Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In May 205, the newly appointed controller of Butch Baking Corporation conducted a thorough review of past accounting, particularly of transactions that exceeded the

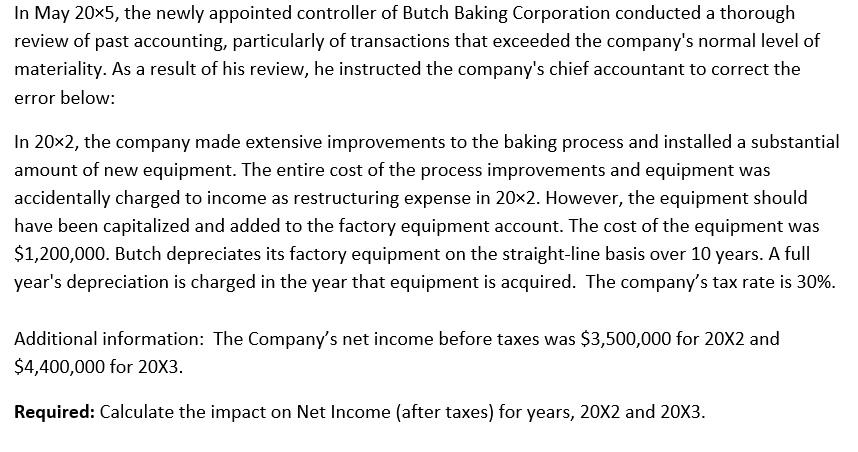

In May 205, the newly appointed controller of Butch Baking Corporation conducted a thorough review of past accounting, particularly of transactions that exceeded the company's normal level of materiality. As a result of his review, he instructed the company's chief accountant to correct the error below: In 20x2, the company made extensive improvements to the baking process and installed a substantial amount of new equipment. The entire cost of the process improvements and equipment was accidentally charged to income as restructuring expense in 20x2. However, the equipment should have been capitalized and added to the factory equipment account. The cost of the equipment was $1,200,000. Butch depreciates its factory equipment on the straight-line basis over 10 years. A full year's depreciation is charged in the year that equipment is acquired. The company's tax rate is 30%. Additional information: The Company's net income before taxes was $3,500,000 for 20X2 and $4,400,000 for 20X3. Required: Calculate the impact on Net Income (after taxes) for years, 20X2 and 20X3.

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

PL Account 20X2 20X3 Profit before tax for the ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started