Question

In November 2021, Kortney (who is a self-employed management consultant) travels from Chicago to Barcelona (Spain) on business. She is gone 10 days (including

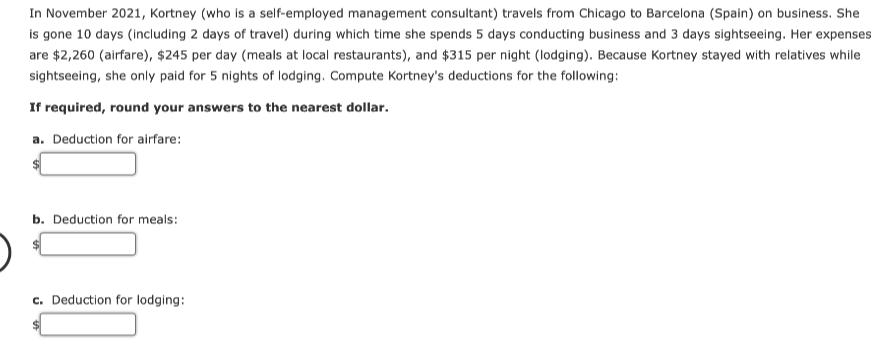

In November 2021, Kortney (who is a self-employed management consultant) travels from Chicago to Barcelona (Spain) on business. She is gone 10 days (including 2 days of travel) during which time she spends 5 days conducting business and 3 days sightseeing. Her expenses are $2,260 (airfare), $245 per day (meals at local restaurants), and $315 per night (lodging). Because Kortney stayed with relatives while sightseeing, she only paid for 5 nights of lodging. Compute Kortney's deductions for the following: If required, round your answers to the nearest dollar. a. Deduction for airfare: b. Deduction for meals: c. Deduction for lodging:

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Deduction for Airfare Airfare Business days Total day...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2017 Essentials Of Taxation Individuals And Business Entities

Authors: William A. Raabe, David M. Maloney, James C. Young, Annette Nellen

20th Edition

978-0357109144, 978-0357686652, 978-1305874824

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App