Answered step by step

Verified Expert Solution

Question

1 Approved Answer

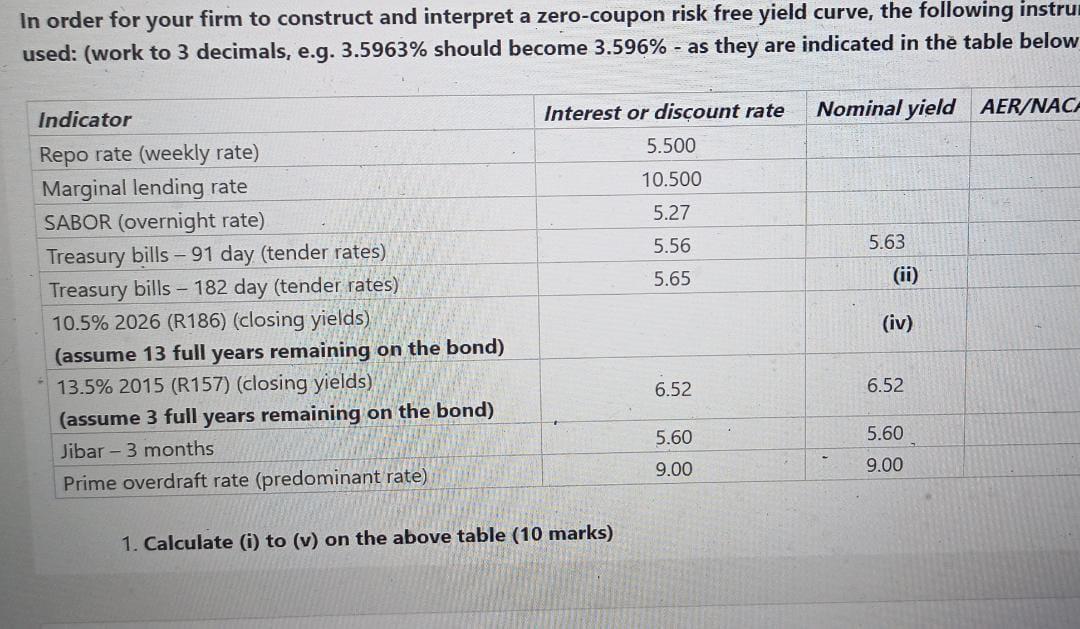

In order for your firm to construct and interpret a zero-coupon risk free yield curve, the following instru used: (work to 3 decimals, e.g. 3.5963%

In order for your firm to construct and interpret a zero-coupon risk free yield curve, the following instru used: (work to 3 decimals, e.g. 3.5963% should become 3.596% - as they are indicated in the table below Nominal yield AER/NACH Interest or discount rate 5.500 10.500 5.27 5.56 5.63 5.65 (ii) Indicator Repo rate (weekly rate) Marginal lending rate SABOR (overnight rate) Treasury bills 91 day (tender rates) Treasury bills -- 182 day (tender rates) 10.5% 2026 (R186) (closing yields) (assume 13 full years remaining on the bond) 13.5% 2015 (R157) (closing yields) (assume 3 full years remaining on the bond) Jibar - 3 months Prime overdraft rate (predominant rate) (iv) 6.52 6.52 5.60 5.60 9.00 9.00 1. Calculate (i) to (v) on the above table (10 marks) In order for your firm to construct and interpret a zero-coupon risk free yield curve, the following instru used: (work to 3 decimals, e.g. 3.5963% should become 3.596% - as they are indicated in the table below Nominal yield AER/NACH Interest or discount rate 5.500 10.500 5.27 5.56 5.63 5.65 (ii) Indicator Repo rate (weekly rate) Marginal lending rate SABOR (overnight rate) Treasury bills 91 day (tender rates) Treasury bills -- 182 day (tender rates) 10.5% 2026 (R186) (closing yields) (assume 13 full years remaining on the bond) 13.5% 2015 (R157) (closing yields) (assume 3 full years remaining on the bond) Jibar - 3 months Prime overdraft rate (predominant rate) (iv) 6.52 6.52 5.60 5.60 9.00 9.00 1. Calculate (i) to (v) on the above table (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started