Answered step by step

Verified Expert Solution

Question

1 Approved Answer

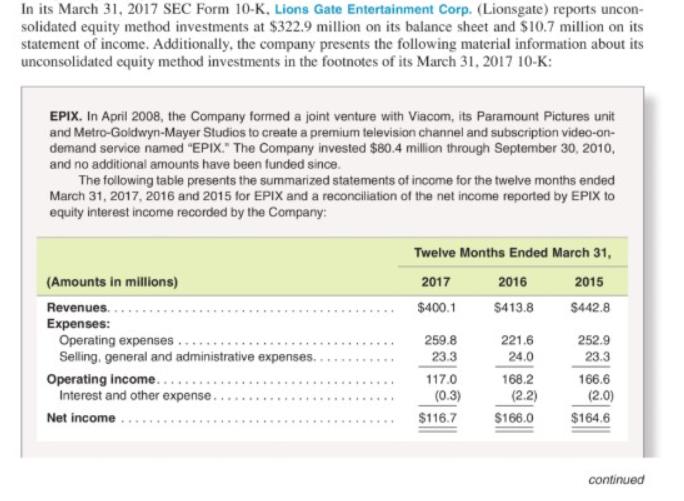

In its March 31, 2017 SEC Form 10-K, Lions Gate Entertainment Corp. (Lionsgate) reports uncon- solidated equity method investments at $322.9 million on its

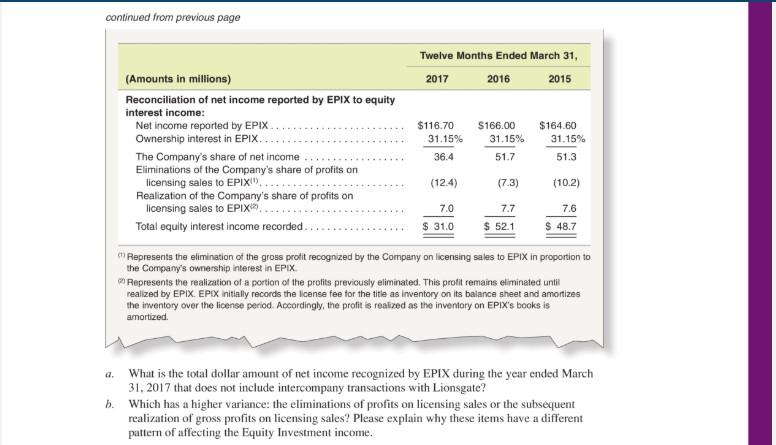

In its March 31, 2017 SEC Form 10-K, Lions Gate Entertainment Corp. (Lionsgate) reports uncon- solidated equity method investments at $322.9 million on its balance sheet and $10.7 million on its statement of income. Additionally, the company presents the following material information about its unconsolidated equity method investments in the footnotes of its March 31, 2017 10-K: EPIX. In April 2008, the Company formed a joint venture with Viacom, its Paramount Pictures unit and Metro-Goldwyn-Mayer Studios to create a premium television channel and subscription video-on- demand service named "EPIX." The Company invested $80.4 million through September 30, 2010, and no additional amounts have been funded since. The following table presents the summarized statements of income for the twelve months ended March 31, 2017, 2016 and 2015 for EPIX and a reconciliation of the net income reported by EPIX to equity interest income recorded by the Company: Twelve Months Ended March 31, (Amounts in millions) 2017 2016 2015 Revenues.. $400.1 $413.8 $442.8 Expenses: Operating expenses... Selling, general and administrative expenses. 259.8 221.6 252.9 .... 23.3 24.0 23.3 Operating income.... Interest and other expense. 117.0 166.6 (2.0) 168.2 (0.3) (2.2) Net income $116.7 $166.0 $164.6 continued continued from previous page Twelve Months Ended March 31, (Amounts in millions) 2017 2016 2015 Reconciliation of net income reported by EPIX to equity interest income: Net income reported by EPIX.. Ownership interest in EPIX.. $116.70 S166.00 $164.60 31.15% 31.15% 31.15% The Company's share of net income Eliminations of the Company's share of profits on licensing sales to EPIX". Realization of the Company's share of profits on licensing sales to EPIX. Total equity interest income recorded.. 36.4 51.7 51.3 (12.4) (7.3) (10.2) 7.0 7.7 7.6 $ 31.0 $ 52.1 $ 48.7 Represents the elimination of the gross profit recognized by the Company on licensing sales to EPIX in proportion to the Company's ownership interest in EPIX. Represents the realization of a portion of the profits previously eliminated. This profit remains eliminated until realized by EPIX. EPIX initially records the license fee for the title as inventory on its balance sheet and amortizes the inventory over the license period. Accordingly, the profit is realized as the inventory on EPIX's books is amortized. a. What is the total dollar amount of net income recognized by EPIX during the year ended March 31, 2017 that does not include intercompany transactions with Lionsgate? b. Which has a higher variance: the eliminations of profits on licensing sales or the subsequent realization of gross profits on licensing sales? Please explain why these items have a different pattern of affecting the Equity Investment income.

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Number 1 1043 million 11670 m less 124m Number 2 The higher variance is the elimination o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started