In January 2016, Bob Prescott, the controller for the Blue Ridge Mill, was considering

the addition of a new on-site longwood woodyard. The addition would have two pri-

mary benefits: to eliminate the need to purchase shortwood from an outside supplier and

create the opportunity to sell shortwood on the open market as a new market for World-

wide Paper Company (WPC). Now the new woodyard would allow the Blue Ridge Mill

not only to reduce its operating costs but also to increase its revenucs. The proposed

woodyard utilized new technology that allowed tree-length logs, called longwood, to be

processed directly, whereas the current process required shortwood, which had to be

purchased from the Shenandoah Mill. This nearby mill, owned hy a competitor, had

excess capacity that allowed it to produce more shortwood than it needed for its own

pulp production. The excess was sold to several different mills, including the Blue

kidge Mil. Thus adding the new longwood equipment would mean that Prescott would

no longer need to use the Shenandoah Mill as a shortwood supplier and that the Blue

Ridge Mill would instead compete with the Shenandoah Mill by selling on the short-

wood market. The question for Prescott was whether these expected benefits were

enough to justify the $18 million capital outlay plus the incremental investment in

working capital over the six-year life of the investment.

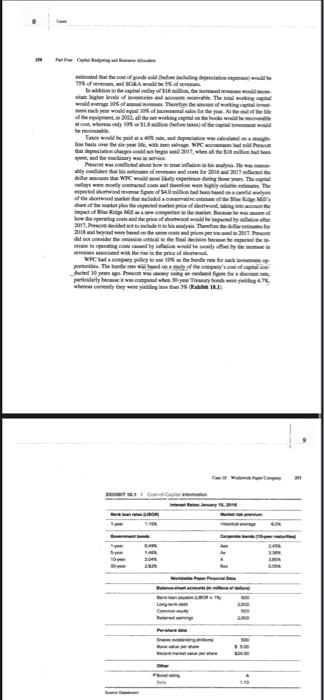

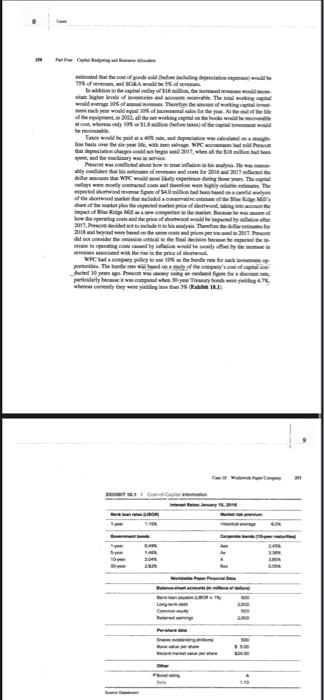

CASE 18 In January 2016, Bob Prescon, the controller for the Blue Ridge Mill, was considering the addition of a new on-site longwood woodyand. The addition would have two pri mary bef: 10-liminate the need to purchase shomwood from an outside supplier and the opportunity to sell shomwood on the open market anerk for World wide Paper Company (WPC). Now the woodyard would allow the Blue Ridge M not only to reduce in operating costs but also to increase in res. The proposed woodyand siled new technology that allowed uwe-imgh ings, called loagwood, to be processed directly, whereas the current process required showood, which had to be purchased from the Shenandoah Mil. This nearby mill, owned by a competitor, hat excess capacity that allowed it to produce more shortwood than it needed for its own palp production. The excess was sold to several different mills, including the Blue Ridge Mill. Thus adding the new kongwood equipment would mean that Prescon would no longer need to use the Shenandoah Mill as a shortwood supplier and that the Blue Ridge Mill would instead compete with the Shenandosh Mil by selling on the short- wood market. The question for Prescot was whether these expected benef enough to justify the 518 million capital ouday plus the incremental investment in working capital over the six year life of the v Coaction would start within a few months, and the investmes only would be spent over two calendar years: $16 million in 2016 and the maining $2 million in 2017. When the new woodyand began operating in 2017. i would significantly reduce the operating costs of the mill. These operating savings would come mostly from the difference in the cost of producing shormwood on-site vervas buying it on the open mar kot and were estimated to be $20 million for 2017 and 53.5 per year For 2017, be expected to show revenues of appesiely 54 million, as the facility came online and began to break into the new market. He expected shortwood sales to mach 500 million in 2018 and continue at the $10 million level dough 2022. P the tanding of Uity of Vi Dari SFC VA All rights Tonder ng poft p phopping ding or th estimated that the cost of goods sold (before including depreciate expenses) would be 75% of revesses, and SGAA would be 5% of even In addition to the capital ouday of $18 million, the increased revesses would neces state higher levels of inventories and accounts receivable. The total working capital would average 10% of mal revenues. Therefore the amount of working capital invest ment each year would equal 10% of incremental sales for the year. At the end of the life of the equipment in 2022, all the networking capital on the books would be recoverable at cost, where only 10% or $1.8 million before taxes) of the capital investment would be necoverable Taxes would be paid ata 40% rus, and depenciation was calculated on th line basis over the six-year life, with zero salvage WPC accountants had told Pro that decision charges could not begin snil 2017, when all the $18 million had been spent, and the machinery was in service. Prescott was conflicted about how to treat inflation in his analysis. Ile was ably confident that his estimates of revesses and costs for 2016 and 2017 reflected the dollar as the WPC would most likely experience during those years. The capital ouflays were mostly contracted costs and therefore were highly reliable estimates. The expected shorwood revenue figure of $4.0 million had bon based on a cam of the shortwood market that included a conservative cate of the fee Ridge Mi share of the market plas the expected market price of aborwood, taking into acothe impact of Blue Ridge Mill as a new competitor in the market. Because he was une of how the operating costs and the price of shortwood would be impacted by inflation after 2017, Prescot decided not to include it in his analysis. Therefore the dollar estimates for 2018 and beyond.bl....cssanLadices eran used in 2017 Pro did not co Cristal to the tin doc because he expected the p Worldwide Paper Company ththe cou of go fopeociation specrect seconditthe 75%off tio pil e of 518 working aighae lees of The wows105 of Thenmcene of eontinge orsectyeir would equal 30% of local coles for the out in 2003, all te net wortip opetal on te booko wed ato rascaly 199%et of de co Troxcewould be 7% rule ant doporscientica has over the s thutdpreciation charps WICaOount 2017, when Presce 58 million had be and the machinerywani Presco wasted thout how to tranflation in his lys. He was m ly cudint thar hiseaiofrnd ro for 3018 and 2017 nildle bear as the Wamil mai thay pin dung ty. The tays were mostly contacted costs and then we highly reliable a c experitnd shortwood mevamrue filete of S4.0 million had thonm oTYDRC e of the hurt oftemple el prie of birteood alt account et of Wine Widge i Now font and the prion of scotrod watbe paedky 2017, Predecided not to include it in his analysis Theme the d 2018 and were based in the same co per in 2017.P d e foal eniie boase he criparand crease in operatings and by fation would be only of b with the riven ln the peice of stero NTC hape hardie rabe for axcha gortuntti The bhede roed of the copieny sdooed of ed 10 years ago Precwying an end geforde utiilarly bcmunopodaeoTreasary fonh woeyilip 47% where come they were yielding in than 25 (181) Jy 15,201 20 CASE 18 In January 2016, Bob Prescon, the controller for the Blue Ridge Mill, was considering the addition of a new on-site longwood woodyand. The addition would have two pri mary bef: 10-liminate the need to purchase shomwood from an outside supplier and the opportunity to sell shomwood on the open market anerk for World wide Paper Company (WPC). Now the woodyard would allow the Blue Ridge M not only to reduce in operating costs but also to increase in res. The proposed woodyand siled new technology that allowed uwe-imgh ings, called loagwood, to be processed directly, whereas the current process required showood, which had to be purchased from the Shenandoah Mil. This nearby mill, owned by a competitor, hat excess capacity that allowed it to produce more shortwood than it needed for its own palp production. The excess was sold to several different mills, including the Blue Ridge Mill. Thus adding the new kongwood equipment would mean that Prescon would no longer need to use the Shenandoah Mill as a shortwood supplier and that the Blue Ridge Mill would instead compete with the Shenandosh Mil by selling on the short- wood market. The question for Prescot was whether these expected benef enough to justify the 518 million capital ouday plus the incremental investment in working capital over the six year life of the v Coaction would start within a few months, and the investmes only would be spent over two calendar years: $16 million in 2016 and the maining $2 million in 2017. When the new woodyand began operating in 2017. i would significantly reduce the operating costs of the mill. These operating savings would come mostly from the difference in the cost of producing shormwood on-site vervas buying it on the open mar kot and were estimated to be $20 million for 2017 and 53.5 per year For 2017, be expected to show revenues of appesiely 54 million, as the facility came online and began to break into the new market. He expected shortwood sales to mach 500 million in 2018 and continue at the $10 million level dough 2022. P the tanding of Uity of Vi Dari SFC VA All rights Tonder ng poft p phopping ding or th estimated that the cost of goods sold (before including depreciate expenses) would be 75% of revesses, and SGAA would be 5% of even In addition to the capital ouday of $18 million, the increased revesses would neces state higher levels of inventories and accounts receivable. The total working capital would average 10% of mal revenues. Therefore the amount of working capital invest ment each year would equal 10% of incremental sales for the year. At the end of the life of the equipment in 2022, all the networking capital on the books would be recoverable at cost, where only 10% or $1.8 million before taxes) of the capital investment would be necoverable Taxes would be paid ata 40% rus, and depenciation was calculated on th line basis over the six-year life, with zero salvage WPC accountants had told Pro that decision charges could not begin snil 2017, when all the $18 million had been spent, and the machinery was in service. Prescott was conflicted about how to treat inflation in his analysis. Ile was ably confident that his estimates of revesses and costs for 2016 and 2017 reflected the dollar as the WPC would most likely experience during those years. The capital ouflays were mostly contracted costs and therefore were highly reliable estimates. The expected shorwood revenue figure of $4.0 million had bon based on a cam of the shortwood market that included a conservative cate of the fee Ridge Mi share of the market plas the expected market price of aborwood, taking into acothe impact of Blue Ridge Mill as a new competitor in the market. Because he was une of how the operating costs and the price of shortwood would be impacted by inflation after 2017, Prescot decided not to include it in his analysis. Therefore the dollar estimates for 2018 and beyond.bl....cssanLadices eran used in 2017 Pro did not co Cristal to the tin doc because he expected the p Worldwide Paper Company ththe cou of go fopeociation specrect seconditthe 75%off tio pil e of 518 working aighae lees of The wows105 of Thenmcene of eontinge orsectyeir would equal 30% of local coles for the out in 2003, all te net wortip opetal on te booko wed ato rascaly 199%et of de co Troxcewould be 7% rule ant doporscientica has over the s thutdpreciation charps WICaOount 2017, when Presce 58 million had be and the machinerywani Presco wasted thout how to tranflation in his lys. He was m ly cudint thar hiseaiofrnd ro for 3018 and 2017 nildle bear as the Wamil mai thay pin dung ty. The tays were mostly contacted costs and then we highly reliable a c experitnd shortwood mevamrue filete of S4.0 million had thonm oTYDRC e of the hurt oftemple el prie of birteood alt account et of Wine Widge i Now font and the prion of scotrod watbe paedky 2017, Predecided not to include it in his analysis Theme the d 2018 and were based in the same co per in 2017.P d e foal eniie boase he criparand crease in operatings and by fation would be only of b with the riven ln the peice of stero NTC hape hardie rabe for axcha gortuntti The bhede roed of the copieny sdooed of ed 10 years ago Precwying an end geforde utiilarly bcmunopodaeoTreasary fonh woeyilip 47% where come they were yielding in than 25 (181) Jy 15,201 20