Answered step by step

Verified Expert Solution

Question

1 Approved Answer

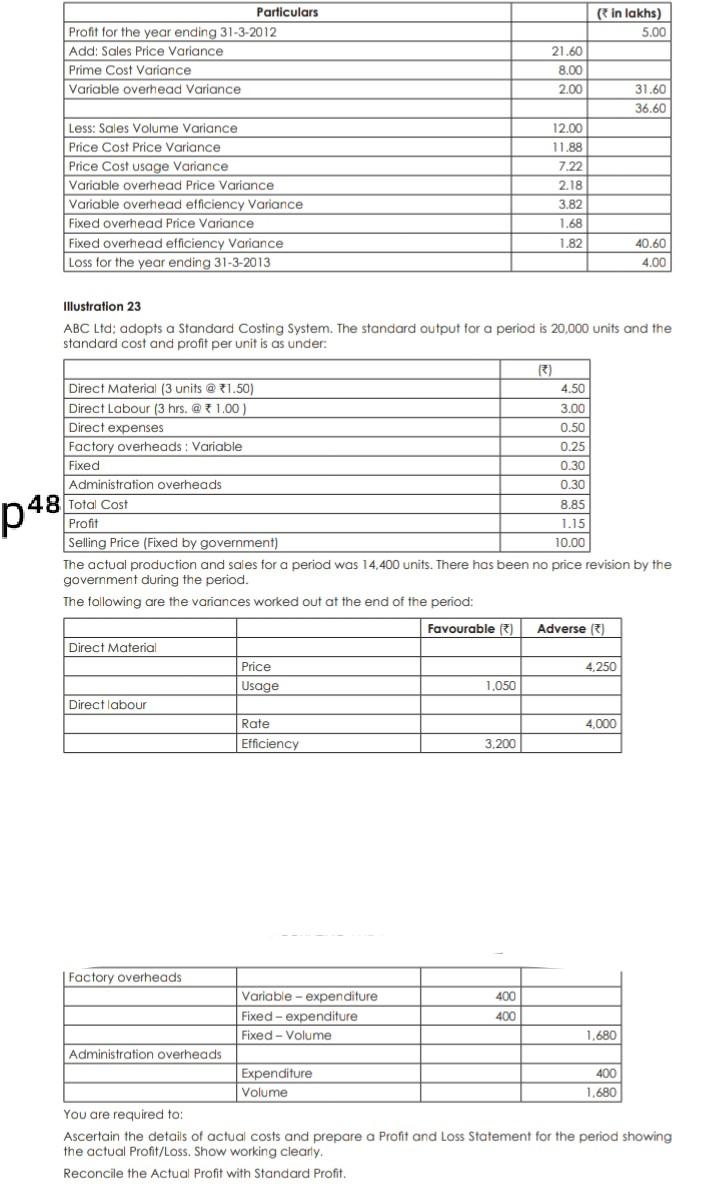

in lakhs) 5.00 Particulars Profit for the year ending 31-3-2012 Add: Sales Price Variance Prime Cost Variance Variable overhead Variance 21.60 8.00 2.00 31.60 36.60

in lakhs) 5.00 Particulars Profit for the year ending 31-3-2012 Add: Sales Price Variance Prime Cost Variance Variable overhead Variance 21.60 8.00 2.00 31.60 36.60 Less: Sales Volume Variance Price Cost Price Variance Price Cost usage Variance Variable overhead Price Variance Variable overhead efficiency Variance Fixed overhead Price Variance Fixed overhead efficiency Variance Loss for the year ending 31-3-2013 12.00 11.88 7.22 2.18 3.82 1.68 1.82 40.60 4.00 Illustration 23 ABC Ltd: adopts a Standard Costing System. The standard output for a period is 20,000 units and the standard cost and profit per unit is as under: () Direct Material (3 units @ 1.50) 4.50 Direct Labour (3 hrs. @ 1.00 ) 3.00 Direct expenses 0.50 Factory overheads : Variable 0.25 Fixed 0.30 Administration overheads 0.30 48 Total Cost 8.85 Profit 1.15 Selling Price (Fixed by government) 10.00 The actual production and sales for a period was 14,400 units. There has been no price revision by the government during the period. The following are the variances worked out at the end of the period: p 48 Favourable ) Adverse (3) Direct Material 4.250 Price Usage 1.050 Direct labour 4,000 Rate Efficiency 3.200 Factory overheads Variable - expenditure 400 Fixed- expenditure 400 Fixed - Volume 1.680 Administration overheads Expenditure 400 Volume 1.680 You are required to: Ascertain the details of actual costs and prepare a profit and Loss Statement for the period showing the actual Profit/Loss. Show working clearly Reconcile the Actual Profit with Standard Profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started