Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In many financial transactions, interest is computed and charged more than once a year. Interest on corporate bonds, for example, is usually payable every

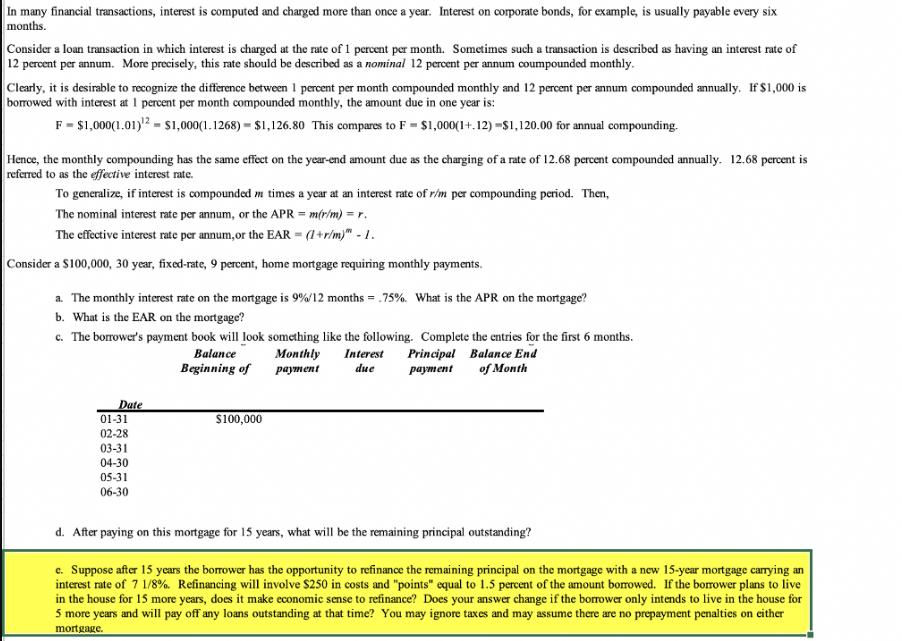

In many financial transactions, interest is computed and charged more than once a year. Interest on corporate bonds, for example, is usually payable every six months. Consider a loan transaction in which interest is charged at the rate of 1 percent per month. Sometimes such a transaction is described as having an interest rate of 12 percent per annum. More precisely, this rate should be described as a nominal 12 percent per annum coumpounded monthly. Clearly, it is desirable to recognize the difference between 1 percent per month compounded monthly and 12 percent per annum compounded annually. If $1,000 is borrowed with interest at 1 percent per month compounded monthly, the amount due in one year is: F = $1,000(1.01)= $1,000(1.1268) = $1,126.80 This compares to F = $1,000(1+.12) -$1,120.00 for annual compounding. Hence, the monthly compounding has the same effect on the year-end amount due as the charging of a rate of 12.68 percent compounded annually. 12.68 percent is referred to as the effective interest rate. To generalize, if interest is compounded m times a year at an interest rate of r/m per compounding period. Then, The nominal interest rate per annum, or the APR = m(r/m) = r. The effective interest rate per annum, or the EAR= (1+r/m) - 1. Consider a $100,000, 30 year, fixed-rate, 9 percent, home mortgage requiring monthly payments. a. The monthly interest rate on the mortgage is 9% / 12 months = .75%. What is the APR on the mortgage? b. What is the EAR on the mortgage? c. The borrower's payment book will look something like the following. Complete the entries for the first 6 months. Monthly Interest Principal Balance End payment of Month payment due Date 01-31 02-28 03-31 04-30 05-31 06-30 Balance Beginning of $100,000 d. After paying on this mortgage for 15 years, what will be the remaining principal outstanding? c. Suppose after 15 years the borrower has the opportunity to refinance the remaining principal on the mortgage with a new 15-year mortgage carrying an interest rate of 7 1/8%. Refinancing will involve $250 in costs and "points" equal to 1.5 percent of the amount borrowed. If the borrower plans to live in the house for 15 more years, does it make economic sense to refinance? Does your answer change if the borrower only intends to live in the house for 5 more years and will pay off any loans outstanding at that time? You may ignore taxes and may assume there are no prepayment penalties on either mortgage.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question a r 9 m 12 APR mrm r 9 b EAR 1rm m 1 191212 1 938 c monthly payment P x R x 1RN1RN1 where P ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started