Answered step by step

Verified Expert Solution

Question

1 Approved Answer

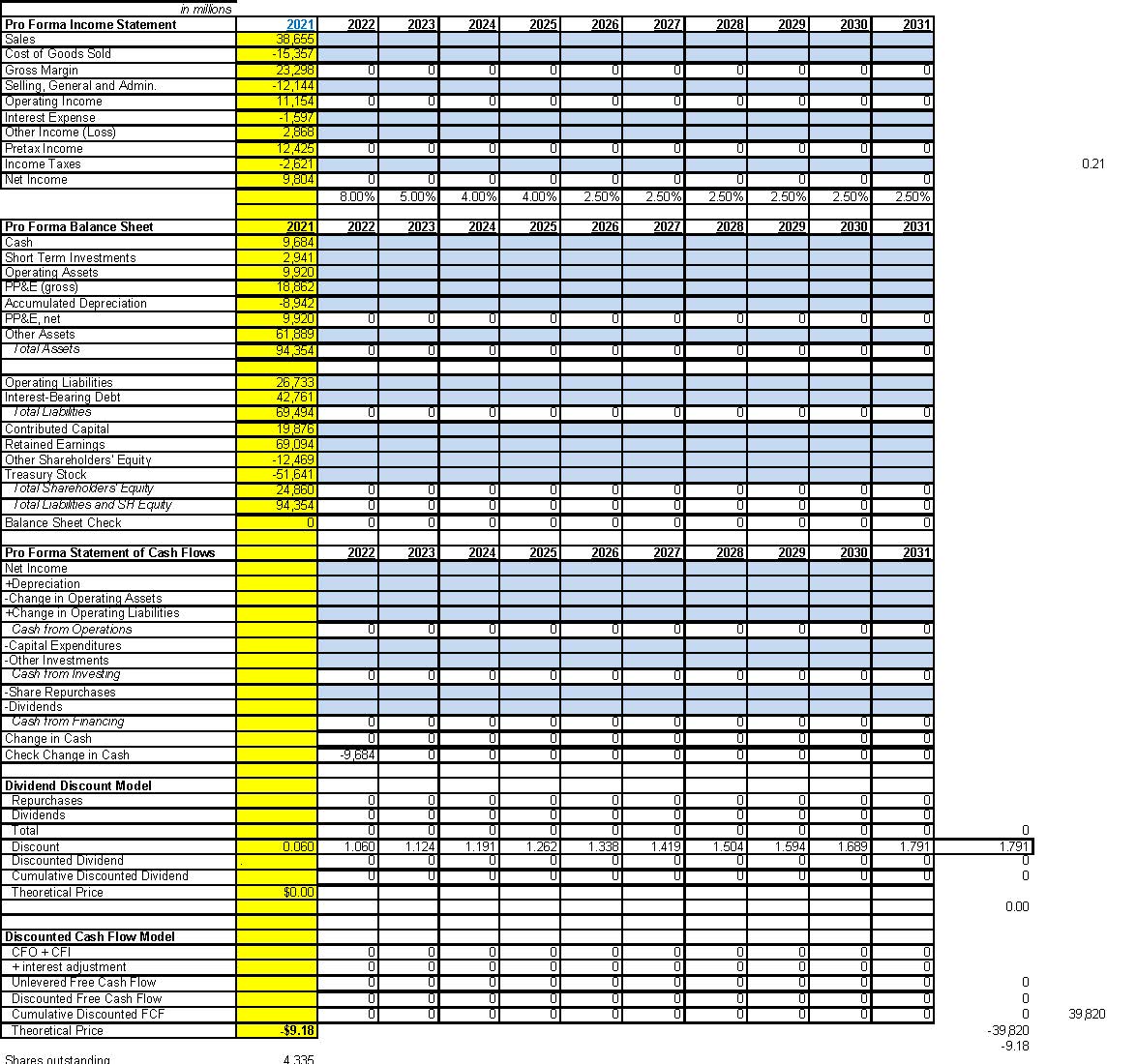

in millions Pro Forma Income Statement 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Sales 38,655 Cost of Goods Sold -15,357

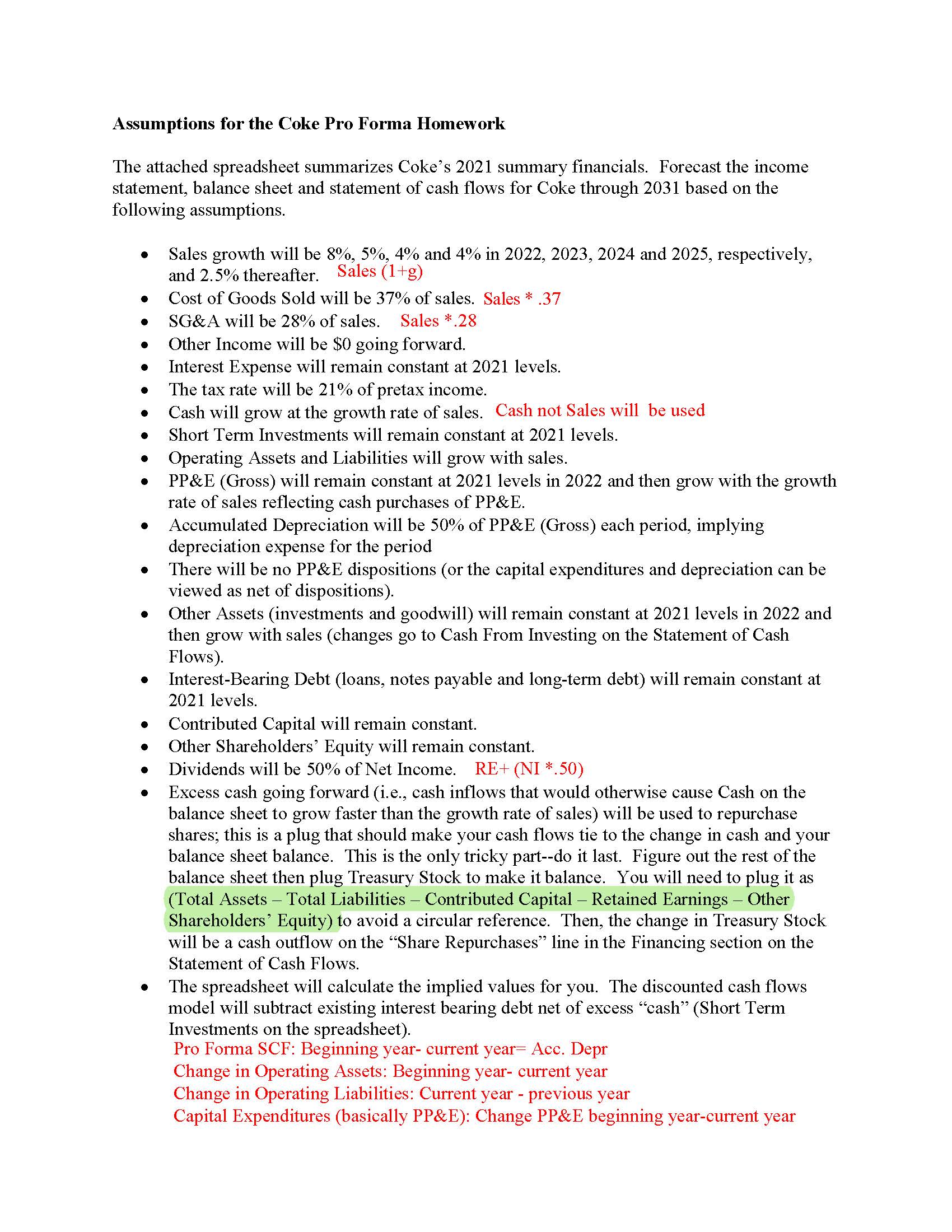

in millions Pro Forma Income Statement 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Sales 38,655 Cost of Goods Sold -15,357 Gross Margin 23,298 0 0 0 0 0 0 0 0 Selling, General and Admin. -12,144|| Operating Income Interest Expense 11,154| -1,597 Other Income (Loss) 2,868 Pretax Income 12,425 0 0 0 0 0 0 0 0 0 0 Income Taxes Net Income -2,621 0.21 9,804 0 0 0 0 0 0 0 0 0 8.00% 5.00% 4.00% 4.00% 2.50% 2.50% 2.50% 2.50% 2.50% 2.50% Pro Forma Balance Sheet 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Cash 9,684 Short Term Investments. 2,941 Operating Assets 9,920 PP&E (gross) 18,862 Accumulated Depreciation -8,942 PP&E, net 9,920 0 0 0 0 Other Assets 61,889 Total Assets 94,354 0 0 0 0 0 0 0 Operating Liabilities Interest-Bearing Debt Total Liabilities Contributed Capital Retained Earnings Other Shareholders' Equity 26,733| 42,761 69,494 0 0 0 19,876 69,094 -12,469 Treasury Stock Total Shareholders' Equity Total Liabilities and SH Equity Balance Sheet Check -51,641 24,860 94,354 01 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Pro Forma Statement of Cash Flows Net Income +Depreciation -Change in Operating Assets +Change in Operating Liabilities Cash from Operations -Capital Expenditures -Other Investments Cash from Investing -Share Repurchases -Dividends Cash from Financing Change in Cash Check Change in Cash Dividend Discount Model Repurchases 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -9,684 0 0 0 0 0 0 0 0 0 0 0 0 Dividends Total 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Discount 0.060 1.060 1.124] 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.791 Discounted Dividend 0 0 0 0 0 0 0 0 0 Cumulative Discounted Dividend U U U U U] U U U U Theoretical Price $0.00 0.00 Discounted Cash Flow Model CFO + CFI +interest adjustment Unlevered Free Cash Flow Discounted Free Cash Flow Cumulative Discounted FCF Theoretical Price Shares outstanding 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 39,820 $9.18 -39 820 -9.18 4 335 Assumptions for the Coke Pro Forma Homework The attached spreadsheet summarizes Coke's 2021 summary financials. Forecast the income statement, balance sheet and statement of cash flows for Coke through 2031 based on the following assumptions. Sales growth will be 8%, 5%, 4% and 4% in 2022, 2023, 2024 and 2025, respectively, and 2.5% thereafter. Sales (1+g) Cost of Goods Sold will be 37% of sales. Sales * .37 SG&A will be 28% of sales. Sales *.28 Other Income will be $0 going forward. Interest Expense will remain constant at 2021 levels. The tax rate will be 21% of pretax income. Cash will grow at the growth rate of sales. Cash not Sales will be used Short Term Investments will remain constant at 2021 levels. Operating Assets and Liabilities will grow with sales. PP&E (Gross) will remain constant at 2021 levels in 2022 and then grow with the growth rate of sales reflecting cash purchases of PP&E. Accumulated Depreciation will be 50% of PP&E (Gross) each period, implying depreciation expense for the period There will be no PP&E dispositions (or the capital expenditures and depreciation can be viewed as net of dispositions). Other Assets (investments and goodwill) will remain constant at 2021 levels in 2022 and then grow with sales (changes go to Cash From Investing on the Statement of Cash Flows). Interest-Bearing Debt (loans, notes payable and long-term debt) will remain constant at 2021 levels. Contributed Capital will remain constant. Other Shareholders' Equity will remain constant. Dividends will be 50% of Net Income. RE+ (NI *.50) Excess cash going forward (i.e., cash inflows that would otherwise cause Cash on the balance sheet to grow faster than the growth rate of sales) will be used to repurchase shares; this is a plug that should make your cash flows tie to the change in cash and your balance sheet balance. This is the only tricky part--do it last. Figure out the rest of the balance sheet then plug Treasury Stock to make it balance. You will need to plug it as (Total Assets - Total Liabilities Contributed Capital Retained Earnings - Other Shareholders' Equity) to avoid a circular reference. Then, the change in Treasury Stock will be a cash outflow on the "Share Repurchases" line in the Financing section on the Statement of Cash Flows. The spreadsheet will calculate the implied values for you. The discounted cash flows model will subtract existing interest bearing debt net of excess "cash" (Short Term Investments on the spreadsheet). Pro Forma SCF: Beginning year- current year= Acc. Depr Change in Operating Assets: Beginning year- current year Change in Operating Liabilities: Current year - previous year Capital Expenditures (basically PP&E): Change PP&E beginning year-current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started