Answered step by step

Verified Expert Solution

Question

1 Approved Answer

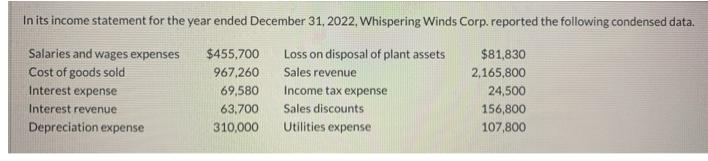

In its income statement for the year ended December 31, 2022, Whispering Winds Corp. reported the following condensed data. Salaries and wages expenses $455,700

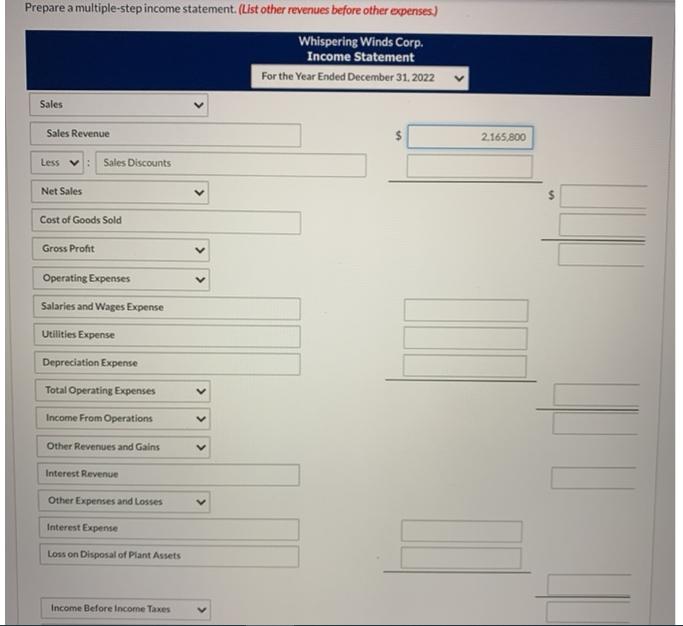

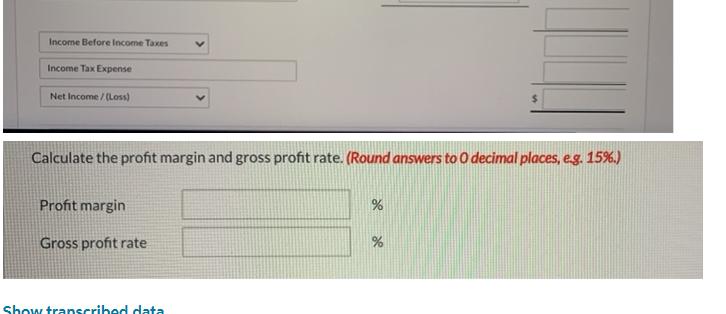

In its income statement for the year ended December 31, 2022, Whispering Winds Corp. reported the following condensed data. Salaries and wages expenses $455,700 Loss on disposal of plant assets Cost of goods sold 967,260 Sales revenue Interest expense Interest revenue Depreciation expense 69,580 63,700 310,000 Income tax expense Sales discounts Utilities expense $81,830 2,165,800 24,500 156,800 107,800 Prepare a multiple-step income statement. (List other revenues before other expenses.) Whispering Winds Corp. Income Statement For the Year Ended December 31, 2022 Sales Sales Revenue Less Sales Discounts Net Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Expense Utilities Expense Depreciation Expense Total Operating Expenses Income From Operations Other Revenues and Gains Interest Revenue Other Expenses and Losses Interest Expense Loss on Disposal of Plant Assets Income Before Income Taxes 2.165,800 s Income Before Income Taxes Income Tax Expense Net Income /(Loss) Calculate the profit margin and gross profit rate. (Round answers to O decimal places, e.g. 15%.) Profit margin Gross profit rate Show transcribed data % $ %

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started