Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In July 2022 Kirk and Rasheeda Wallace and their two dependent children moved from Chicago to Albuquerque, New Mexico, a distance of 1,327 miles,

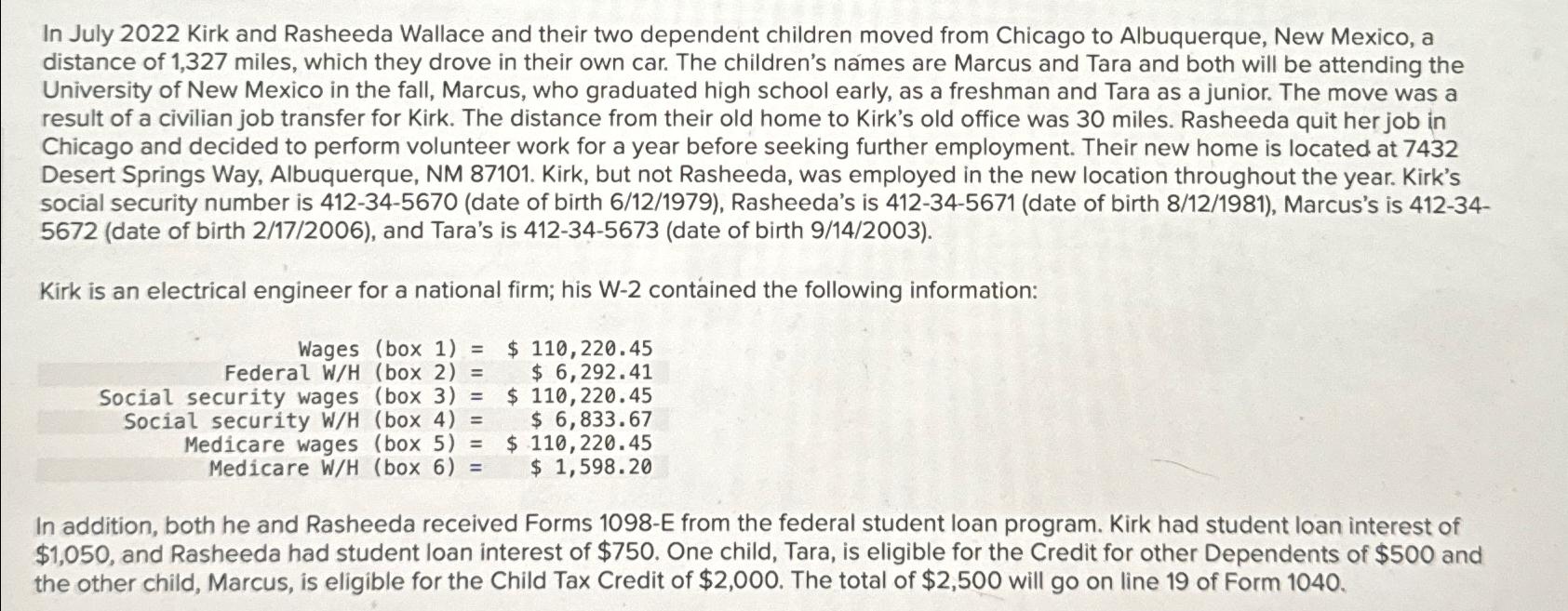

In July 2022 Kirk and Rasheeda Wallace and their two dependent children moved from Chicago to Albuquerque, New Mexico, a distance of 1,327 miles, which they drove in their own car. The children's names are Marcus and Tara and both will be attending the University of New Mexico in the fall, Marcus, who graduated high school early, as a freshman and Tara as a junior. The move was a result of a civilian job transfer for Kirk. The distance from their old home to Kirk's old office was 30 miles. Rasheeda quit her job in Chicago and decided to perform volunteer work for a year before seeking further employment. Their new home is located at 7432 Desert Springs Way, Albuquerque, NM 87101. Kirk, but not Rasheeda, was employed in the new location throughout the year. Kirk's social security number is 412-34-5670 (date of birth 6/12/1979), Rasheeda's is 412-34-5671 (date of birth 8/12/1981), Marcus's is 412-34- 5672 (date of birth 2/17/2006), and Tara's is 412-34-5673 (date of birth 9/14/2003). Kirk is an electrical engineer for a national firm; his W-2 contained the following information: Federal W/H Wages (box 1) = (box 2) = (box 3) = (box 4) Social security wages Social security W/H Medicare wages Medicare W/H $ 110,220.45 $ 6,833.67 $ 6,292.41 $ 110,220.45 = (box 5) = (box 6) = $ 110,220.45 $ 1,598.20 In addition, both he and Rasheeda received Forms 1098-E from the federal student loan program. Kirk had student loan interest of $1,050, and Rasheeda had student loan interest of $750. One child, Tara, is eligible for the Credit for other Dependents of $500 and the other child, Marcus, is eligible for the Child Tax Credit of $2,000. The total of $2,500 will go on line 19 of Form 1040.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information the tax implications for Kirk and Rasheeda Wallace for the tax yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started