Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Note 3 on the handout Amazon details its Property and Equipment balances. Using just the information in this note, including current year depreciation

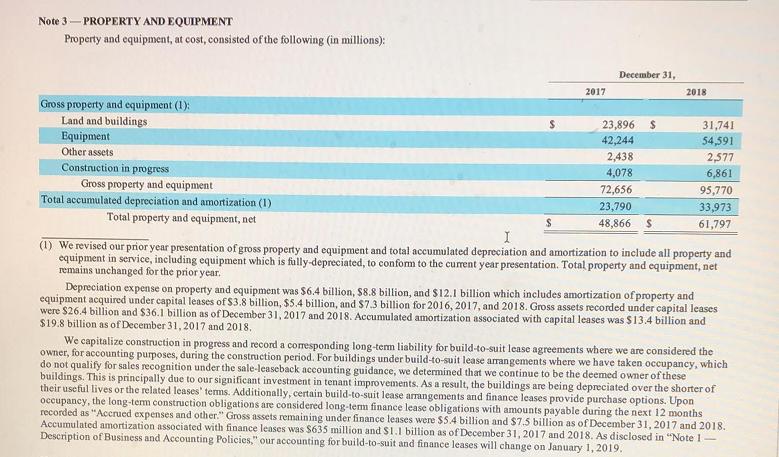

In Note 3 on the handout Amazon details its Property and Equipment balances. Using just the information in this note, including current year depreciation expense, what is the average remaining expected useful life (in years) of Amazon's property and equipment as of the end of 2018? Note 3 PROPERTY AND EQUIPMENT Property and equipment, at cost, consisted of the following (in millions): Gross property and equipment (1): Land and buildings Equipment Other assets Construction in progress Gross property and equipment Total accumulated depreciation and amortization (1) Total property and equipment, net $ 2017 December 31, 23,896 42,244 2,438 4,078 $S 72,656 23,790 48,866 $ 2018 31,741 54,591 2,577 6,861 95,770 33,973 61,797 I (1) We revised our prior year presentation of gross property and equipment and total accumulated depreciation and amortization to include all property and equipment in service, including equipment which is fully-depreciated, to conform to the current year presentation. Total property and equipment, net remains unchanged for the prior year. Depreciation expense on property and equipment was $6.4 billion, $8.8 billion, and $12.1 billion which includes amortization of property and equipment acquired under capital leases of $3.8 billion, $5.4 billion, and $7.3 billion for 2016, 2017, and 2018. Gross assets recorded under capital leases were $26.4 billion and $36.1 billion as of December 31, 2017 and 2018. Accumulated amortization associated with capital leases was $13.4 billion and $19.8 billion as of December 31, 2017 and 2018. We capitalize construction in progress and record a corresponding long-term liability for build-to-suit lease agreements where we are considered the owner, for accounting purposes, during the construction period. For buildings under build-to-suit lease arrangements where we have taken occupancy, which do not qualify for sales recognition under the sale-leaseback accounting guidance, we determined that we continue to be the deemed owner of these buildings. This is principally due to our significant investment in tenant improvements. As a result, the buildings are being depreciated over the shorter of their useful lives or the related leases' terms. Additionally, certain build-to-suit lease arrangements and finance leases provide purchase options. Upon occupancy, the long-term construction obligations are considered long-term finance lease obligations with amounts payable during the next 12 months recorded as "Accrued expenses and other." Gross assets remaining under finance leases were $5.4 billion and $7.5 billion as of December 31, 2017 and 2018. Accumulated amortization associated with finance leases was $635 million and $1.1 billion as of December 31, 2017 and 2018. As disclosed in "Note 1 Description of Business and Accounting Policies," our accounting for build-to-suit and finance leases will change on January 1, 2019.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The average remaining expected useful life of Amazons property and equipment as of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started