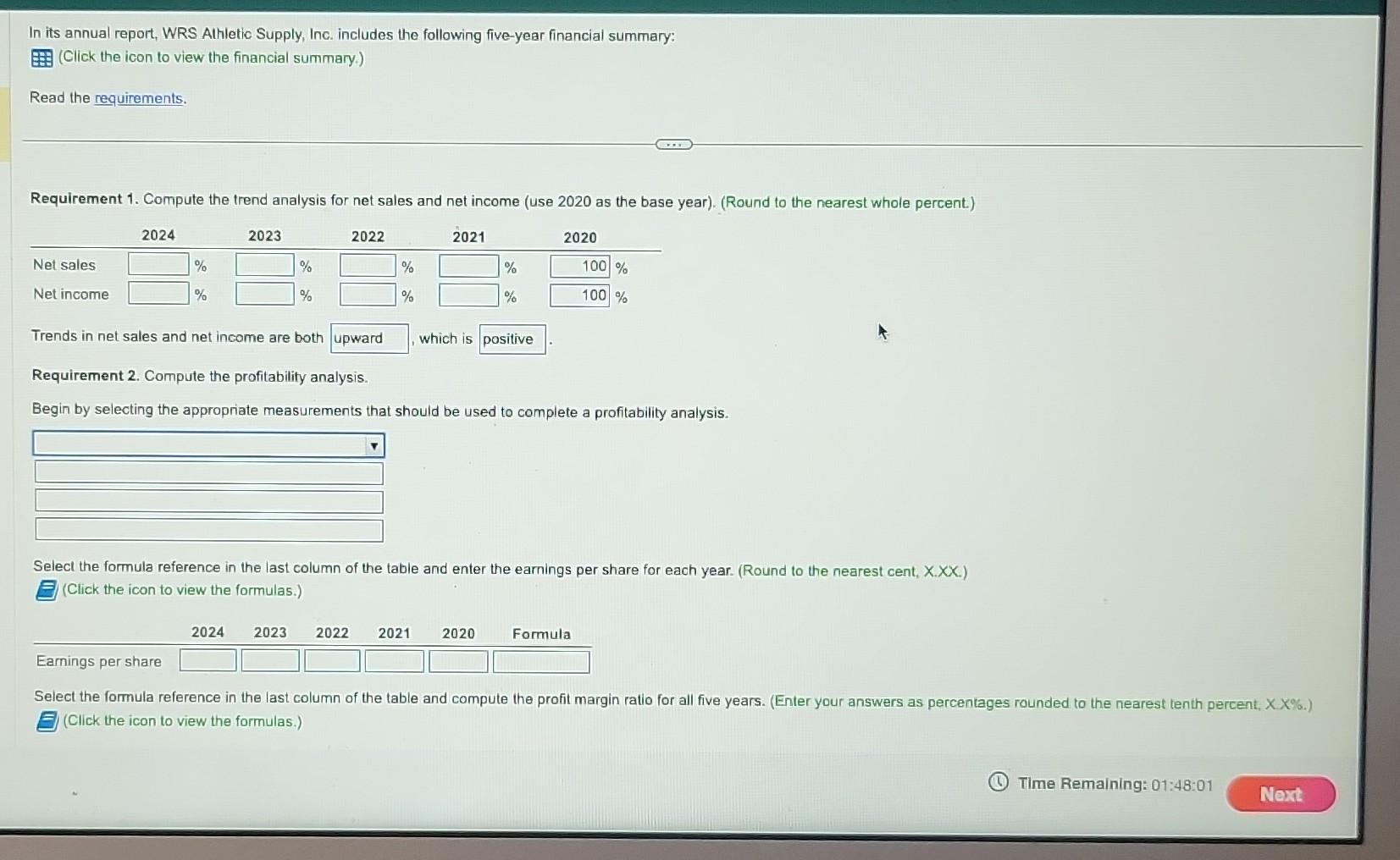

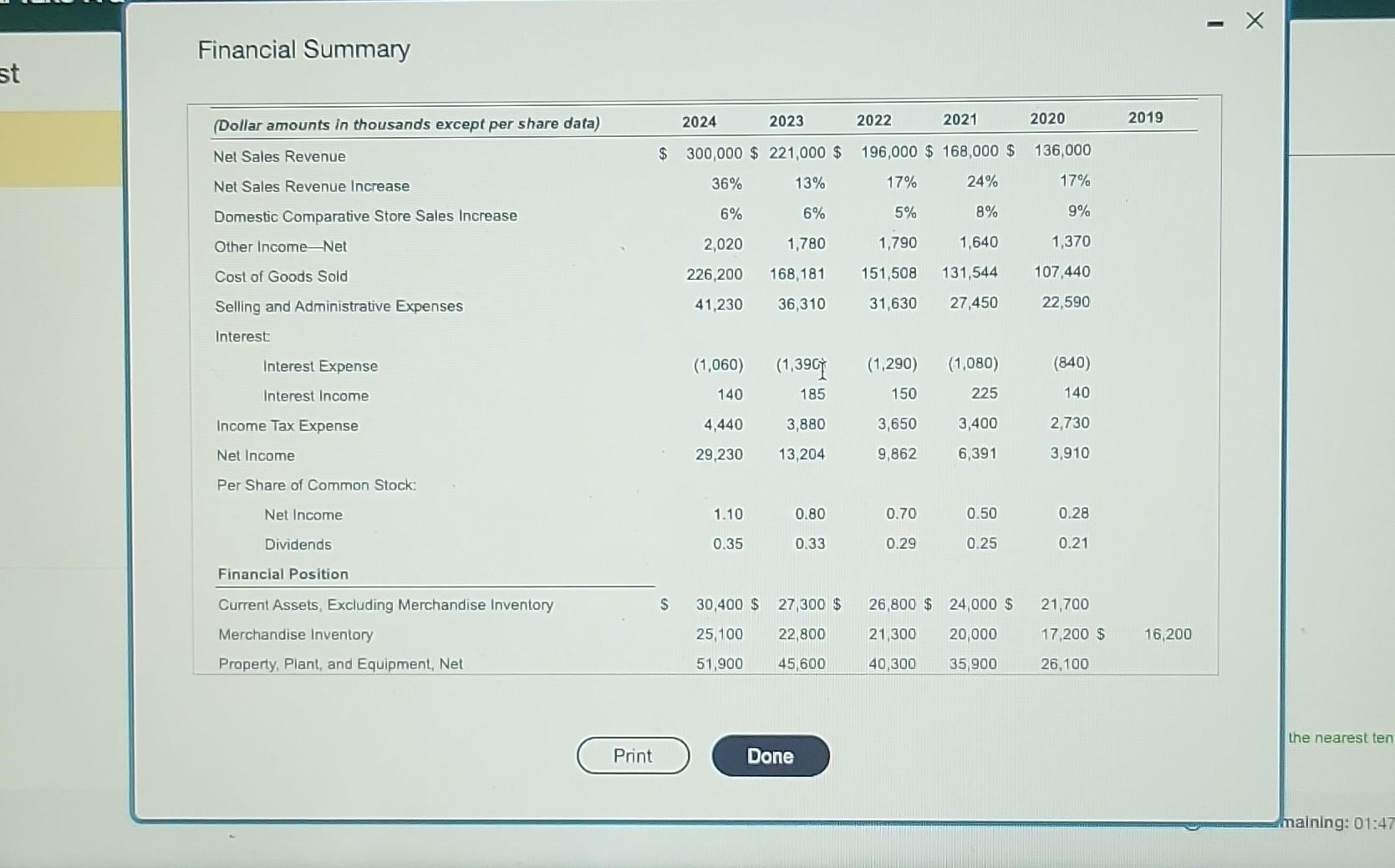

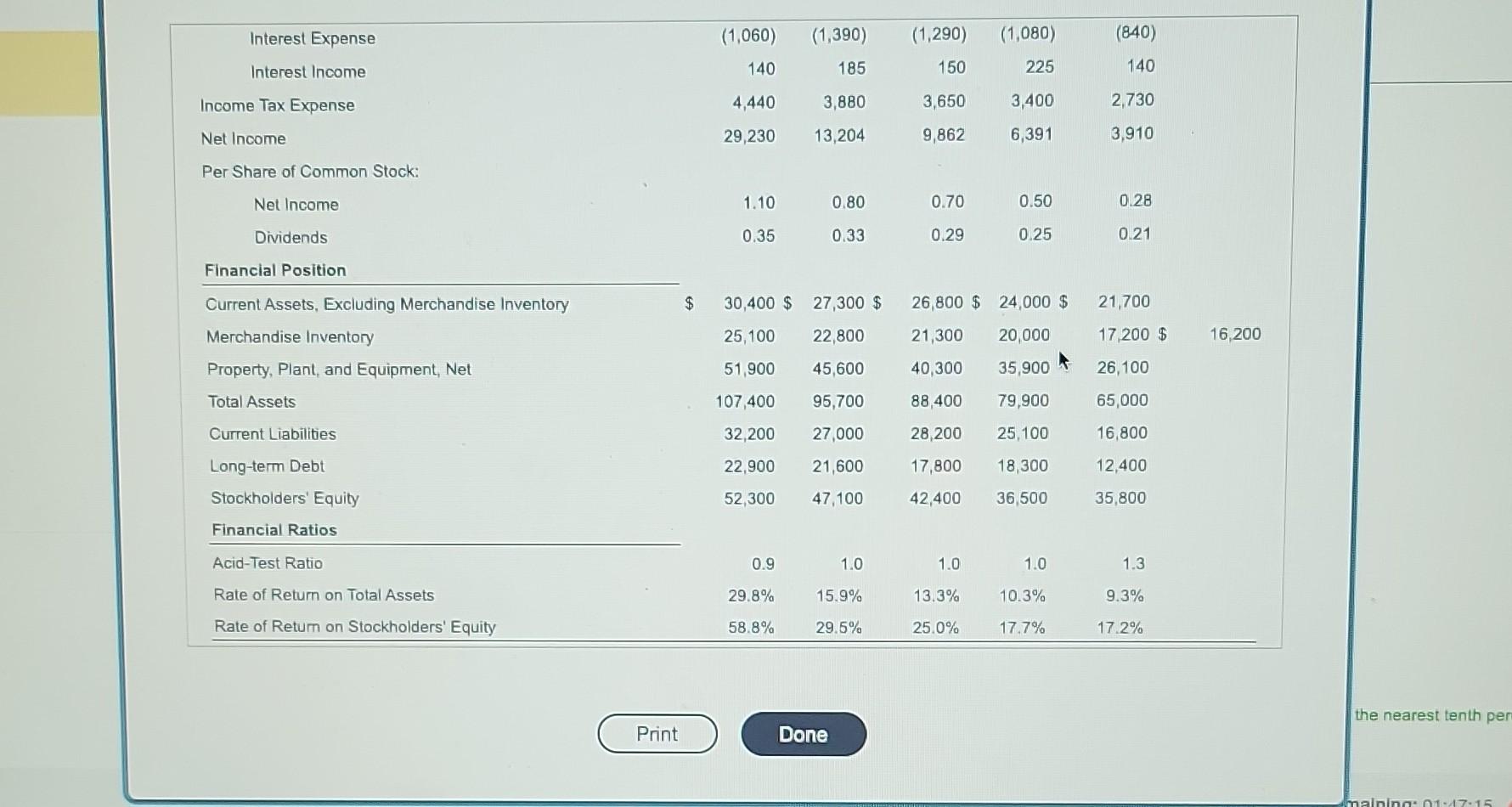

In its annual report, WRS Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the nequirements.

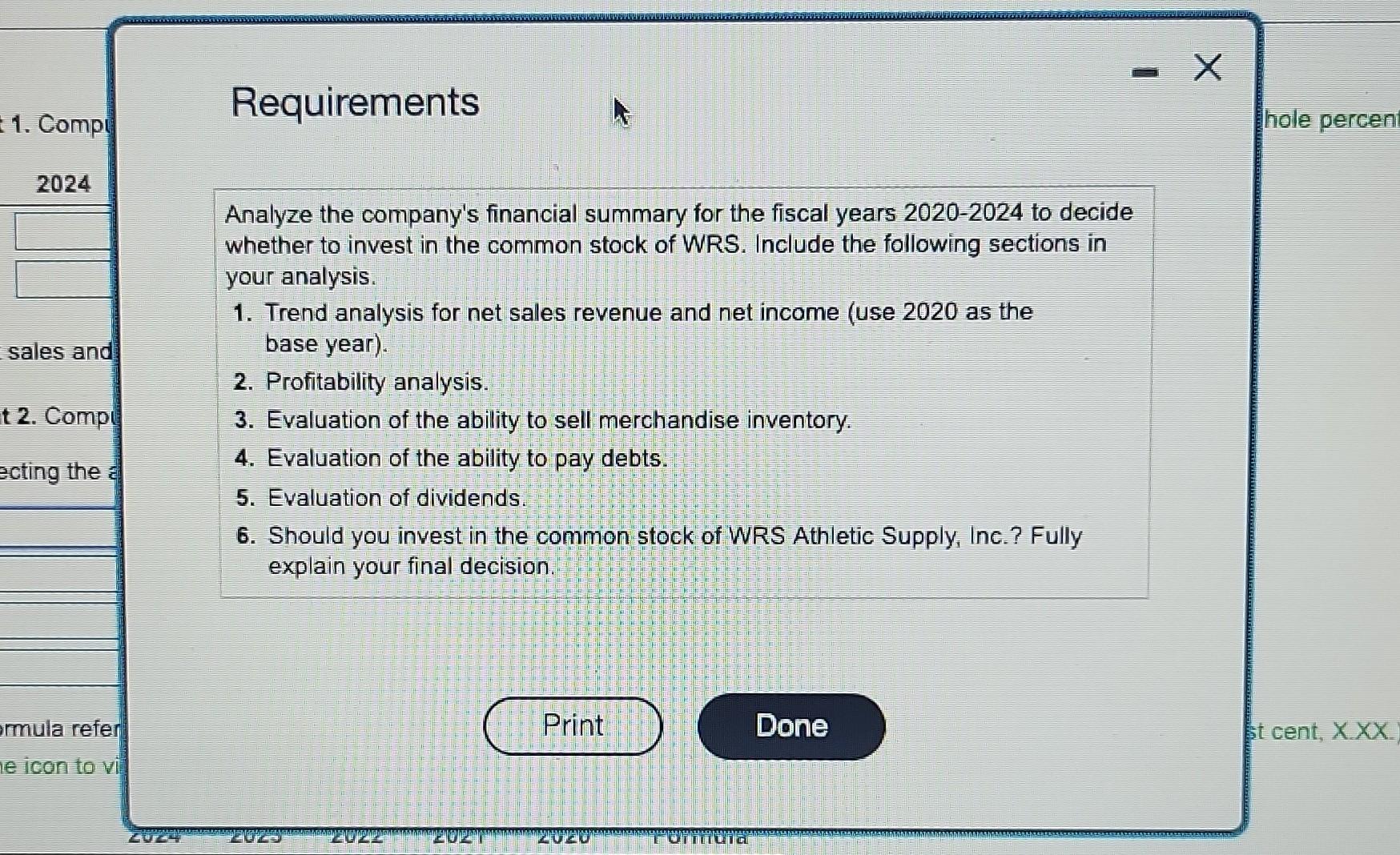

In its annual report, WRS Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the nequirements. Requirement 1. Compute the trend analysis for net sales and net income (use 2020 as the base year). (Round to the nearest whole percent.) Trends in net sales and net income are both which is Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis. Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent, X.XX.) (Click the icon to view the formulas.) Select the formula reference in the last column of the table and compute the profit margin ratio for all five years. (Enter your answers as percentages rounded to the nearest tenth percent, X X\%.) (Click the icon to view the formulas.) Financial Summary the nearest tenth per Analyze the company's financial summary for the fiscal years 2020-2024 to decide whether to invest in the common stock of WRS. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2020 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WRS Athletic Supply, Inc.? Fully explain your final decision. In its annual report, WRS Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the nequirements. Requirement 1. Compute the trend analysis for net sales and net income (use 2020 as the base year). (Round to the nearest whole percent.) Trends in net sales and net income are both which is Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis. Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent, X.XX.) (Click the icon to view the formulas.) Select the formula reference in the last column of the table and compute the profit margin ratio for all five years. (Enter your answers as percentages rounded to the nearest tenth percent, X X\%.) (Click the icon to view the formulas.) Financial Summary the nearest tenth per Analyze the company's financial summary for the fiscal years 2020-2024 to decide whether to invest in the common stock of WRS. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2020 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WRS Athletic Supply, Inc.? Fully explain your final decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started