Answered step by step

Verified Expert Solution

Question

1 Approved Answer

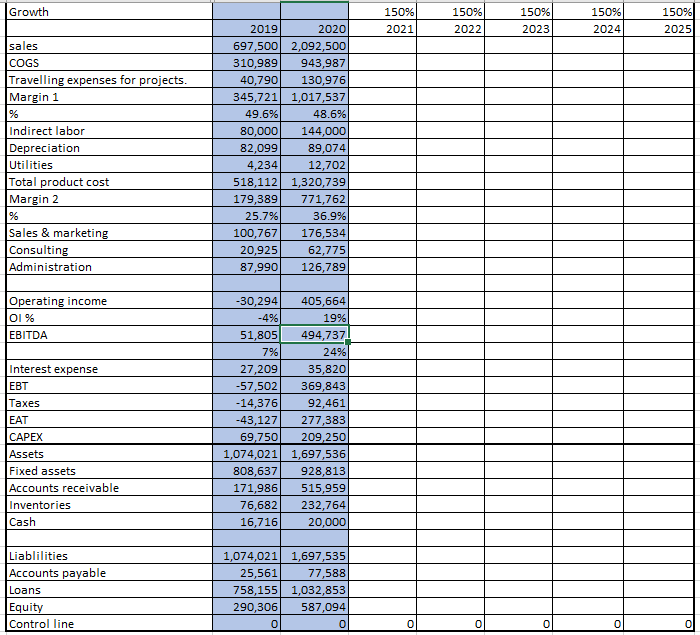

In light of recent results, the Board is asking from you the forecast for the next five business years. Scenario: Sales grow 50% over last

In light of recent results, the Board is asking from you the forecast for the next five business years.

Scenario:

- Sales grow 50% over last year and this growth continues for the 5 years.

- Contribution margin will be reduced in 1% compared to the last year of past activity and maintained stable for the rest of the years.

- Travelling expenses for projects will increase in the same proportion as sales.

- Indirect Labor will increase in the same proportion as sales.

- Depreciation based on 10 years.

- Utilities will increase in the same proportion as sales.

- All other costs will increase at a 10% year over year.

- Accounts receivables in days remain constant, as last year of activity.

- Accounts payable in days remain constant, as last year of activity.

- Inventories in days remain constant, as last year of activity.

- Interest expense is 4%.

- Investments will be 5% of net sales every year.

- Make a forecast for all balance sheet accounts.

Prepare an excel sheet with the forecasts of each and every one of the lines of the income statement. (with formula)

Growth 150% 2021 150% 2022 150% 2023 150% 2024 150% 2025 sales COGS Travelling expenses for projects. Margin 1 Indirect labor Depreciation Utilities Total product cost Margin 2 2019 2020 697,500 2,092,500 310,989 943,987 40,790 130,976 345,721 1,017,537 49.6% 48.6% 80,000 144,000 82,099 89,074 4,234| 12,702 518,112 1,320,739 179,3891 771,762 25.7% 36.9% 100,767 176,534 20,925 62,775 87,990 126,789 Sales & marketing Consulting Administration Operating income 01 % EBITDA Interest expense EBT Taxes EAT CAPEX Assets Fixed assets Accounts receivable Inventories Cash -30,294 405,664 -4%. 19% 51,805 494,737 7% 24% 27,209 35,820 -57,502 369,843 -14,376 92,461 -43,127 277,383 69,750 209,250 1,074,021 1,697,536 808,637 928,813 171,986 515,959 76,682 232,764 16,716) 20,000 Accountable Liablilities Accounts payable Loans Equity Control line 1,074,021 1,697,535 25,561 77,588 758,155 1,032,853 290,306 587,094 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started