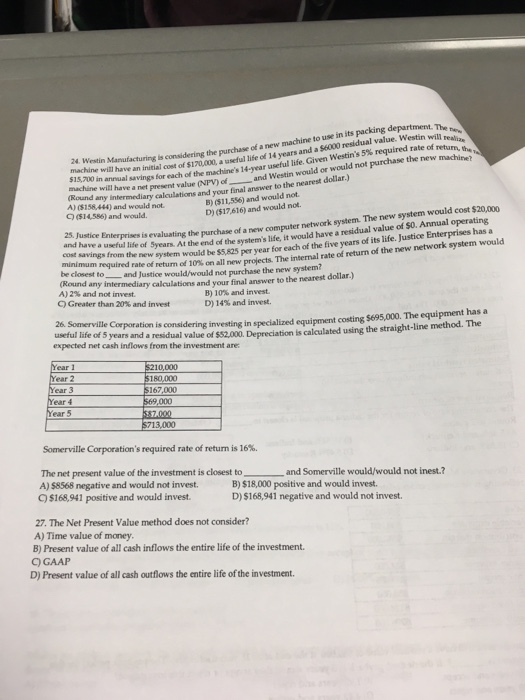

in its packing department. Thee Westin Manufacturing is considering the machine will have an initial cost of $120.000, a useful life of 14 years and a 96000 residual value. Westin wia SISTO in annual savingsf reach of he purchase of a new machine to use in its packing hine, 14-year useful life. Given Westin's 5% required rate of return,th. and Westin would or would not purchase the new machine 2 Westin machine kound any intermediary calculations and your final answer to the nearest dollar.) will have a net present value (NPV) of A) (158,444) and would not. C) ($14586) and would BOSI 1,556) and would not. D) ($17,616) and would not. 25. Justice Enterprises is and have a useful life cost savings from the system minimum required rate of return of be closest toand Justice would/would not purc (Round any intermediary calculations and your final answer to the nearest dollar.) evaluating the purchase of a new computer network system. The new system would cost $20,000 of Syears. At the end of the system's lfe, it would have a residual value of $0. Annual operating new system would be $5,825 per year for each of the five years of its life. Justice Enterprises has a At the 10% on all new projects. The internal rate of return of the new network system would hase the new system? A)2% and not invest. B) 10% and invest. D) 14% and invest. Greater than 20% and invest useful life of expected net cash inflows from the investment are Corporation is considering investing in specialized equipment costing $695,000. The equipment has a years and a residual value of $52.000. Depreciation is calculated using the straight-line method. The ear 1 10,000 180,000 167,000 Year 3 ear 4 Year 5 Somerville Corporation's required rate of retum is 16%. The net present value of the investment is closest to-? A) $8568 negative and would not invest. C)$168,941 positive and would invest and Somerville would would not iest? B) $18,000 positive and would invest. D)$168,941 negative and would not invest. 27. The Net Present Value method does not consider? A) Time value of money B) Present value of all cash inflows the entire life of the investment C) GAAP D) Present value of all cash outflows the entire life of the investment