Answered step by step

Verified Expert Solution

Question

1 Approved Answer

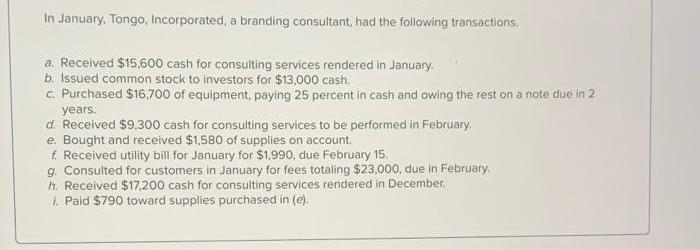

In January, Tongo, Incorporated, a branding consultant, had the following transactions. a. Received $15,600 cash for consulting services rendered in January. b. Issued common

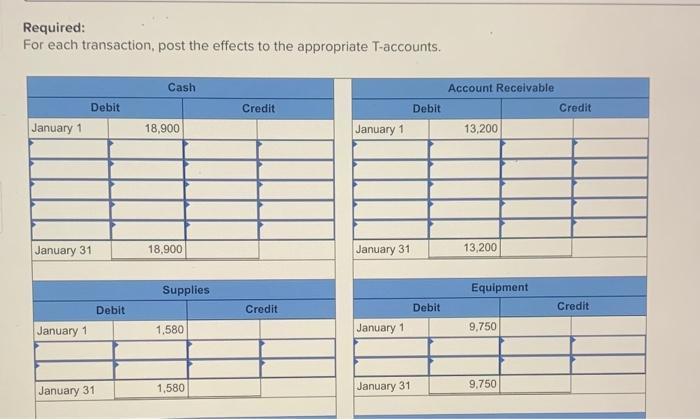

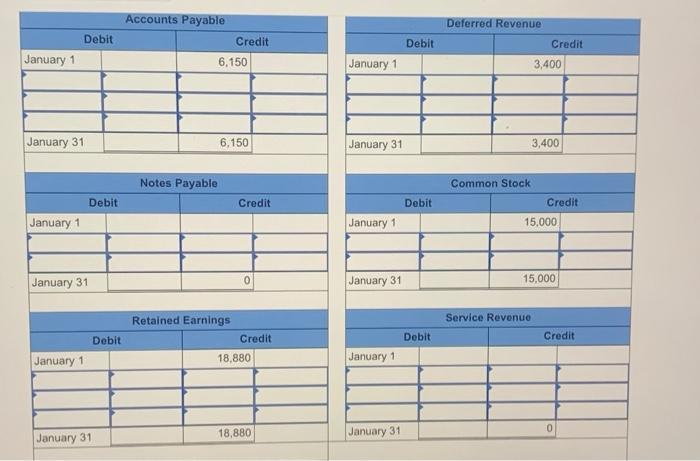

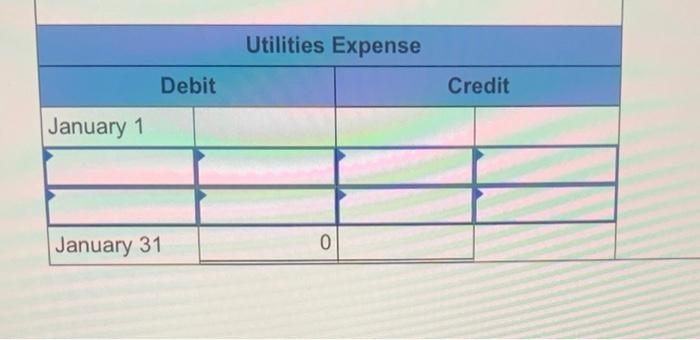

In January, Tongo, Incorporated, a branding consultant, had the following transactions. a. Received $15,600 cash for consulting services rendered in January. b. Issued common stock to investors for $13,000 cash. c. Purchased $16,700 of equipment, paying 25 percent in cash and owing the rest on a note due in 2 years. d. Received $9,300 cash for consulting services to be performed in February. e. Bought and received $1,580 of supplies on account. f. Received utility bill for January for $1,990, due February 15. g. Consulted for customers in January for fees totaling $23,000, due in February. h. Received $17,200 cash for consulting services rendered in December. 1. Paid $790 toward supplies purchased in (e). Required: For each transaction, post the effects to the appropriate T-accounts. Cash Account Receivable Credit Debit Credit January 1 13,200 Debit January 1 18,900 January 311 18,900 January 1 Debit Supplies 1,580 January 31 1,580 January 31 13,200 Equipment Credit Credit Debit January 11 9,750 January 311 9,750 January 11 January 31 Debit Accounts Payable Credit Debit 6,150 January 11 6,150 January 31 Deferred Revenue Credit 3,400 3,400 Notes Payable Common Stock Debit Credit Debit Credit January 1 January 1 15,000 January 31 0 January 31 15,000 Retained Earnings Service Revenue Debit Credit Debit Credit January 1 18,880 January 11 January 31 18,880 January 31 0 January 1 Debit Utilities Expense January 31 0 Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started