In myevaluationof Goldplus decision, I didananalysis onmarket sizebased on some information from the case,with the help ofsome assumptions.One pieceof informationthat affected my analysis (specifically, the second bullet point in thesupplement document containing my analysis of market size) wasGoldplus' performance in thepilot test.Now imagine that afterpiloting GoldplusinErode and Ratlam,Tanishq managerspilotedthe brandin3moresmalltownsthat are very similar to Ratlamandperformanceinthe 3 additional towns was very similar to that inRatlam.Clearly explain, with suitable numbers/calculationsasneeded, as tohow this new piece of informationwouldaffect my analysis of market size and conclusions therefrom??

Note this is a rather precise task with something of a "correct" answer although stylistic variations would naturally occur andexpected.However, please be precise but clear (not cryptic) in your response

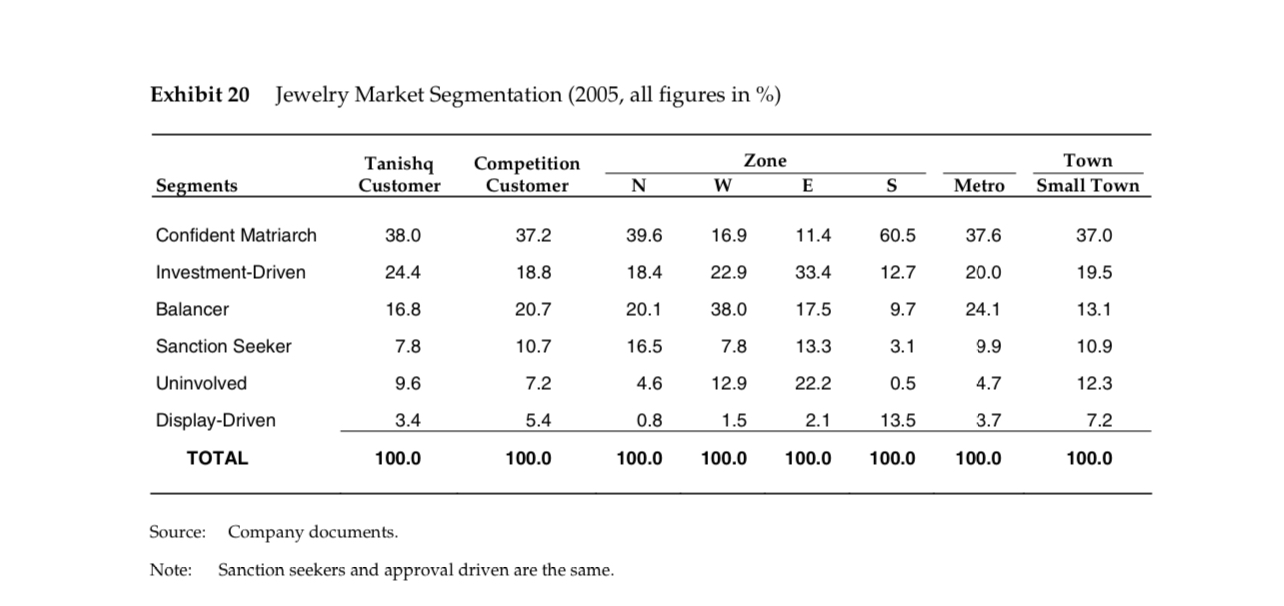

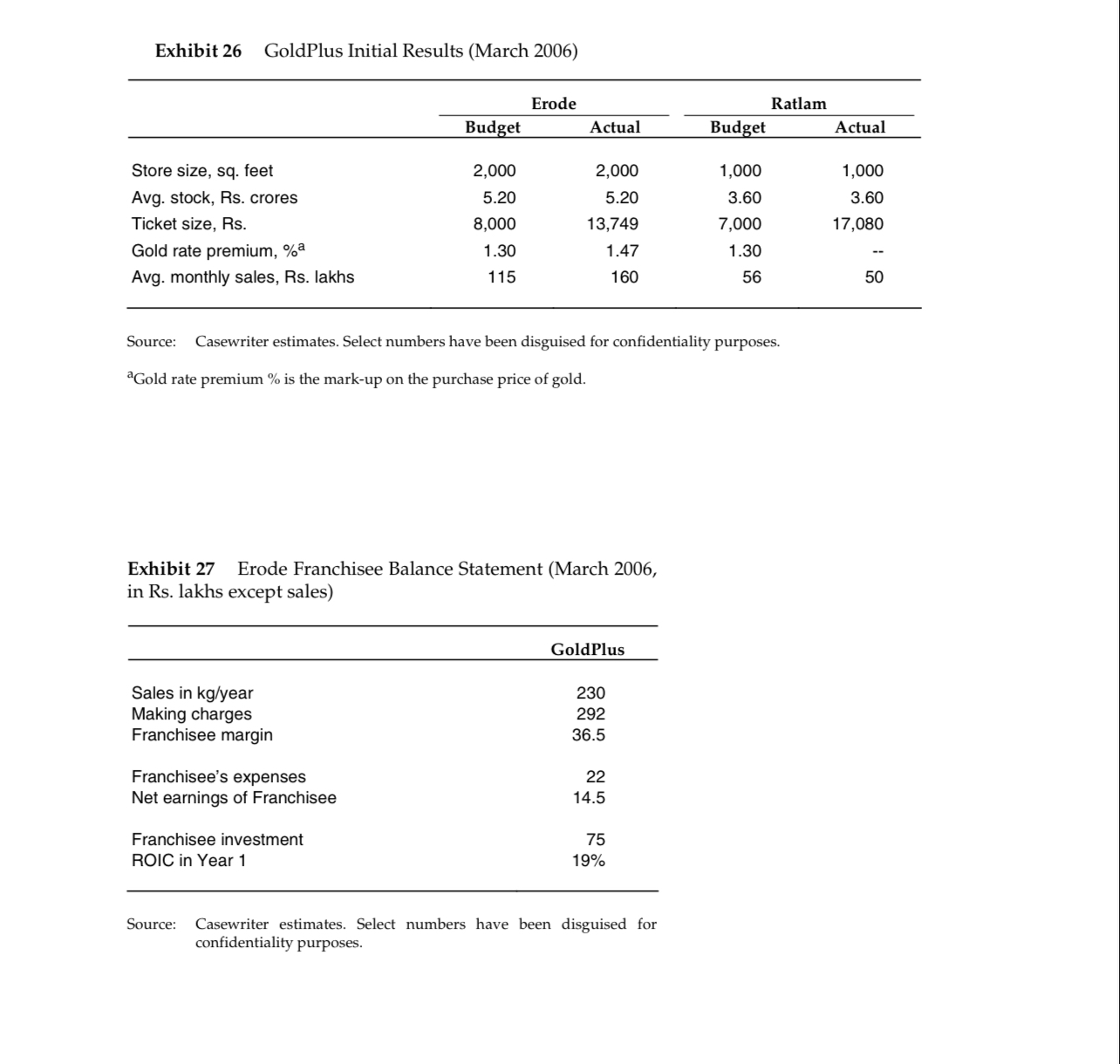

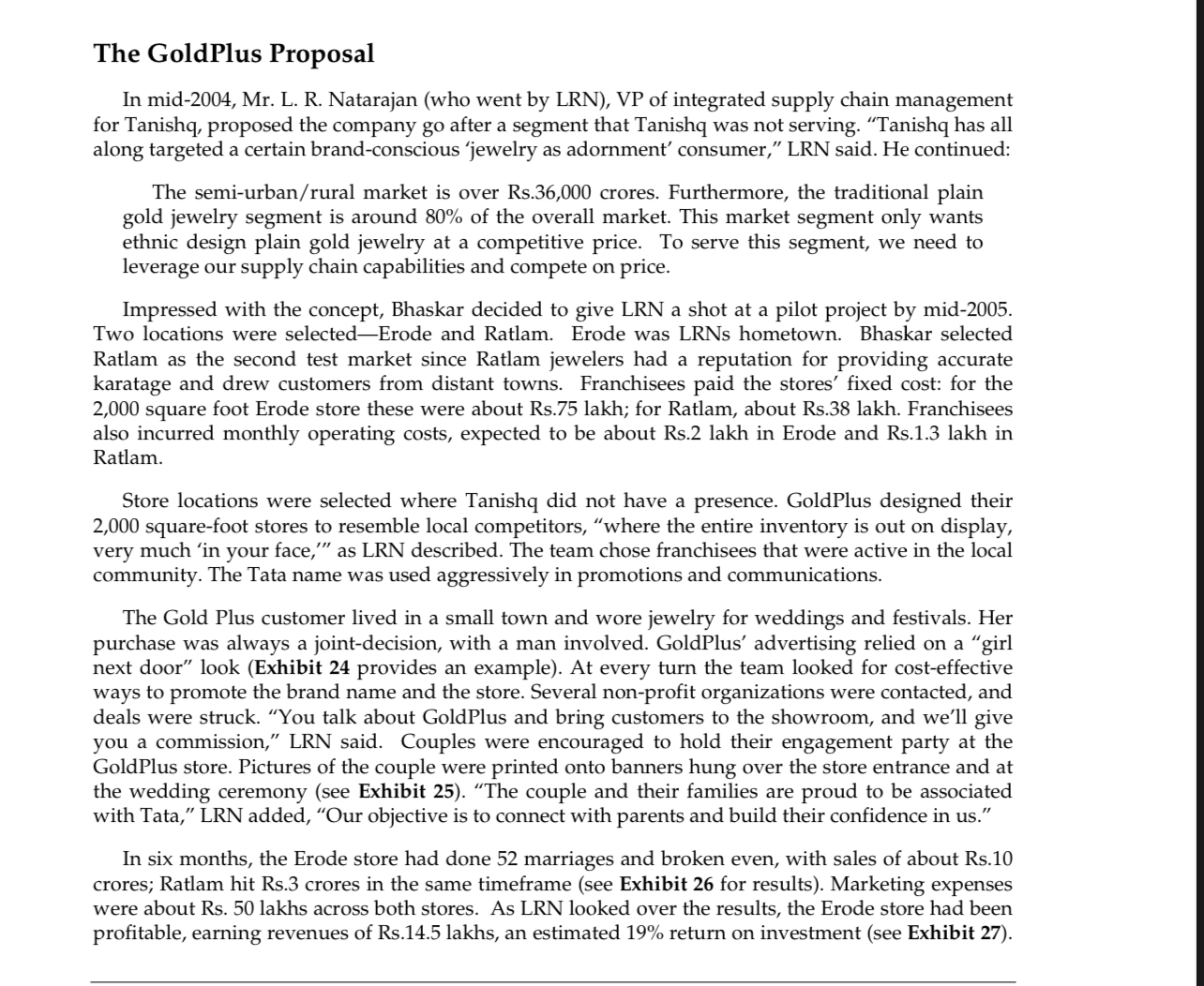

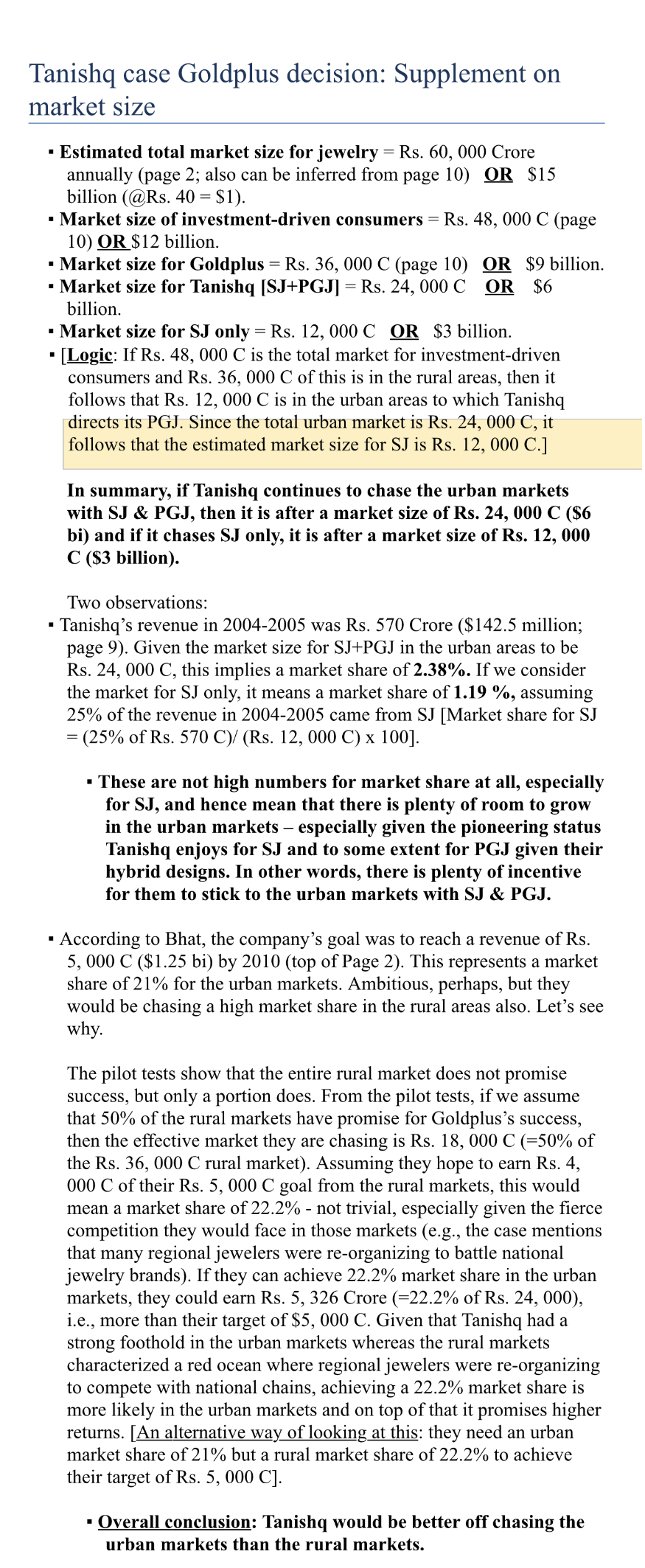

Exhibit 20 Jewelry Market Segmentation (2005, all figures in %) Tanishq Competition Zone Town Segments Customer Customer N W E S Metro Small Town Confident Matriarch 38.0 37.2 39.6 16.9 11.4 60.5 37.6 37.0 Investment-Driven 24.4 18.8 18.4 22.9 33.4 12.7 20.0 19.5 Balancer 16.8 20.7 20.1 38.0 17.5 9.7 24.1 13.1 Sanction Seeker 7.8 10.7 16.5 7.8 13.3 3.1 9.9 10.9 Uninvolved 9.6 7.2 4.6 12.9 22.2 0.5 4.7 12.3 Display-Driven 3.4 5.4 0.8 1.5 2.1 13.5 3.7 7.2 TOTAL 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 Source: Company documents. Note: Sanction seekers and approval driven are the same.Exhibit 26 GoldPlus Initial Results (March 2006) Erode Ratlam Budget Actual Budget Actual Store size, sq. feet 2,000 2,000 1,000 1,000 Avg. stock, Rs. crores 5.20 5.20 3.60 3.60 Ticket size, Rs. 8,000 13,749 7,000 17,080 Gold rate premium, % 1.30 1.47 1.30 Avg. monthly sales, Rs. lakhs 115 160 56 50 Source: Casewriter estimates. Select numbers have been disguised for confidentiality purposes. *Gold rate premium % is the mark-up on the purchase price of gold. Exhibit 27 Erode Franchisee Balance Statement (March 2006, in Rs. lakhs except sales) GoldPlus Sales in kg/year 230 Making charges 292 Franchisee margin 36.5 Franchisee's expenses 22 Net earnings of Franchisee 14.5 Franchisee investment 75 ROIC in Year 1 19% Source: Casewriter estimates. Select numbers have been disguised for confidentiality purposes.The GoldPlus Proposal In mid-2004, Mr. L. R. Natarajan (who went by LRN), VP of integrated supply chain management for Tanishq, proposed the company go after a segment that Tanishq was not serving. "Tanishq has all along targeted a certain brand-conscious 'jewelry as adornment' consumer," LRN said. He continued: The semi-urban/rural market is over Rs.36,000 crores. Furthermore, the traditional plain gold jewelry segment is around 80% of the overall market. This market segment only wants ethnic design plain gold jewelry at a competitive price. To serve this segment, we need to leverage our supply chain capabilities and compete on price. Impressed with the concept, Bhaskar decided to give LRN a shot at a pilot project by mid-2005. Two locations were selected-Erode and Ratlam. Erode was LRNs hometown. Bhaskar selected Ratlam as the second test market since Ratlam jewelers had a reputation for providing accurate karatage and drew customers from distant towns. Franchisees paid the stores' fixed cost: for the 2,000 square foot Erode store these were about Rs.75 lakh; for Ratlam, about Rs.38 lakh. Franchisees also incurred monthly operating costs, expected to be about Rs.2 lakh in Erode and Rs.1.3 lakh in Ratlam. Store locations were selected where Tanishq did not have a presence. GoldPlus designed their 2,000 square-foot stores to resemble local competitors, "where the entire inventory is out on display, very much 'in your face,"" as LRN described. The team chose franchisees that were active in the local community. The Tata name was used aggressively in promotions and communications. The Gold Plus customer lived in a small town and wore jewelry for weddings and festivals. Her purchase was always a joint-decision, with a man involved. GoldPlus' advertising relied on a "girl next door" look (Exhibit 24 provides an example). At every turn the team looked for cost-effective ways to promote the brand name and the store. Several non-profit organizations were contacted, and deals were struck. "You talk about GoldPlus and bring customers to the showroom, and we'll give you a commission," LRN said. Couples were encouraged to hold their engagement party at the GoldPlus store. Pictures of the couple were printed onto banners hung over the store entrance and at the wedding ceremony (see Exhibit 25). "The couple and their families are proud to be associated with Tata," LRN added, "Our objective is to connect with parents and build their confidence in us." In six months, the Erode store had done 52 marriages and broken even, with sales of about Rs.10 crores; Ratlam hit Rs.3 crores in the same timeframe (see Exhibit 26 for results). Marketing expenses were about Rs. 50 lakhs across both stores. As LRN looked over the results, the Erode store had been profitable, earning revenues of Rs.14.5 lakhs, an estimated 19% return on investment (see Exhibit 27).Tanishq case Goldplus decision: Supplement on market size - Estimated total market size for jewelry 2 Rs. 60, 000 Crore annually (page 2; also can be inferred from page 10) % $15 billion (@Rs. 40 : $1). - Market size of investment-driven consumers = Rs. 48, 000 C (page 10) $12 billion. - Market size for Goldplus = Rs. 36, 000 C (page 10) $9 billion. - Market size for Tanishq [SJ+PGJ] = Rs. 24, 000 C QB $6 billion. - Market size for SJ only = Rs. 12, 000 C @ $3 billion. - [Qgig If Rs. 48, 000 C is the total market for investment-driven consumers and Rs. 36, 000 C of this is in the rural areas, then it follows that Rs. 12, 000 C is in the urban areas to which Tanishq "directsitsPGJTSincethe"total'urbanmarket'is'Rsztrit follows that the estimated market size for SJ is Rs. 12, 000 C.] In summary, if Tanishq continues to chase the urban markets with SJ & PGJ, then it is after a market size of Rs. 24, 000 C ($6 hi) and if it chases SJ only, it is after a market size of Rs. 12, 000 C ($3 billion). Two observations: - Tanishq's revenue in 2004-2005 was Rs. 570 Crore ($142.5 million; page 9). Given the market size for SJ+PGJ in the urban areas to be Rs. 24, 000 C, this implies a market share of 2.33%. If we consider the market for SJ only, it means a market share of 1.19 %, assuming 25% of the revenue in 2004-2005 came 'orn SJ [Market share for SJ = (25% of Rs. 570 C}! (Rs. 12,000 C) x 100]. - These are not high numbers for market share at all, especially for SJ, and hence mean that there is plenty of room to grow in the urban markets especially given the pioneering status Tanishq enjoys for SJ and to some extent for PGJ given their hybrid designs. In other words, there is plenty of incentive for them to stick to the urban markets with SJ & PGJ. - According to Bhat, the company's goal was to reach a revenue of Rs. 5, 000 C ($1.25 bi) by 2010 (top of Page 2). This represents a market share of 2 1% for the urban markets. Ambitious, perhaps, but they would be chasing a high market share in the rural areas also. Let's see why. The pilot tests show that the entire rural market does not promise success, but only a portion does. From the pilot tests, if we assume that 50% of the rural markets have promise for Goldplus's success, then the effective market they are chasing is Rs. 18, 000 C (=50% of the Rs. 36, 000 C rural market). Assuming they hope to earn Rs. 4, 000 C of their Rs. 5, 000 C goal from the rural markets, this would mean a market share of 22.2% - not trivial, especially given the erce competition they would face in those markets (e.g., the case mentions that many regional jewelers were re-organizing to battle national jewelry brands). If they can achieve 22.2% market share in the urban markets, they could earn Rs. 5, 326 Crore (=22.2% of Rs. 24, 000), i.e., more than their target of $5, 000 C. Given that Tanishq had a strong foothold in the urban markets whereas the rural markets characterized a red ocean where regional jewelers were reorganizing to compete with national chains, achieving a 22.2% market share is more likely in the urban markets and on top of that it promises higher returns. [An alternative way of looking at this: they need an urban market share of 2 1% but a rural market share of 22.2% to achieve their target of Rs. 5, 000 C]. - Overall conclusion: Tanishq would be better off chasing the urban markets than the rural markets