Answered step by step

Verified Expert Solution

Question

1 Approved Answer

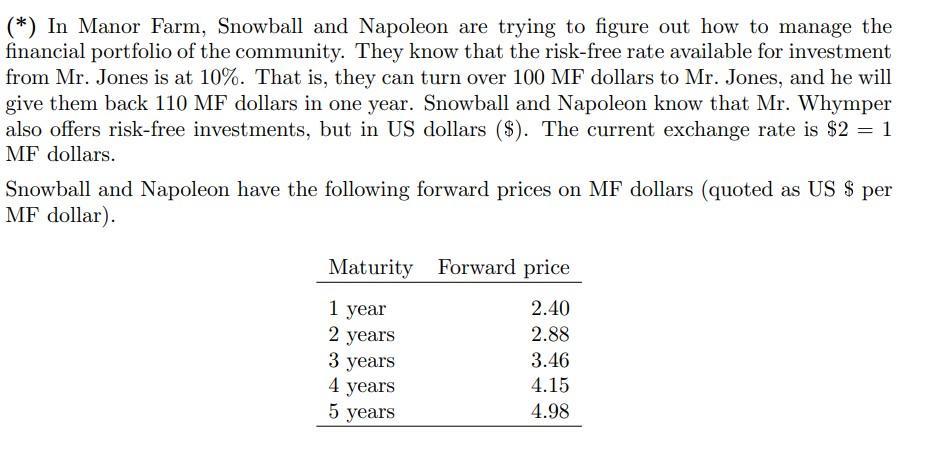

() In Manor Farm, Snowball and Napoleon are trying to figure out how to manage the financial portfolio of the community. They know that the

() In Manor Farm, Snowball and Napoleon are trying to figure out how to manage the financial portfolio of the community. They know that the risk-free rate available for investment from Mr. Jones is at 10%. That is, they can turn over 100MF dollars to Mr. Jones, and he will give them back 110MF dollars in one year. Snowball and Napoleon know that Mr. Whymper also offers risk-free investments, but in US dollars ($). The current exchange rate is $2=1 MF dollars. Snowball and Napoleon have the following forward prices on MF dollars (quoted as US $ per MF dollar). If financial markets in and around Manor Farm are arbitrage free, transaction costs are minor, and the such - what rate of interest (for $ deposits) do you think Mr. Whymper should offer? () In Manor Farm, Snowball and Napoleon are trying to figure out how to manage the financial portfolio of the community. They know that the risk-free rate available for investment from Mr. Jones is at 10%. That is, they can turn over 100MF dollars to Mr. Jones, and he will give them back 110MF dollars in one year. Snowball and Napoleon know that Mr. Whymper also offers risk-free investments, but in US dollars ($). The current exchange rate is $2=1 MF dollars. Snowball and Napoleon have the following forward prices on MF dollars (quoted as US $ per MF dollar). If financial markets in and around Manor Farm are arbitrage free, transaction costs are minor, and the such - what rate of interest (for $ deposits) do you think Mr. Whymper should offer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started