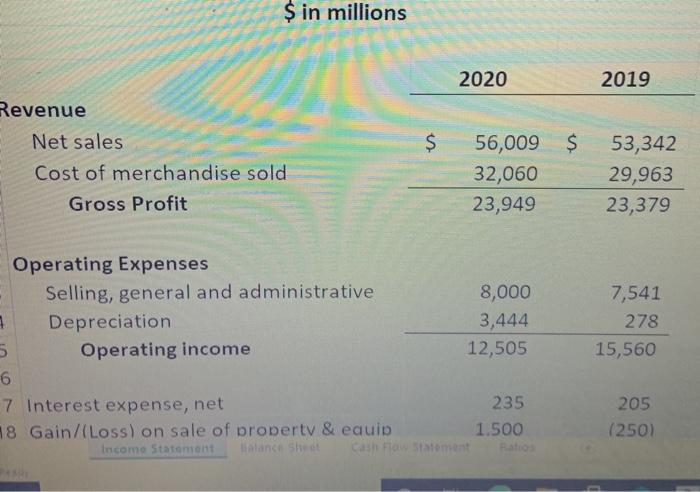

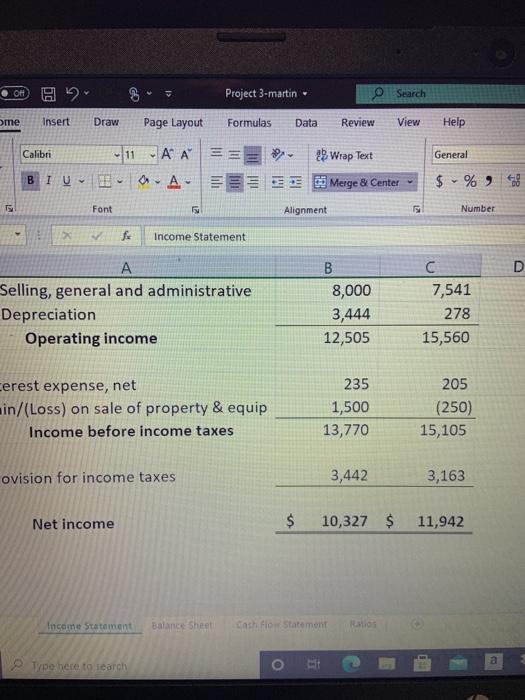

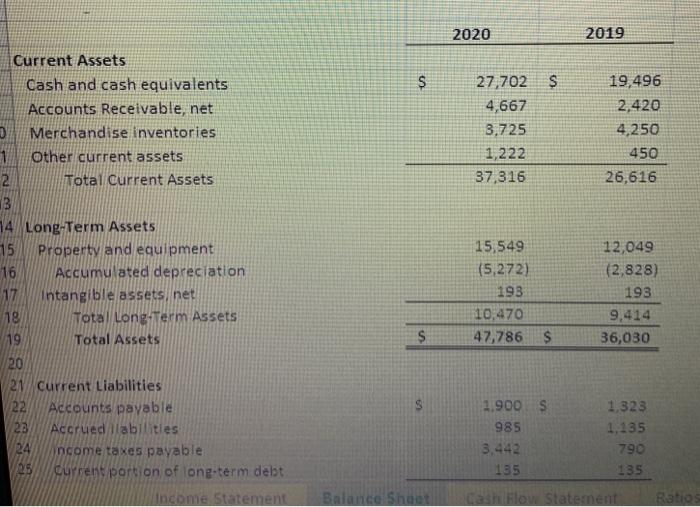

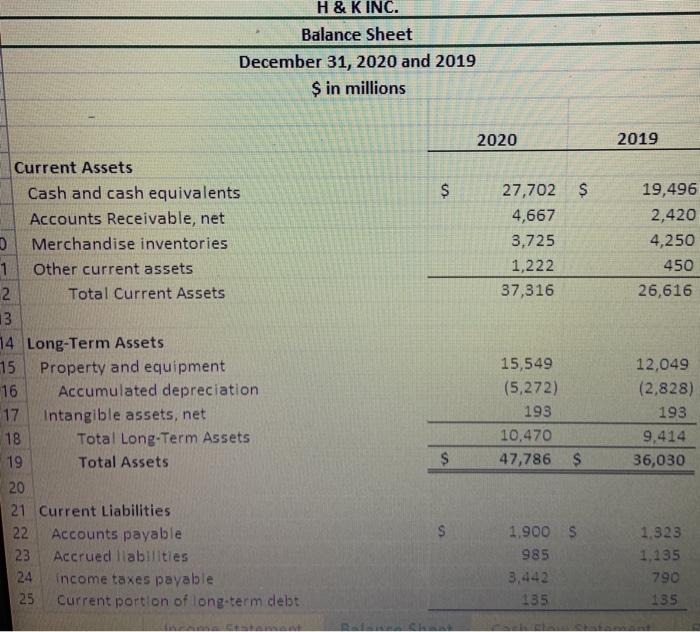

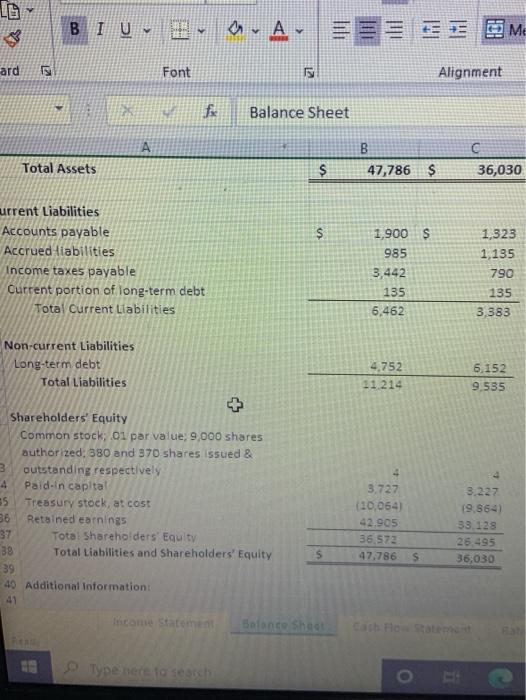

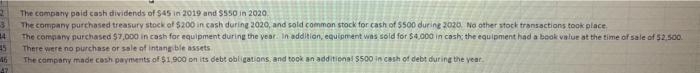

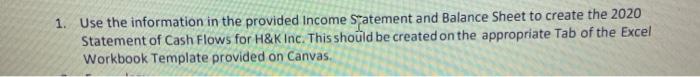

$ in millions 2020 2019 $ Revenue Net sales Cost of merchandise sold Gross Profit 56,009 $ 32,060 23,949 53,342 29,963 23,379 Operating Expenses Selling, general and administrative 8,000 Depreciation 3,444 5 Operating income 12,505 6 7 Interest expense, net 235 18 Gain/(Loss) on sale of property & equip 1.500 Income Statement balance She Cash Flow Statement 7,541 278 15,560 205 (250) of B Project 3-martin O Search omne Insert Draw Page Layout Formulas Data Review View Help Calibri General 11AA 25 Wrap Text O-A Es Merge & Center BIU $ - % 15 Font Alignment Number x Income Statement D A Selling, general and administrative Depreciation Operating income B 8,000 3,444 12,505 7,541 278 15,560 erest expense, net in/(Loss) on sale of property & equip Income before income taxes 235 1,500 13,770 205 (250) 15,105 ovision for income taxes 3,442 3,163 Net income $ 10,327 $ 11,942 Income Statement Balance Sheet Cash flo Statement a Type here to search o 2020 2019 $ 27,702 $ 4,667 3,725 1,222 37,316 19,496 2,420 4,250 450 26,616 Current Assets Cash and cash equivalents Accounts Receivable, net Merchandise inventories Other current assets 2 Total Current Assets 3 14 Long-Term Assets 15 Property and equipment 16 Accumulated depreciation 17 Intangible assets net 18 Total Long Term Assets 19 Total Assets 20 21 Current Liabilities 22 Accounts payable 23 Accrued abilities 24 income taxes payable 05 Current portion of long-term debt Income Statement 15,549 (5,272) 193 10,470 47,786 12,049 (2,828) 193 9,414 36,030 $ S 1.900 $ 985 1,323 1.135 790 135 3.442 135 Balance Shoot Cash Flow Statement Ratio H&K INC. Balance Sheet December 31, 2020 and 2019 $ in millions 2020 2019 $ $ 27,702 4,667 3,725 1,222 37,316 19,496 2,420 4,250 450 26,616 Current Assets Cash and cash equivalents Accounts Receivable, net D Merchandise inventories 1 Other current assets 2 Total Current Assets 3 74 Long-Term Assets 15 Property and equipment 16 Accumulated depreciation 17 Intangible assets, net 18 Total Long-Term Assets 19 Total Assets 20 21 Current Liabilities 22 Accounts payable 23 Accrued llabilities 24 income taxes payable 25 Current portion of long-term debt 15,549 (5,272) 193 10,470 47,786 $ 12,049 (2,828) 193 9,414 36,030 $ S 1.900 S 985 3,442 135 1.323 1.135 790 135 a-A~ V EEEM ard Font Alignment f Balance Sheet Total Assets B 47,786 $ 36,030 $ $ urrent Liabilities Accounts payable Accrued liabilities Income taxes payable Current portion of long-term debt Total Current Liabilities 1,900 $ 985 3,442 135 6,462 1,323 1,135 790 135 3.383 Non-current Liabilities Long-term debt Total Liabilities 4,752 11.214 6.152 9.535 3 Shareholders' Equity Common stock, 01 par value, 9.000 shares authorized: 380 and 370 shares issued & 3 outstanding respectively 4 Paid in capital 5 Treasury stock, at cost 36 Retained earnings 37 Total Shareholders' Equity 39 Total Liabilities and Shareholders' Equity 39 40 Additional Information 3.727 (10.064 42.905 36.572 47,786 3.227 19.864 33 128 26.495 36,030 S s Balance Sheet 18 Type here to search 3 24 45 46 The company paid cash dividends of $45 in 2019 and SSSO in 2020, The company purchased treasury stock of $200 in cash during 2020, and sold common stock for cash of $500 during 2020. No other stock transactions took place The comparw purchased $7,000 in cash for equipment during the year. In addition, equipment was sold for $4.000 in cash the equipment had a book value at the time of sale of $2.500 There were no purchase or sale at intang ble assets The company made cash payments of $1900 on its debt obligations and took an additional $500 in Cash of debt during the year. 1. Use the information in the provided Income Satement and Balance Sheet to create the 2020 Statement of Cash Flows for H&K Inc. This should be created on the appropriate Tab of the Excel Workbook Template provided on Canvas