Question

In October 2013, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering and tracking each product line had exceeded the profits earned.

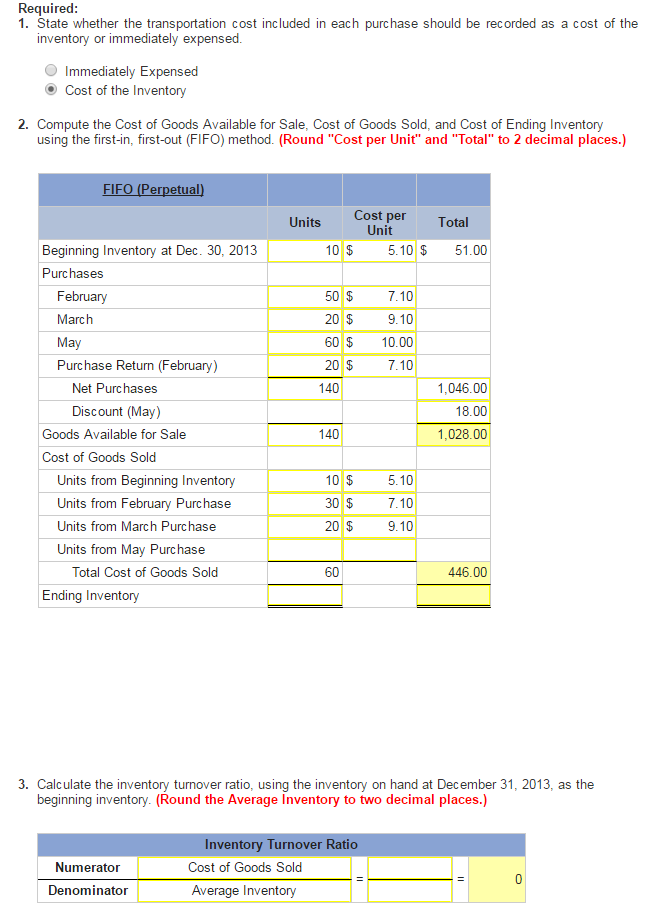

| In October 2013, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering and tracking each product line had exceeded the profits earned. In December, a supplier asked her to sell a prepackaged spa kit. Feeling she could manage a single product line, Nicole agreed. Nicoles Getaway Spa would make monthly purchases from the supplier at a cost that included production costs and a transportation charge. Nicoles Getaway Spa would keep track of its new inventory using a perpetual inventory system. |

| On December 30, 2013, Nicoles Getaway Spa purchased 10 units at a total cost of $5.10 per unit. Nicole purchased 50 more units at $7.10 in February 2014, but returned 20 defective units to her supplier. In March, Nicole purchased 20 units at $9.10 per unit. In May, 60 units were purchased at $10 per unit; however, Nicole took advantage of a 3/10, n/30 discount from her supplier. In June, NGS sold 60 units at a selling price of $11.10 per unit and 30 units at $9.10 per unit. I got this far because I am stumped at this point (not sure if all of these are all 100% correct):

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started