Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In May, 2018, Capacity Ltd. took a bank loan to be used specifically for the construction of a new factory building. The construction was

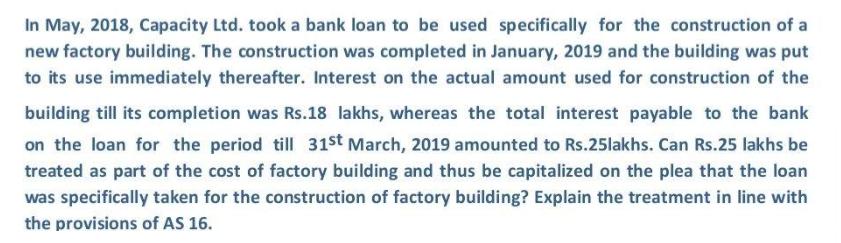

In May, 2018, Capacity Ltd. took a bank loan to be used specifically for the construction of a new factory building. The construction was completed in January, 2019 and the building was put to its use immediately thereafter. Interest on the actual amount used for construction of the building till its completion was Rs.18 lakhs, whereas the total interest payable to the bank on the loan for the period till 31st March, 2019 amounted to Rs.25lakhs. Can Rs.25 lakhs be treated as part of the cost of factory building and thus be capitalized on the plea that the loan was specifically taken for the construction of factory building? Explain the treatment in line with the provisions of AS 16.

Step by Step Solution

★★★★★

3.49 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

AS 16 states unequivocally that capitalization of borrowing costs should end ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started