Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In less than five years of existence, Luckin Coffee has been variously a symbol of the dynamism of Chinese capitalism, the subject of a

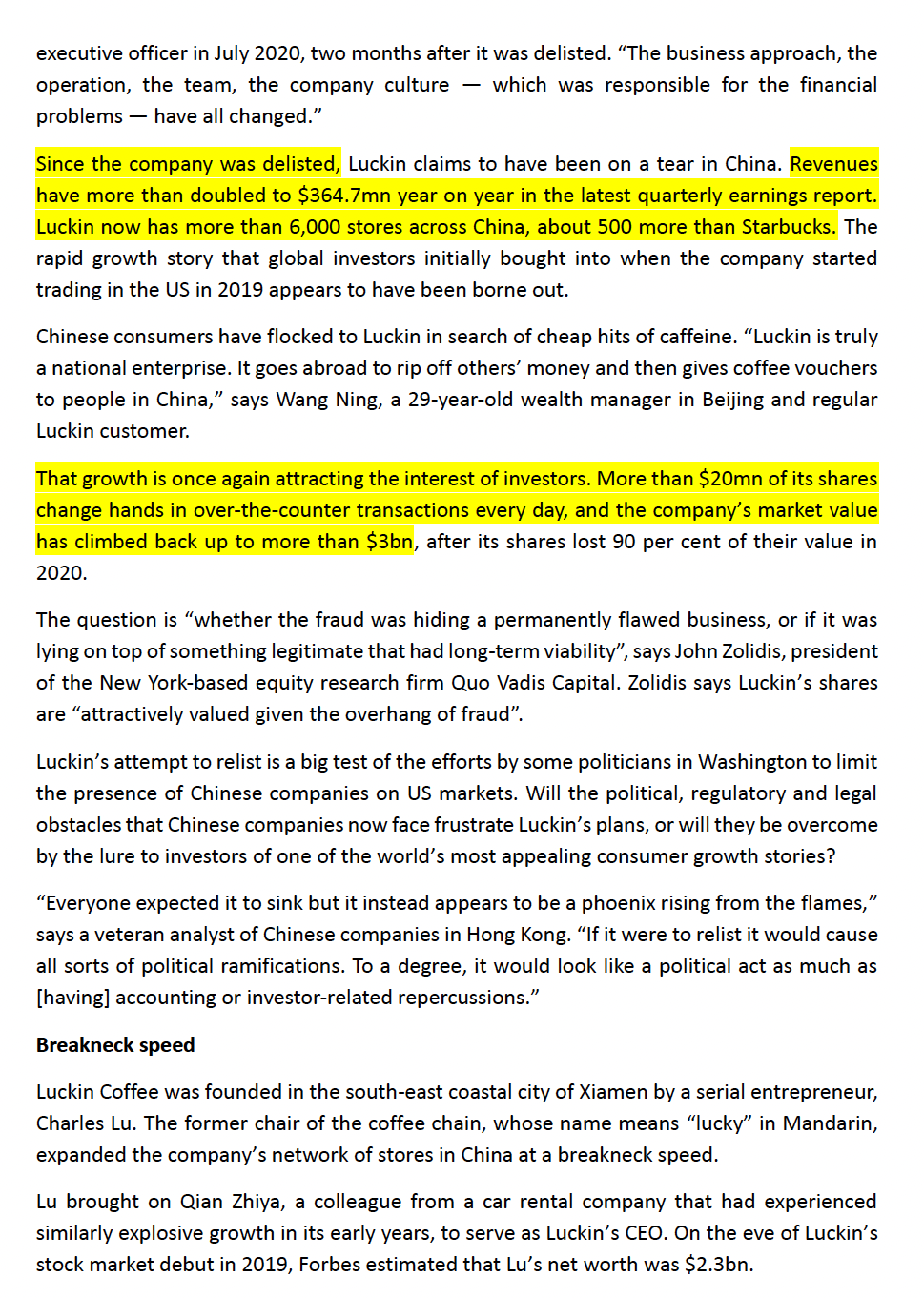

In less than five years of existence, Luckin Coffee has been variously a symbol of the dynamism of Chinese capitalism, the subject of a massive fraud scandal, and now - its new senior executives insist - a plucky comeback story that has the potential to test US-China relations. Founded in 2017, the chain of coffee shops spread quickly across China, creating a homegrown challenger to Starbucks. Just two years later, Luckin floated on Nasdaq with a market value that reached $13bn as investors were seduced by the prospect of booming Chinese consumer demand. But the company unravelled in 2020 after it was revealed to have defrauded investors by faking more than $300mn of sales. Luckin was delisted by Nasdaq and forced to pay $180mn to settle charges from the US Securities and Exchange Commission. The scandal stung investors such as BlackRock and GIC and provided the latest illustration of the failure of Big Four auditors to spot holes in company accounts - Luckin had been audited by EY. Most of all, it became a trigger for a political controversy over the presence of Chinese companies on US capital markets. The scandal was seized upon by some US senators as a prime example of how Chinese corporates could not be trusted, part of a broader push by some in Washington to decouple the US financial system from China. But two years later, Luckin is hoping that investors, regulators and even politicians have forgotten the entire episode. The Chinese coffee chain is staging an audacious comeback that involves trying to raise new capital, meeting with investors and plotting with advisers to relist its shares in the US, according to people familiar with the matter. The company declined to comment on its proposed relisting plans, but one senior executive said it was now "in a position where we're more comfortable re-engaging with public investors" and that it wanted to "regain credibility". Luckin says it has turned a new page. "Almost everything about Luckin apart from the name has changed over the past two years," says Guo Jinyi, who took over as chief executive officer in July 2020, two months after it was delisted. "The business approach, the operation, the team, the company culture which was responsible for the financial problems have all changed." Since the company was delisted, Luckin claims to have been on a tear in China. Revenues have more than doubled to $364.7mn year on year in the latest quarterly earnings report. Luckin now has more than 6,000 stores across China, about 500 more than Starbucks. The rapid growth story that global investors initially bought into when the company started trading in the US in 2019 appears to have been borne out. Chinese consumers have flocked to Luckin in search of cheap hits of caffeine. "Luckin is truly a national enterprise. It goes abroad to rip off others' money and then gives coffee vouchers to people in China," says Wang Ning, a 29-year-old wealth manager in Beijing and regular Luckin customer. That growth is once again attracting the interest of investors. More than $20mn of its shares change hands in over-the-counter transactions every day, and the company's market value has climbed back up to more than $3bn, after its shares lost 90 per cent of their value in 2020. The question is "whether the fraud was hiding a permanently flawed business, or if it was lying on top of something legitimate that had long-term viability", says John Zolidis, president of the New York-based equity research firm Quo Vadis Capital. Zolidis says Luckin's shares are "attractively valued given the overhang of fraud. Luckin's attempt to relist is a big test of the efforts by some politicians in Washington to limit the presence of Chinese companies on US markets. Will the political, regulatory and legal obstacles that Chinese companies now face frustrate Luckin's plans, or will they be overcome by the lure to investors of one of the world's most appealing consumer growth stories? "Everyone expected it to sink but it instead appears to be a phoenix rising from the flames," says a veteran analyst of Chinese companies in Hong Kong. "If it were to relist it would cause all sorts of political ramifications. To a degree, it would look like a political act as much as [having] accounting or investor-related repercussions." Breakneck speed Luckin Coffee was founded in the south-east coastal city of Xiamen by a serial entrepreneur, Charles Lu. The former chair of the coffee chain, whose name means "lucky" in Mandarin, expanded the company's network of stores in China at a breakneck speed. Lu brought on Qian Zhiya, a colleague from a car rental company that had experienced similarly explosive growth in its early years, to serve as Luckin's CEO. On the eve of Luckin's stock market debut in 2019, Forbes estimated that Lu's net worth was $2.3bn. At the root of the Luckin fraud was its aggressive expansion strategies, favoured by Lu, of grabbing market share for new customers with heavily discounted beverages and then inflating the net selling price to hide the fact it was selling at a loss. "The company was burning through money," says one Luckin insider of the period leading up to the IPO and follow-on offering. This was highlighted in a damning 89-page report first published by American short selling firm Muddy Waters in January 2020, which accused it of inflating sales, having poor corporate governance and being a "fundamentally broken" business. An undercover research firm dispatched more than 1,000 researchers to Luckin Coffee stores to monitor customer traffic and coffee sales and found discrepancies with their reported figures. Lu and Qian, who have both since left the company, did not respond to requests for comment. Lu posted on his public WeChat account in May 2020: "My style may have been too aggressive and the company may have grown too fast, which led to many problems. But it was never my intention to deceive investors." Two years on, Luckin says things have changed. A senior executive says its internal controls have been improved by hiring personnel from the Big Four accounting firms to conduct internal checks and report directly to the audit committee, which corporate governance experts say is a crucial step for any company that is planning to attract new international investors. At the centre of the coffee chain's turnround has been David Li, whose $2bn private equity fund, Centurium Capital, was one of Luckin's earliest and biggest financial backers. Centurium sold $232mn worth of shares just before the scandal but has since bought several larger stakes in Luckin at a much lower price. Last month, it became the company's controlling shareholder after it acquired shares that were previously held by Luckin's co- founders. Li has been "cleaning up the company, getting rid of the bad guys", says a person close to him. He "had a team camped out at the company for months, working out a turnround strategy", the person adds. Luckin used the cash injection from Centurium to pay for shareholder litigation and repay some of the debts due on bonds and overseas restructuring costs. The company is now on the brink of ending bankruptcy proceedings in the US, a crucial step in its path to relist. As a result of the bankruptcy process, the hedge funds that bought about $420mn of its convertible bonds in January 2020 will receive about 96 cents on the dollar. "After only one- and-a-half years, they have got almost all their money back, plus some new bonds, cash and stock," says an external adviser involved in the restructuring process. "If you break it down, it is a genuinely unprecedented situation," says the person. "I've never seen another case where you have such a high return for creditors, settlement of legal and regulatory matters and improving operating performance all in the same short period of 18 months." Li and Guo's turnround strategy includes closing down underperforming stores and increasing the price of a cup of coffee by 60 per cent to an average of $2.50 still half the price of an equivalent Starbucks coffee. Luckin claims it has reduced property and staffing costs through the use of an "in-app" purchase system and has started using franchisees to expand the number of its stores rather than owning them all outright. It has also had remarkable success with new beverages, including a coconut velvet latte that sold out over the summer. Xu Xueqiong, 36, a small business owner in Anqing, a city in Anhui province, is an avid fan of the drink. She says Luckin's branding, use of coupons and sweeter flavours "suit Chinese people's consumption habits". Michael Norris, a senior research analyst at Shanghai-based consultancy AgencyChina, says that Guo's gamble to start using franchisee partners to share the risk of opening new stores, especially in lower-tier cities, has paid off. Revenue from those stores has tripled in the last quarter compared with the same period the previous year, according to its financial statements. But analysts have warned that Chinese consumer habits are fickle, and Luckin is increasingly fighting competition from domestic rivals with substantial financial backing, including a new, trendier competitor, Manner Coffee. Norris adds that investors may be sceptical at reports of accelerating growth: "Revenues rising sharply is something that those of us who have been following Luckin have seen before." Luckin reported a net loss of $859mn for the 2020 financial year. In the first nine months of 2021, its net losses were $3.6mn, according to its financial statements. Carson Block, founder and head of Muddy Waters, says he is "surprised" at Luckin's turnround: "In the old days, companies were finished once confirmed that they were frauds, especially to the extent of Luckin." "But Luckin seems to be saying the fraud is water under the bridge. That now they've raised the money on the back of lies, they're putting it to use and becoming real," adds Block. Winning back trust Far harder than inventing coconut lattes will be the job of convincing foreign investors and regulators that its finances can be trusted. Luckin is setting out plans to relist at a time when tensions between the US and China over the quality of Chinese companies listed in US markets is at an all-time low. The most recent case was the disastrous listing of Didi, a ride-hailing app, last June, when regulatory blocks by Beijing days after its flotation meant its shares crashed by 80 per cent and investors lost billions. Since then, new flotations by Chinese companies in the US have been in effect paralysed. Both Washington and Beijing are wary of continuing to permit the deepening of financial links between Wall Street and corporate China. To relist on the Nasdaq centralised exchange Luckin needs to first formally exit bankruptcy proceedings, which according to an individual involved in the process should happen in the next few weeks. It then needs to re-register with the SEC before making an application to Nasdaq. The exchange can deny a company's listing if it believes investors might be at risk, but in general, it is required to accept those companies that meet the exchange's requirements. The SEC and Nasdaq refused to comment on Luckin's relisting plans. The company will also need to navigate new laws that have come into place in the wake of its 2020 scandal which make the US a far less hospitable environment for Chinese companies going public. The US Holding Foreign Companies Accountable Act, which was passed in late 2020, puts pressure on Chinese companies to make audit papers available for inspection. It could force about 240 Chinese companies worth a combined $2tn to delist from US exchanges over the next few years. "There is no indication that either the US or China will budge on this issue," says Jay Ritter, an IPO expert at the University of Florida, who added this made the environment tough for a Luckin return. Under this law, the US authorities could delist companies that fail to submit to US regulatory checks on their audits for three years in a row. This has resulted in a stalemate for companies and their accountants as Beijing does not permit foreign oversight of Chinese companies' financial records. As a result, even if it successfully relists, Luckin could be delisted again by US regulators in the future purely because of a lack of access to its audit files. "If Luckin relists and is trading, what's the price discount for the fact that if you buy the shares you don't know if or where you're going to be able to sell them in two or three years' time?" says one accounting expert. Crucial to Luckin's comeback will be investors' confidence that its books are credible, especially given the failures of original auditors EY to identify duplicity, and perhaps also the fact that the CFO at the time of the scandal, Reinout Schakel, is still in place. Since the fraud was exposed, Luckin has had two new audit firms. The group appointed Hong Kong accounting firm Centurion ZD CPA as its auditor in April 2021 after its previous auditor, New York-based Marcum Bernstein & Pinchuk, was replaced. Marcum said at the time that it had "not gathered sufficient independent third-party data or conducted sufficient audit procedures to complete the audit". As US regulators and exchanges put greater focus on the quality of Chinese company audits, the work of a smaller firm is likely to receive enhanced scrutiny. Centurion, which says it has about 40 accountants in Hong Kong and the US, is registered with the US audit regulator, which allows it to sign off the accounts of Chinese companies listed in America. But so far it audits just a small number of such companies traded on Nasdaq or over the counter. Centurion did not respond to request for comment for this article. In its audit of Luckin's 2020 accounts, the most recent full-year audited financial statements, Centurion identified as a "material weakness" that Luckin lacked "entity level control policies and procedures, including failure to demonstrate commitment to integrity and ethical values". It also said Luckin lacked appropriate separation of duties, including around making investment decisions and use of funds. Even so, some investors may be tempted back into its equity because of Luckin's growth prospects, according to fund managers. "By market capitalisation per store, it is a cheap and attractive asset," says a fund manager who has traded Luckin's over-the-counter shares. "That means people aren't put off by the fraud." Yet so far, it is primarily China-focused hedge funds and mainland capital that have flooded back into Luckin shares. "It's hard to see someone like Fidelity getting back into it on day one," the fund manager adds. Winning back the support of large international investors would be critical for Luckin's comeback story. "I suspect there is work to be done for redemption before that," says Kerrie Waring, chief executive of the International Corporate Governance Network, a lobby group for institutional investors whose members manage global assets of $59tn. "The focus [for investors and regulators] will be in the integrity of financial disclosures and the degree to which the numbers can be trusted going forward," Waring adds. "The new external auditors will also be under the spotlight." As investors question whether they can trust Luckin's turnround story, one former US regulator says the fact that the company is under such intense scrutiny means it may be less likely to repeat past crimes. "Sometimes the safest place to eat is a place that's just reopened after the health department shut them down."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started