Answered step by step

Verified Expert Solution

Question

1 Approved Answer

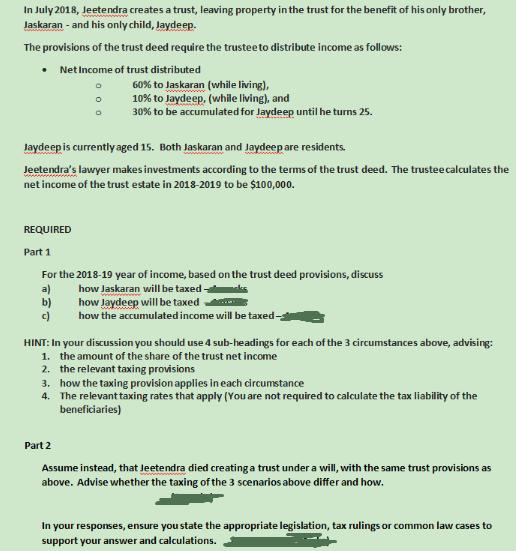

In July 2018, Jeetendra creates a trust, leaving property in the trust for the benefit of his only brother, Jaskaran - and his only

In July 2018, Jeetendra creates a trust, leaving property in the trust for the benefit of his only brother, Jaskaran - and his only child, Jaydeep. The provisions of the trust deed require the trustee to distribute income as follows: Net Income of trust distributed 0 0 Jaydeep is currently aged 15. Both Jaskaran and Jaydeep are residents. Jeetendra's lawyer makes investments according to the terms of the trust deed. The trustee calculates the net income of the trust estate in 2018-2019 to be $100,000. a) b) c) 60% to Jaskaran (while living), 10% to Jaydeep, (while living), and 30% to be accumulated for Jaydeep until he turns 25. REQUIRED Part 1 For the 2018-19 year of income, based on the trust deed provisions, discuss how Jaskaran will be taxed how Jaydeep will be taxed how the accumulated income will be taxed- Part 2 HINT: In your discussion you should use 4 sub-headings for each of the 3 circumstances above, advising: 1. the amount of the share of the trust net income 2. the relevant taxing provisions 3. how the taxing provision applies in each circumstance 4. The relevant taxing rates that apply (You are not required to calculate the tax liability of the beneficiaries) Assume instead, that Jeetendra died creating a trust under a will, with the same trust provisions as above. Advise whether the taxing of the 3 scenarios above differ and how. In your responses, ensure you state the appropriate legislation, tax rulings or common law cases to support your answer and calculations.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Taxation of Trust Income in 201819 a Taxation of Jaskarans Share Amount of Jaskarans Share of Trust Net Income 60 of 100000 60000 Relevant Taxi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started