Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In January of the current year, Wanda transferred machinery worth $200,000 (adjusted basis of $30,000) to a controlled corporation, Oriole, Inc. The transfer qualified

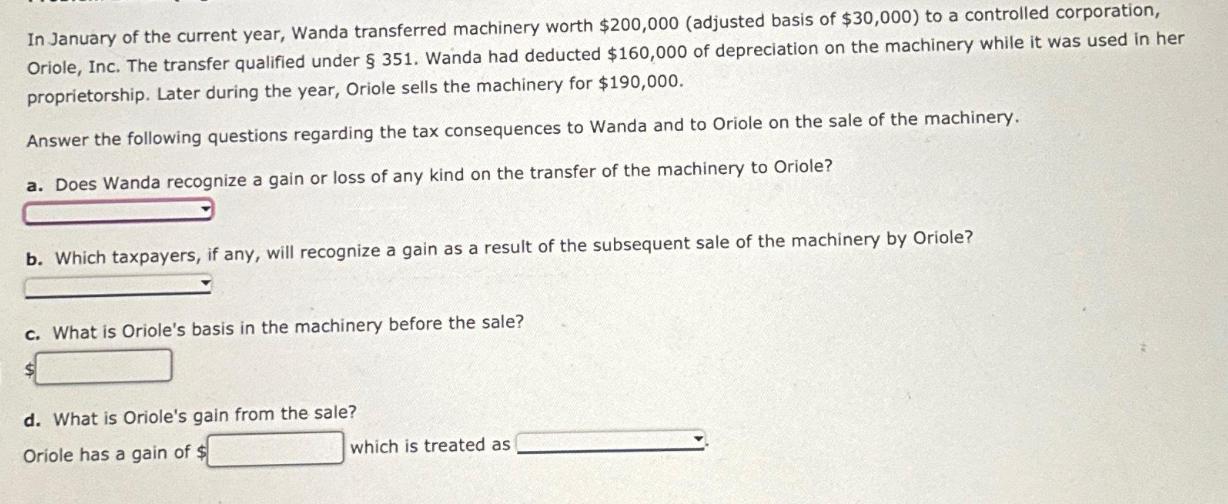

In January of the current year, Wanda transferred machinery worth $200,000 (adjusted basis of $30,000) to a controlled corporation, Oriole, Inc. The transfer qualified under 351. Wanda had deducted $160,000 of depreciation on the machinery while it was used in her proprietorship. Later during the year, Oriole sells the machinery for $190,000. Answer the following questions regarding the tax consequences to Wanda and to Oriole on the sale of the machinery. a. Does Wanda recognize a gain or loss of any kind on the transfer of the machinery to Oriole? b. Which taxpayers, if any, will recognize a gain as a result of the subsequent sale of the machinery by Oriole? c. What is Oriole's basis in the machinery before the sale? d. What is Oriole's gain from the sale? Oriole has a gain of $ which is treated as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Wanda does not recognize a gain or loss on the transfer of the machinery to Oriole under 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6633520d9708d_936067.pdf

180 KBs PDF File

6633520d9708d_936067.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started