Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Modern Portfolio Theory, one is interested in allocating a certain amount of money into a set of N stocks. The portfolio w E

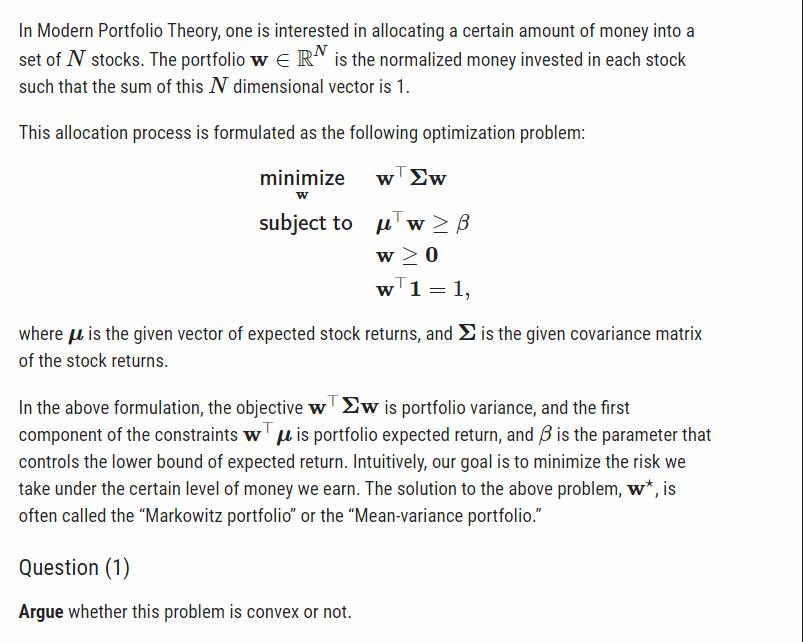

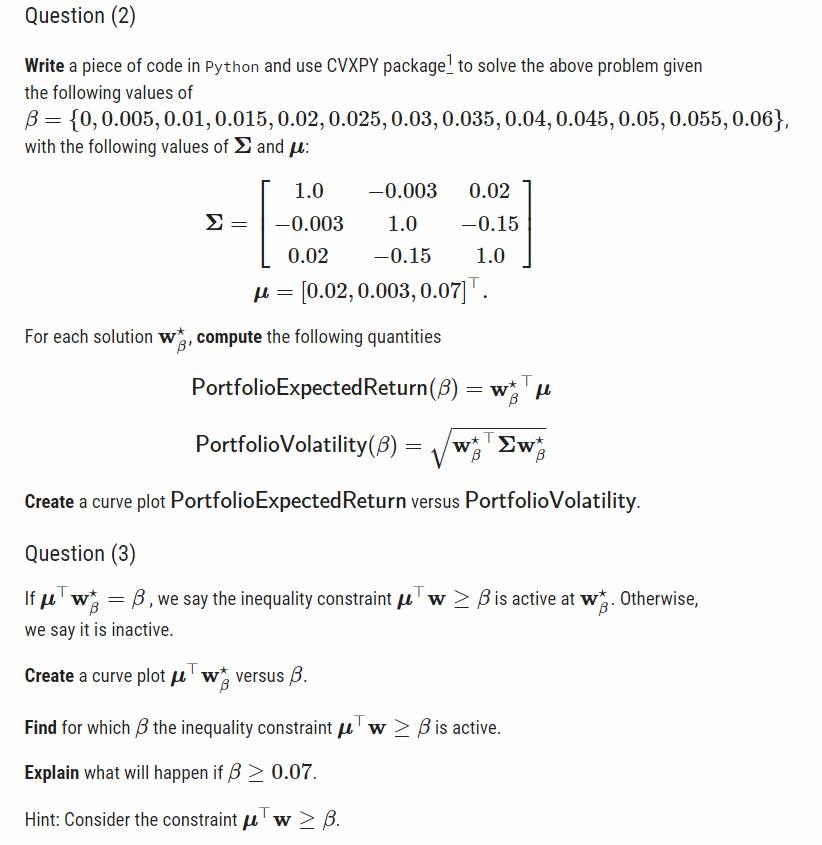

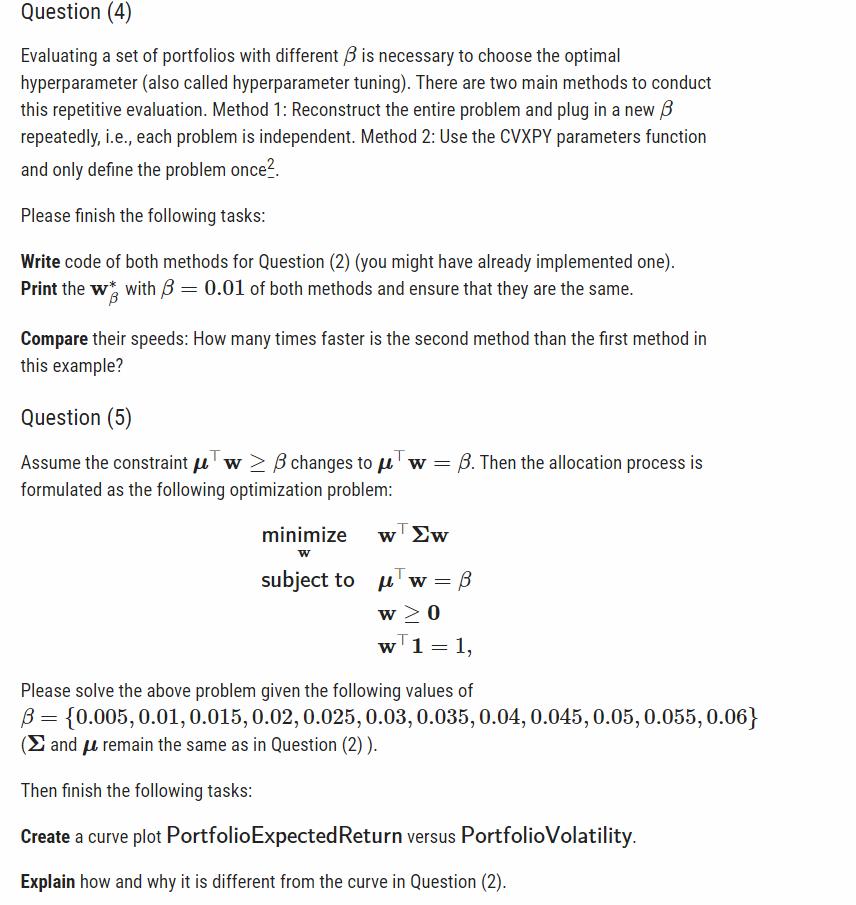

In Modern Portfolio Theory, one is interested in allocating a certain amount of money into a set of N stocks. The portfolio w E RN is the normalized money invested in each stock such that the sum of this N dimensional vector is 1. This allocation process is formulated as the following optimization problem: minimize w Ew W subject to w B w0 w 1 = 1, where is the given vector of expected stock returns, and is the given covariance matrix of the stock returns. In the above formulation, the objective w w is portfolio variance, and the first component of the constraints wis portfolio expected return, and 3 is the parameter that controls the lower bound of expected return. Intuitively, our goal is to minimize the risk we take under the certain level of money we earn. The solution to the above problem, w*, is often called the "Markowitz portfolio" or the "Mean-variance portfolio." Question (1) Argue whether this problem is convex or not. Question (2) Write a piece of code in Python and use CVXPY package to solve the above problem given the following values of B = {0, 0.005, 0.01, 0.015, 0.02, 0.025, 0.03, 0.035, 0.04, 0.045, 0.05, 0.055, 0.06}, with the following values of and : = 1.0 -0.003 0.02 -0.003 1.0 -0.15 1.0 l = = [0.02, 0.003, 0.07]. For each solution w, compute the following quantities 0.02 -0.15 Portfolio Expected Return (3) T = W* fl B Portfolio Volatility (B) = w Ew Create a curve plot Portfolio Expected Return versus Portfolio Volatility. Question (3) If w = 6, we say the inequality constraint Tw Bis active at w. Otherwise, we say it is inactive. Create a curve plot w versus 3. B Find for which the inequality constraint w is active. Explain what will happen if 30.07. Hint: Consider the constraint w B. Question (4) Evaluating a set of portfolios with different 3 is necessary to choose the optimal hyperparameter (also called hyperparameter tuning). There are two main methods to conduct this repetitive evaluation. Method 1: Reconstruct the entire problem and plug in a new repeatedly, i.e., each problem is independent. Method 2: Use the CVXPY parameters function and only define the problem once. Please finish the following tasks: Write code of both methods for Question (2) (you might have already implemented one). Print the w with 3 = 0.01 of both methods and ensure that they are the same. Compare their speeds: How many times faster is the second method than the first method in this example? Question (5) Assume the constraint TwB changes to Tw formulated as the following optimization problem: minimize W subject to = B. Then the allocation process is w Zw T. w = w 0 w 1 = 1, Please solve the above problem given the following values of B = {0.005, 0.01, 0.015, 0.02, 0.025, 0.03, 0.035, 0.04, 0.045, 0.05, 0.055, 0.06} ( and remain the same as in Question (2)). Then finish the following tasks: Create a curve plot Portfolio Expected Return versus Portfolio Volatility. Explain how and why it is different from the curve in Question (2).

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The given optimization problem is a convex problem To show this we need to prove that the objective function and the constraints satisfy the conditions for convexity Objective Function The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started