Question

In March, a speculator who is gambling that the Japanese yen will appreciate against the U.S. dollars pays $1,360 (premium) to buy a June

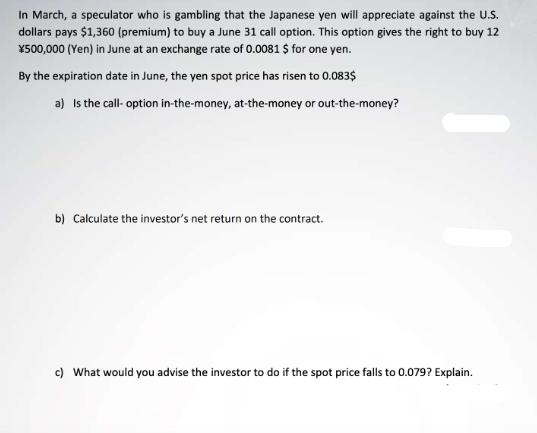

In March, a speculator who is gambling that the Japanese yen will appreciate against the U.S. dollars pays $1,360 (premium) to buy a June 31 call option. This option gives the right to buy 12 500,000 (Yen) in June at an exchange rate of 0.0081 $ for one yen. By the expiration date in June, the yen spot price has risen to 0.083$ a) is the call-option in-the-money, at-the-money or out-the-money? b) Calculate the investor's net return on the contract. c) What would you advise the investor to do if the spot price falls to 0.079? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Call Option Analysis a IntheMoney The call option is inthemoney because the spot price of the yen 00...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App