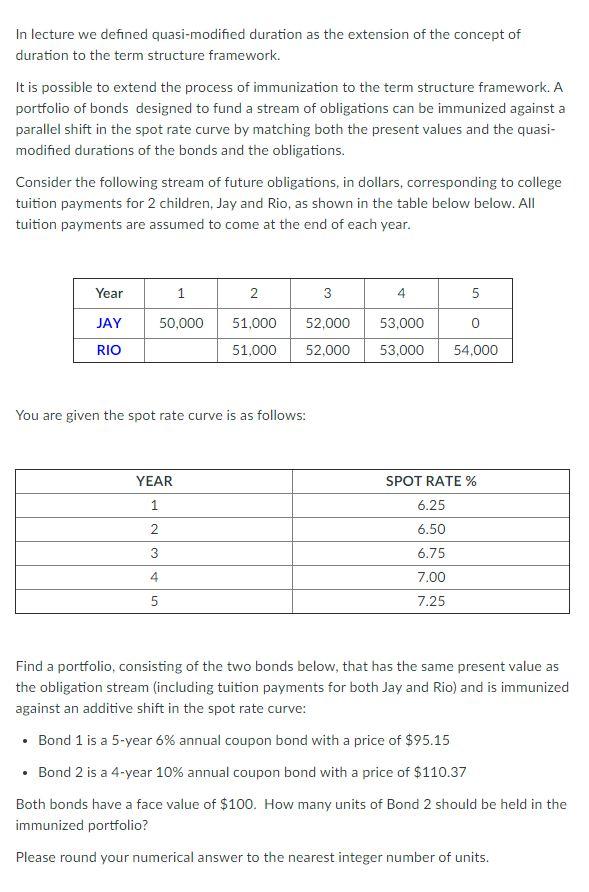

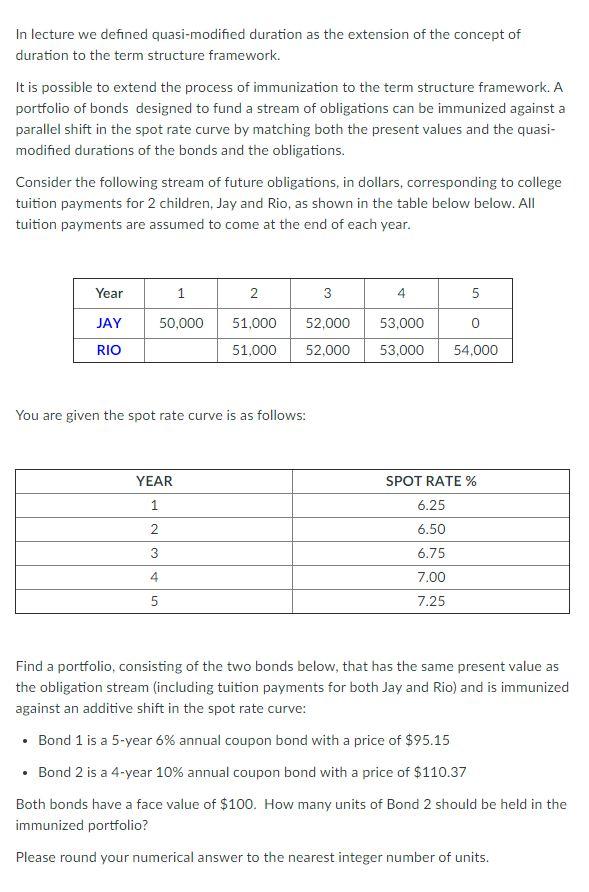

In lecture we defined quasi- modified duration as the extension of the concept of duration to the term structure framework. It is possible to extend the process of immunization to the term structure framework. A portfolio of bonds designed to fund a stream of obligations can be immunized against a parallel shift in the spot rate curve by matching both the present values and the quasi- modified durations of the bonds and the obligations. Consider the following stream of future obligations, in dollars, corresponding to college tuition payments for 2 children, Jay and Rio, as shown in the table below below. All tuition payments are assumed to come at the end of each year. Year 1 2 3 4 5 50,000 0 JAY RIO 51,000 51,000 52,000 52.000 53,000 53,000 54,000 You are given the spot rate curve is as follows: YEAR 1 SPOT RATE % 6.25 6.50 6.75 2 3 4 7.00 5 7.25 . Find a portfolio. consisting of the two bonds below, that has the same present value as the obligation stream (including tuition payments for both Jay and Rio) and is immunized against an additive shift in the spot rate curve: Bond 1 is a 5-year 6% annual coupon bond with a price of $95.15 Bond 2 is a 4-year 10% annual coupon bond with a price of $110.37 Both bonds have a face value of $100. How many units of Bond 2 should be held in the immunized portfolio? Please round your numerical answer to the nearest integer number of units. In lecture we defined quasi- modified duration as the extension of the concept of duration to the term structure framework. It is possible to extend the process of immunization to the term structure framework. A portfolio of bonds designed to fund a stream of obligations can be immunized against a parallel shift in the spot rate curve by matching both the present values and the quasi- modified durations of the bonds and the obligations. Consider the following stream of future obligations, in dollars, corresponding to college tuition payments for 2 children, Jay and Rio, as shown in the table below below. All tuition payments are assumed to come at the end of each year. Year 1 2 3 4 5 50,000 0 JAY RIO 51,000 51,000 52,000 52.000 53,000 53,000 54,000 You are given the spot rate curve is as follows: YEAR 1 SPOT RATE % 6.25 6.50 6.75 2 3 4 7.00 5 7.25 . Find a portfolio. consisting of the two bonds below, that has the same present value as the obligation stream (including tuition payments for both Jay and Rio) and is immunized against an additive shift in the spot rate curve: Bond 1 is a 5-year 6% annual coupon bond with a price of $95.15 Bond 2 is a 4-year 10% annual coupon bond with a price of $110.37 Both bonds have a face value of $100. How many units of Bond 2 should be held in the immunized portfolio? Please round your numerical answer to the nearest integer number of units