Answered step by step

Verified Expert Solution

Question

1 Approved Answer

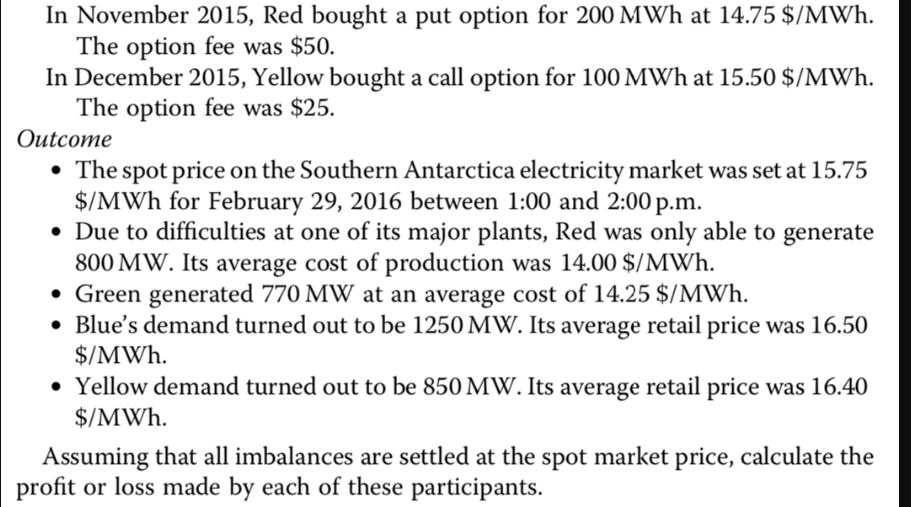

In November 2015, Red bought a put option for 200 MWh at 14.75 $/MWh. The option fee was $50. In December 2015, Yellow bought

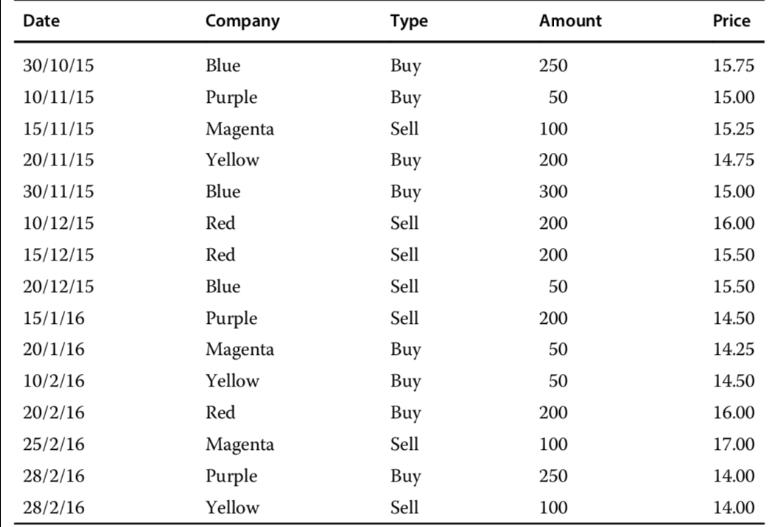

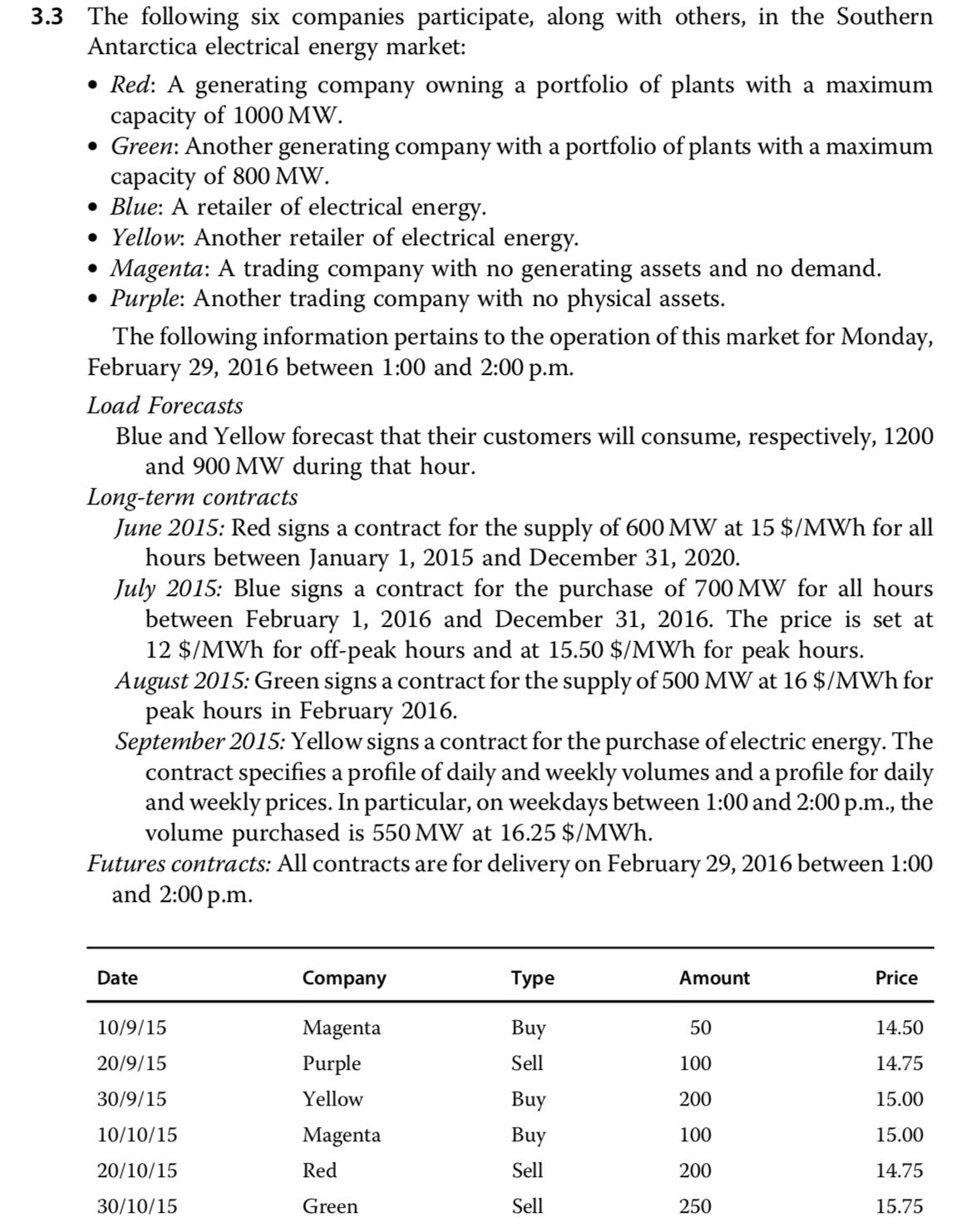

In November 2015, Red bought a put option for 200 MWh at 14.75 $/MWh. The option fee was $50. In December 2015, Yellow bought a call option for 100 MWh at 15.50 $/MWh. The option fee was $25. Outcome The spot price on the Southern Antarctica electricity market was set at 15.75 $/MWh for February 29, 2016 between 1:00 and 2:00 p.m. Due to difficulties at one of its major plants, Red was only able to generate 800 MW. Its average cost of production was 14.00 $/MWh. Green generated 770 MW at an average cost of 14.25 $/MWh. Blue's demand turned out to be 1250 MW. Its average retail price was 16.50 $/MWh. Yellow demand turned out to be 850 MW. Its average retail price was 16.40 $/MWh. Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by each of these participants. Date Company Amount Price 30/10/15 Blue Buy 250 15.75 10/11/15 Purple Buy 50 15.00 15/11/15 Magenta Sell 100 15.25 20/11/15 Yellow Buy 200 14.75 30/11/15 Blue Buy 300 15.00 10/12/15 Red Sell 200 16.00 15/12/15 Red Sell 200 15.50 20/12/15 Blue Sell 50 15.50 15/1/16 Purple Sell 200 14.50 20/1/16 Magenta Buy 50 14.25 10/2/16 Yellow Buy 50 14.50 20/2/16 Red Buy 200 16.00 25/2/16 Magenta Sell 100 17.00 28/2/16 Purple Buy 250 14.00 28/2/16 Yellow Sell 100 14.00 3.3 The following six companies participate, along with others, in the Southern Antarctica electrical energy market: Red: A generating company owning a portfolio of plants with a maximum capacity of 1000 MW. Green: Another generating company with a portfolio of plants with a maximum capacity of 800 MW. Blue: A retailer of electrical energy. Yellow: Another retailer of electrical energy. Magenta: A trading company with no generating assets and no demand. Purple: Another trading company with no physical assets. The following information pertains to the operation of this market for Monday, February 29, 2016 between 1:00 and 2:00 p.m. Load Forecasts Blue and Yellow forecast that their customers will consume, respectively, 1200 and 900 MW during that hour. Long-term contracts June 2015: Red signs a contract for the supply of 600 MW at 15 $/MWh for all hours between January 1, 2015 and December 31, 2020. July 2015: Blue signs a contract for the purchase of 700 MW for all hours between February 1, 2016 and December 31, 2016. The price is set at 12 $/MWh for off-peak hours and at 15.50 $/MWh for peak hours. August 2015: Green signs a contract for the supply of 500 MW at 16 $/MWh for peak hours in February 2016. September 2015: Yellow signs a contract for the purchase of electric energy. The contract specifies a profile of daily and weekly volumes and a profile for daily and weekly prices. In particular, on weekdays between 1:00 and 2:00 p.m., the volume purchased is 550 MW at 16.25 $/MWh. Futures contracts: All contracts are for delivery on February 29, 2016 between 1:00 and 2:00 p.m. Date Company Type Amount Price 10/9/15 Magenta Buy 50 14.50 20/9/15 Purple Sell 100 14.75 30/9/15 Yellow Buy 200 15.00 10/10/15 Magenta Buy 100 15.00 20/10/15 Red Sell 200 14.75 30/10/15 Green Sell 250 15.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started