In my Fundamentals Accounting Principles 16th Edition, Larson Book: I need to: Explain in detail the elements and individual items included in the financial statements on page 183 of your textbook. The first picture shows page 183, the rest of them is the additional information if you need it. (pages 181, 182, 184). I don't know if you require this information. I am also not sure if my instructor meant page 184... but what I have been doing was this: (this is just a snippit)

Accounts Receivable: This is money that is due or owed. Someone who has not paid for their service or products yet. This would be considered an ASSET,

In this example, The Cutlery provided a $130.00 service to a client for will pay in September. The service was done in August. Therefore, when we make the adjusting entry we would use:

Accounts receivable 130 Hair cutting services .130

Pre-Paid Insurance: Pre-Paid insurance is paying a chunk of insurance in advance.

The Cutlery has pre-paid insurance for 6 months starting on August 1 ad we know from the unadjusted trial balance; the pre-paid insurance was 2400. Therefore, we need to make an adjusting entry and figure out how much insurance costs for each month. We calculate 2400 / 6 = 400.00/Month. Therefore, the adjusting entries would be:

Insurance Expense.400 Pre-paid Insurance .400

I just wanted to know, if this is what im suppose to be doing, or am i completely missing the question?

This is page 183:

Here is 181-182 and 184 incase you need it:

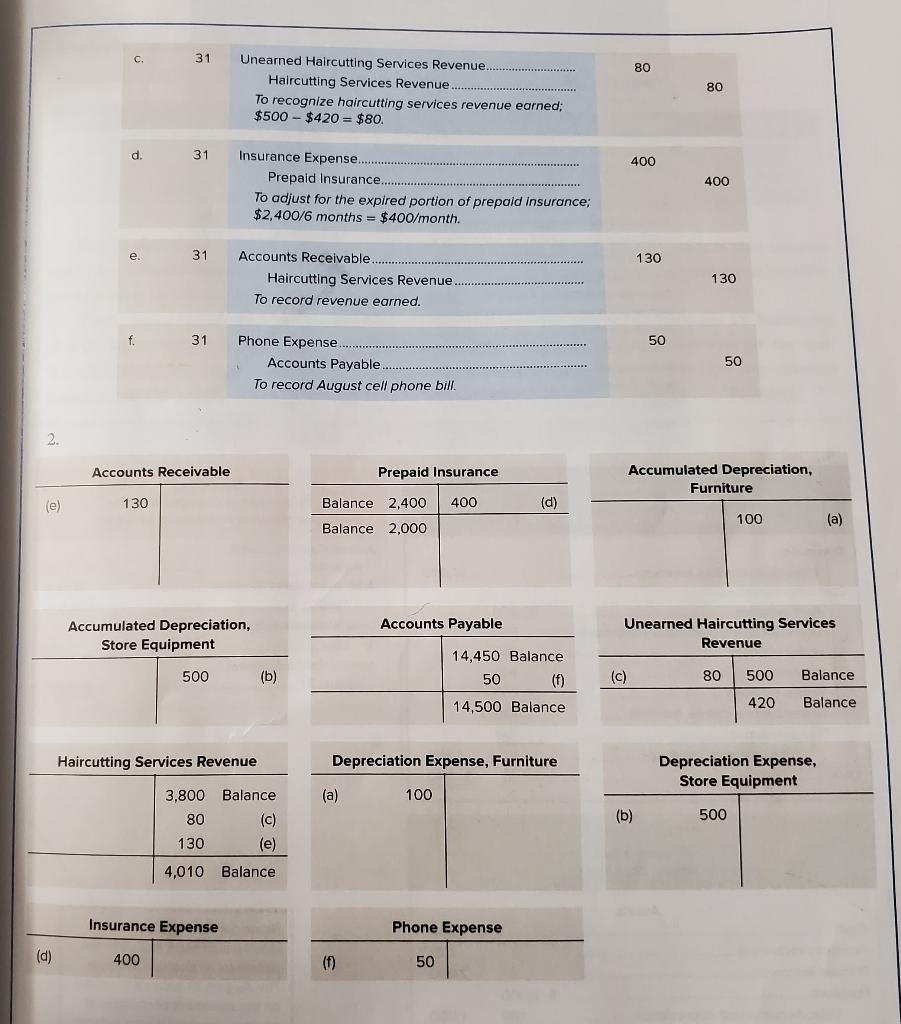

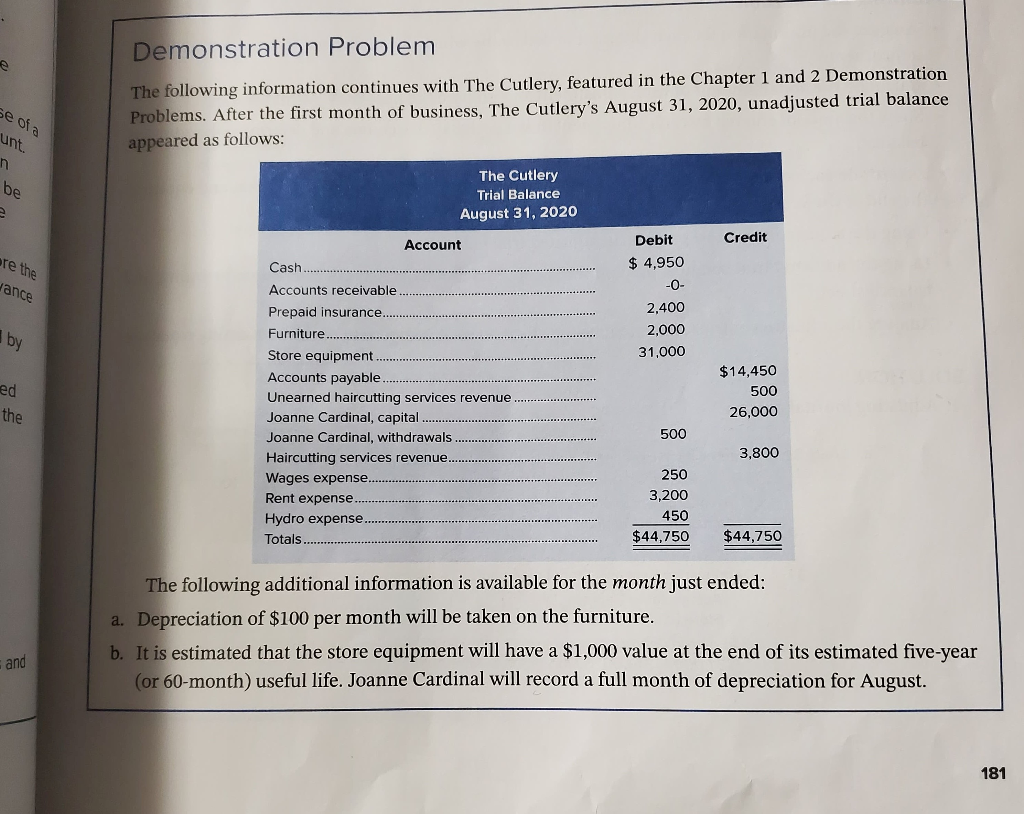

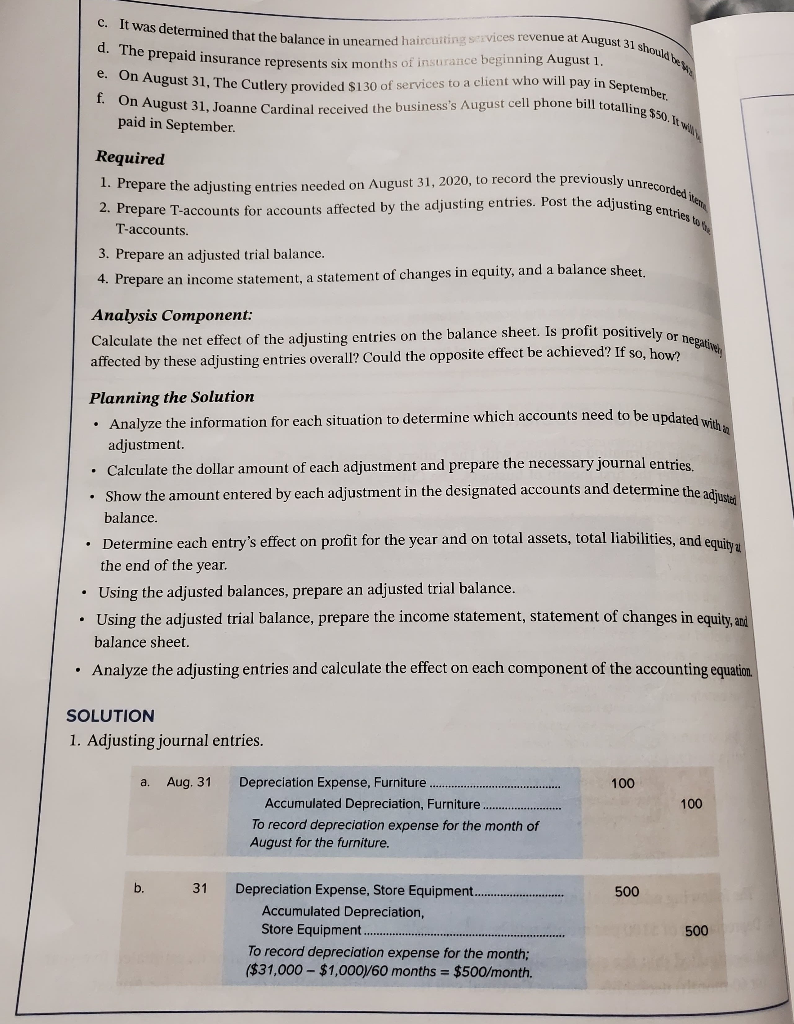

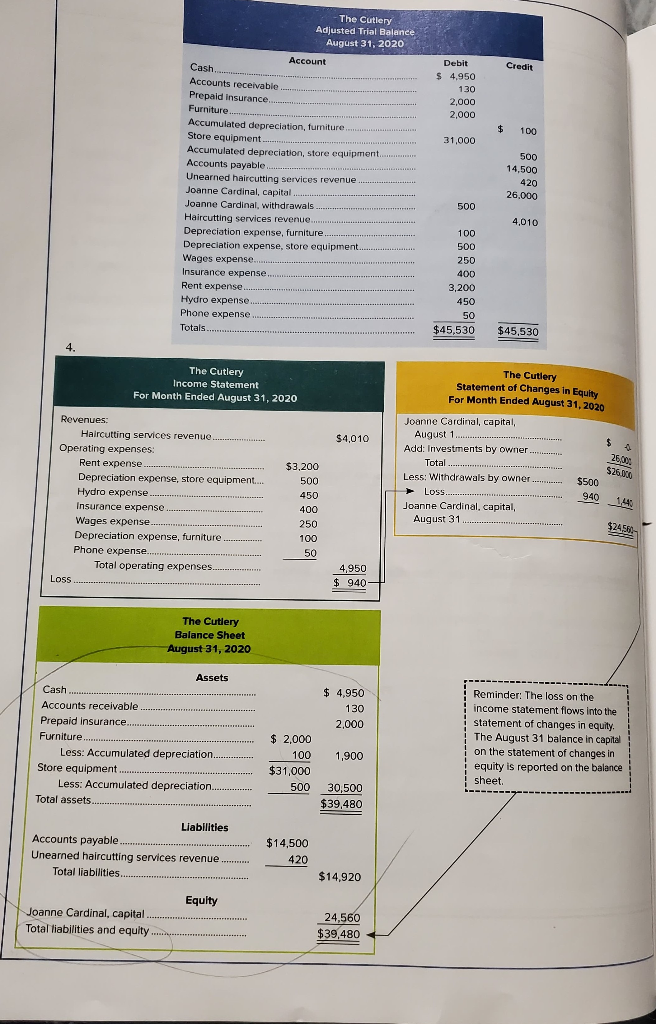

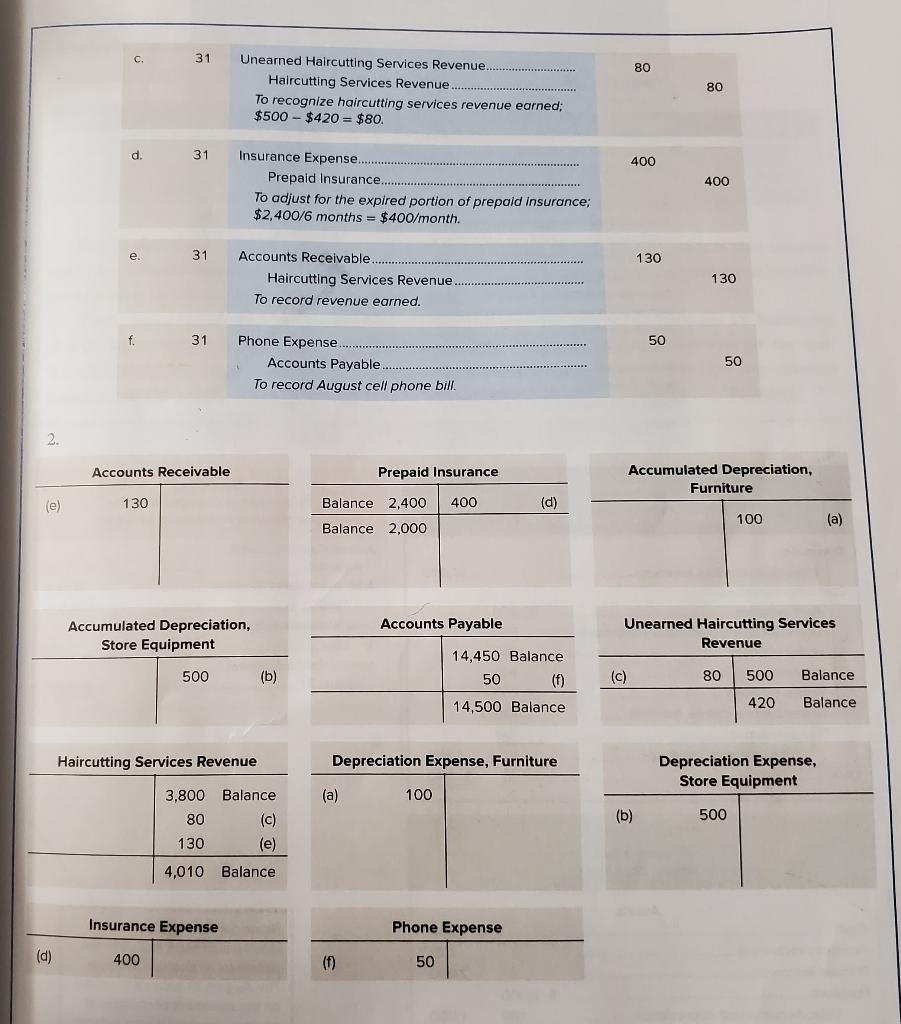

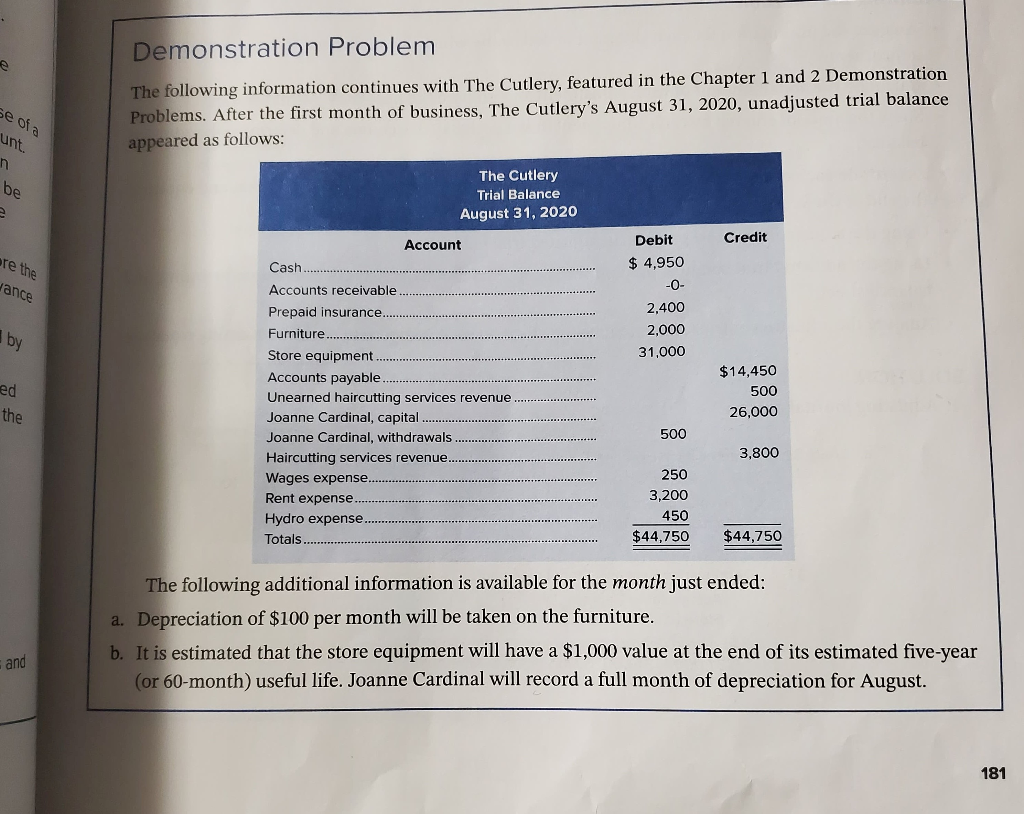

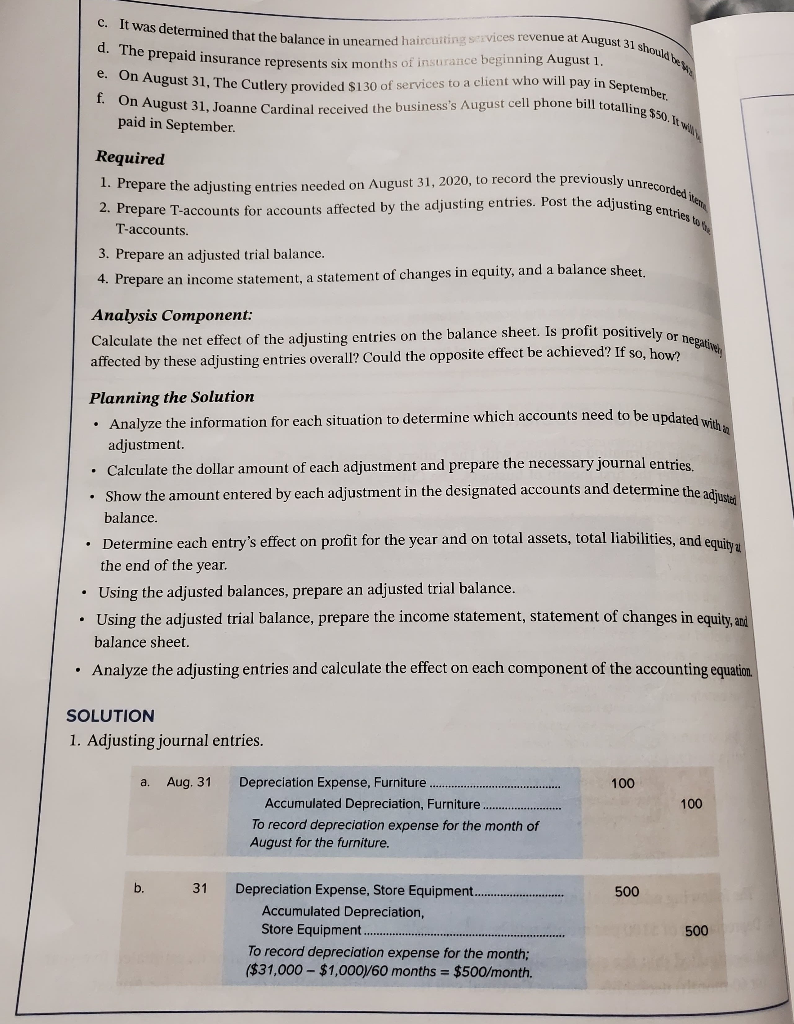

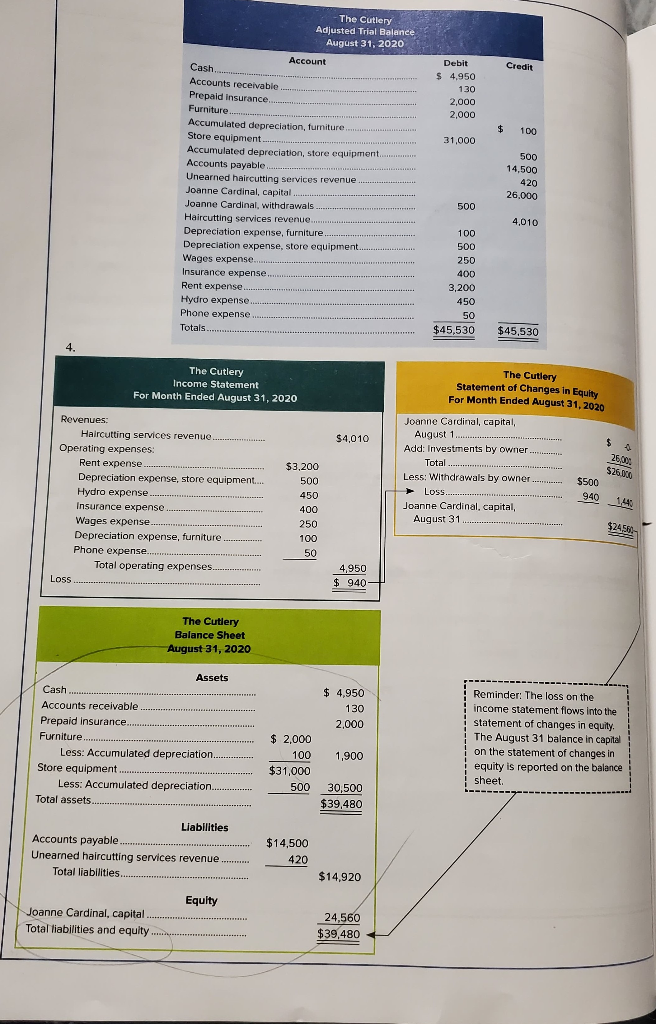

c. 31 80 Unearned Haircutting Services Revenue...... Haircutting Services Revenue.. To recognize haircutting services revenue earned; $500 - $420 = $80. 80 d. 31 400 Insurance Expense... Prepaid Insurance..................... To adjust for the expired portion of prepaid insurance; $2,400/6 months = $400/month. 400 e. 31 130 Accounts Receivable............... Haircutting Services Revenue ........ To record revenue earned. 130 f. 31 50 Phone Expense.... Accounts Payable.. To record August cell phone bill. Accounts Receivable Accumulated Depreciation, Furniture 130 Prepaid Insurance Balance 2,400 400 Balance 2,000 (d) 100 (a) Accounts Payable Accumulated Depreciation, Store Equipment 500 Unearned Haircutting Services Revenue (c) 80 500 Balance 420 Balance 14,450 Balance 50 (f) 14,500 Balance (b) Haircutting Services Revenue Depreciation Expense, Furniture Depreciation Expense, Store Equipment (a) 100 (b) 500 3,800 Balance 80 (c) 130 (e) 4,010 Balance Insurance Expense Phone Expense (d) 400 (1) 50 Demonstration Problem The following information continues with The Cutlery, featured in the Chapter 1 and 2 Demonstration Problems. After the first month of business, The Cutlery's August 31, 2020, unadjusted trial balance appeared as follows: Se ofa unt. The Cutlery Trial Balance August 31, 2020 D Credit are the wance Debit $ 4,950 -O- 2.400 2,000 31,000 ed Account Cash.............. Accounts receivable................ Prepaid insurance....... Furniture.. Store equipment .................. Accounts payable.................. Unearned haircutting services revenue Joanne Cardinal, capital Joanne Cardinal, withdrawals .............. Haircutting services revenue.... Wages expense.... Rent expense............... Hydro expense........... Totals................. $14,450 500 26,000 the 500 3,800 250 3,200 450 $44,750 $44,750 The following additional information is available for the month just ended: a. Depreciation of $100 per month will be taken on the furniture. b. It is estimated that the store equipment will have a $1,000 value at the end of its estimated five-year (or 60-month) useful life. Joanne Cardinal will record a full month of depreciation for August. and 181 st 31 shoes c. It was determined that the balance in unearned han d. The prepaid insurance represents s e. On August 31, The Cutlery provided uned that the balance in uneared haircutting stivices revenue at August 31 insurance represents six months of insurance beginning August 1. ugust 31, The Cutlery provided $130 of services to a client who will pay in Septe August 31, Joanne Cardinal received the business's August cell phone bill totalli paid in September in September. totalling $50.tw w unrecorded to justing entries Required 1. Prepare the adjusting entries needed on August 31, 2020, to record the previously unre 2. Prepare T-accounts for accounts affected by the adjusting entries. Post the adjustin T-accounts. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, a statement of changes in equity, and a balance sheet. itively or negative Analysis Component: Calculate the net effect of the adjusting entries on the balance sheet. Is profit positively or affected by these adjusting entries overall? Could the opposite effect be achieved? If so, how be updated with a Planning the Solution Analyze the information for each situation to determine which accounts need to be updated adjustment. Calculate the dollar amount of each adjustment and prepare the necessary journal entries. Show the amount entered by each adjustment in the designated accounts and determine the adi balance. Determine each entry's effect on profit for the year and on total assets, total liabilities, and em the end of the year. Using the adjusted balances, prepare an adjusted trial balance. Using the adjusted trial balance, prepare the income statement, statement of changes in equity, and balance sheet. Analyze the adjusting entries and calculate the effect on each component of the accounting equation. SOLUTION 1. Adjusting journal entries. a. Aug, 31 100 Depreciation Expense, Furniture.. Accumulated Depreciation, Furniture...................... To record depreciation expense for the month of August for the furniture. 100 b. 31 500 Depreciation Expense, Store Equipment.... ..... Accumulated Depreciation, Store Equipment. To record depreciation expense for the month; ($31,000 - $1,000/60 months = $500/month. 500 Credit $ Debit 4,950 130 2,000 2,000 $ 100 31,000 500 The Cutlery Adjusted Trial Balance August 31, 2020 Account Cash. Accounts receivable Prepaid insurance... Furniture Accumulated depreciation, furniture..... Store equipment Accumulated depreciation, store equipment........... Accounts payable.. Unearned haircutting services revenue... Joanne Cardinal, capital....... Joanne Cardinal, withdrawals .......... ...... Haircutting services revenue.......... Depreciation expense, furniture............. Depreciation expense, store equipment..... Wages expense........ Insurance expense........... Rent expense.................. Hydro expense............. Phone expense.... Totals... 14,500 420 26.000 500 4,010 100 500 250 400 3,200 450 50 $45,530 $45,530 The Cutlery Income Statement For Month Ended August 31, 2020 The Cutlery Statement of Changes in Equity For Month Ended August 31, 2020 $4,010 Revenues: Haircutting services revenue...................... Operating expenses: Rent expense... Depreciation expense, store equipment.... Hydro expense.......... Insurance expense.......... Wages expense Depreciation expense, furniture ............ Phone expense. Total operating expenses....... LOSS. $26.00 Joanne Cardinal, capital, August 1...... Add: Investments by owner ............... Total Less: Withdrawals by owner.......... Loss..... Joanne Cardinal capital, August 31.. $3,200 500 450 400 250 100 50 4,950 $ 940 The Cutlery Balance Sheet August 31, 2020 $ 4,950 130 2,000 Assets Cash... Accounts receivable............... Prepaid Insurance..................----- Furniture....... Less: Accumulated depreciation........... Store equipment................ Less: Accumulated depreciation........... Total assets....... Reminder: The loss on the income statement flows into the statement of changes in equity. The August 31 balance in capital on the statement of changes in equity is reported on the balance sheet 2,000 100 $31,000 500 1,900 30,500 $39,480 Liabilities Accounts payable............ Unearned haircutting services revenue ......... ces revenue ......... Total liabilities..... $14,500 420 $14,920 Equity Joanne Cardinal, capital.......... Total liabilities and equity .................. 24,560 $39,480 c. 31 80 Unearned Haircutting Services Revenue...... Haircutting Services Revenue.. To recognize haircutting services revenue earned; $500 - $420 = $80. 80 d. 31 400 Insurance Expense... Prepaid Insurance..................... To adjust for the expired portion of prepaid insurance; $2,400/6 months = $400/month. 400 e. 31 130 Accounts Receivable............... Haircutting Services Revenue ........ To record revenue earned. 130 f. 31 50 Phone Expense.... Accounts Payable.. To record August cell phone bill. Accounts Receivable Accumulated Depreciation, Furniture 130 Prepaid Insurance Balance 2,400 400 Balance 2,000 (d) 100 (a) Accounts Payable Accumulated Depreciation, Store Equipment 500 Unearned Haircutting Services Revenue (c) 80 500 Balance 420 Balance 14,450 Balance 50 (f) 14,500 Balance (b) Haircutting Services Revenue Depreciation Expense, Furniture Depreciation Expense, Store Equipment (a) 100 (b) 500 3,800 Balance 80 (c) 130 (e) 4,010 Balance Insurance Expense Phone Expense (d) 400 (1) 50 Demonstration Problem The following information continues with The Cutlery, featured in the Chapter 1 and 2 Demonstration Problems. After the first month of business, The Cutlery's August 31, 2020, unadjusted trial balance appeared as follows: Se ofa unt. The Cutlery Trial Balance August 31, 2020 D Credit are the wance Debit $ 4,950 -O- 2.400 2,000 31,000 ed Account Cash.............. Accounts receivable................ Prepaid insurance....... Furniture.. Store equipment .................. Accounts payable.................. Unearned haircutting services revenue Joanne Cardinal, capital Joanne Cardinal, withdrawals .............. Haircutting services revenue.... Wages expense.... Rent expense............... Hydro expense........... Totals................. $14,450 500 26,000 the 500 3,800 250 3,200 450 $44,750 $44,750 The following additional information is available for the month just ended: a. Depreciation of $100 per month will be taken on the furniture. b. It is estimated that the store equipment will have a $1,000 value at the end of its estimated five-year (or 60-month) useful life. Joanne Cardinal will record a full month of depreciation for August. and 181 st 31 shoes c. It was determined that the balance in unearned han d. The prepaid insurance represents s e. On August 31, The Cutlery provided uned that the balance in uneared haircutting stivices revenue at August 31 insurance represents six months of insurance beginning August 1. ugust 31, The Cutlery provided $130 of services to a client who will pay in Septe August 31, Joanne Cardinal received the business's August cell phone bill totalli paid in September in September. totalling $50.tw w unrecorded to justing entries Required 1. Prepare the adjusting entries needed on August 31, 2020, to record the previously unre 2. Prepare T-accounts for accounts affected by the adjusting entries. Post the adjustin T-accounts. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, a statement of changes in equity, and a balance sheet. itively or negative Analysis Component: Calculate the net effect of the adjusting entries on the balance sheet. Is profit positively or affected by these adjusting entries overall? Could the opposite effect be achieved? If so, how be updated with a Planning the Solution Analyze the information for each situation to determine which accounts need to be updated adjustment. Calculate the dollar amount of each adjustment and prepare the necessary journal entries. Show the amount entered by each adjustment in the designated accounts and determine the adi balance. Determine each entry's effect on profit for the year and on total assets, total liabilities, and em the end of the year. Using the adjusted balances, prepare an adjusted trial balance. Using the adjusted trial balance, prepare the income statement, statement of changes in equity, and balance sheet. Analyze the adjusting entries and calculate the effect on each component of the accounting equation. SOLUTION 1. Adjusting journal entries. a. Aug, 31 100 Depreciation Expense, Furniture.. Accumulated Depreciation, Furniture...................... To record depreciation expense for the month of August for the furniture. 100 b. 31 500 Depreciation Expense, Store Equipment.... ..... Accumulated Depreciation, Store Equipment. To record depreciation expense for the month; ($31,000 - $1,000/60 months = $500/month. 500 Credit $ Debit 4,950 130 2,000 2,000 $ 100 31,000 500 The Cutlery Adjusted Trial Balance August 31, 2020 Account Cash. Accounts receivable Prepaid insurance... Furniture Accumulated depreciation, furniture..... Store equipment Accumulated depreciation, store equipment........... Accounts payable.. Unearned haircutting services revenue... Joanne Cardinal, capital....... Joanne Cardinal, withdrawals .......... ...... Haircutting services revenue.......... Depreciation expense, furniture............. Depreciation expense, store equipment..... Wages expense........ Insurance expense........... Rent expense.................. Hydro expense............. Phone expense.... Totals... 14,500 420 26.000 500 4,010 100 500 250 400 3,200 450 50 $45,530 $45,530 The Cutlery Income Statement For Month Ended August 31, 2020 The Cutlery Statement of Changes in Equity For Month Ended August 31, 2020 $4,010 Revenues: Haircutting services revenue...................... Operating expenses: Rent expense... Depreciation expense, store equipment.... Hydro expense.......... Insurance expense.......... Wages expense Depreciation expense, furniture ............ Phone expense. Total operating expenses....... LOSS. $26.00 Joanne Cardinal, capital, August 1...... Add: Investments by owner ............... Total Less: Withdrawals by owner.......... Loss..... Joanne Cardinal capital, August 31.. $3,200 500 450 400 250 100 50 4,950 $ 940 The Cutlery Balance Sheet August 31, 2020 $ 4,950 130 2,000 Assets Cash... Accounts receivable............... Prepaid Insurance..................----- Furniture....... Less: Accumulated depreciation........... Store equipment................ Less: Accumulated depreciation........... Total assets....... Reminder: The loss on the income statement flows into the statement of changes in equity. The August 31 balance in capital on the statement of changes in equity is reported on the balance sheet 2,000 100 $31,000 500 1,900 30,500 $39,480 Liabilities Accounts payable............ Unearned haircutting services revenue ......... ces revenue ......... Total liabilities..... $14,500 420 $14,920 Equity Joanne Cardinal, capital.......... Total liabilities and equity .................. 24,560 $39,480