Question

In order to bring you up to speed with Garcia Energys current situation, you have been asked to assess Garcia Energys financial performance during 2017

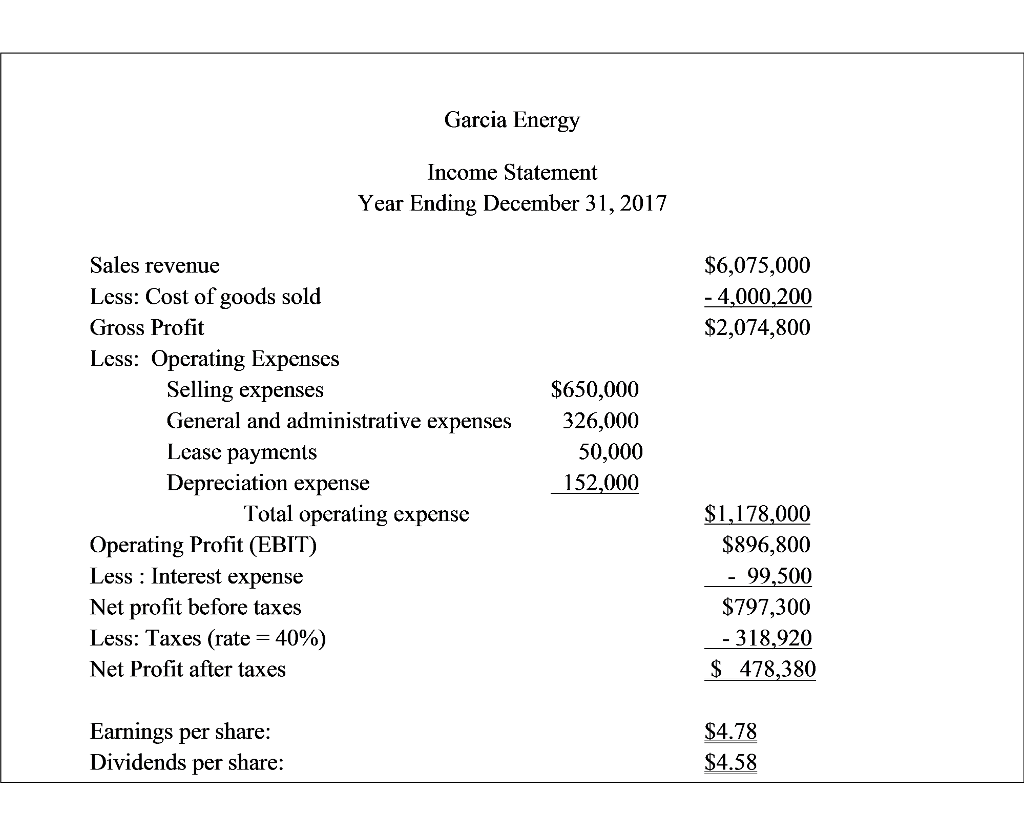

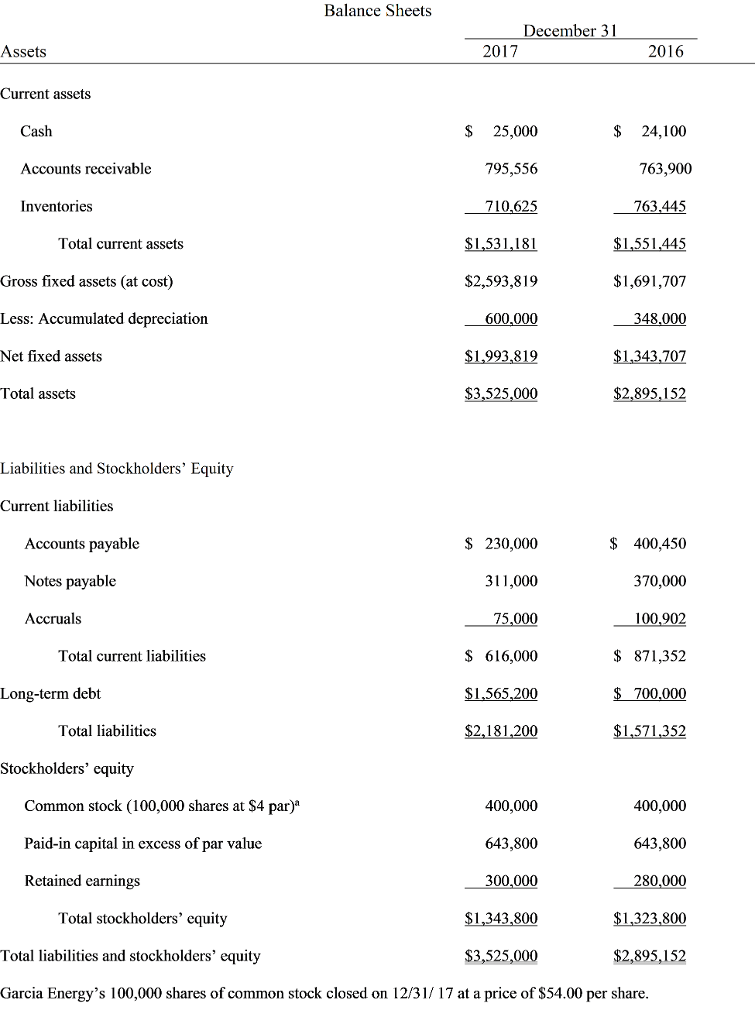

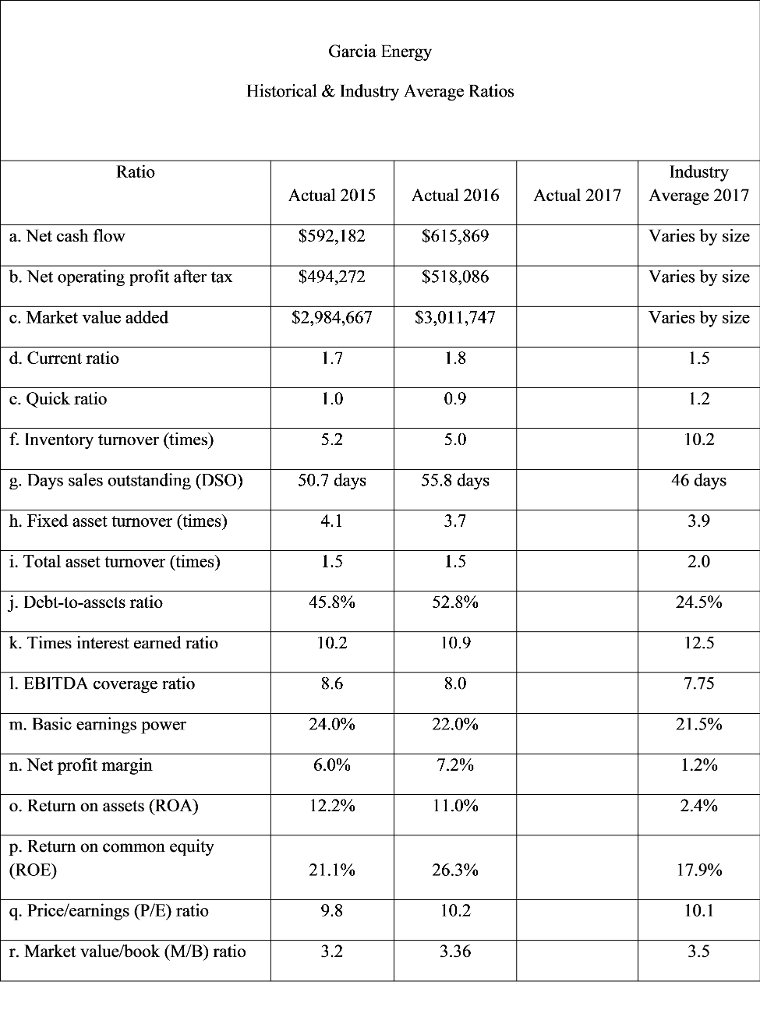

In order to bring you up to speed with Garcia Energys current situation, you have been asked to assess Garcia Energys financial performance during 2017 and its financial position at year-end 2017. To complete this assignment, you have gathered the firms 2017 financial statements (below). In addition, your assistant obtained the firms ratio values for 2015 and 2016, along with the 2017 industry average ratios. During the year, lease payments were $50,000, while sinking fund payments were $25,000.

To Do:

1. a.Calculate the firms 2017 financial ratios, and then fill in the table given at the bottom of this section. (ASSUME a 365-day year)

b.In between 200 and 300 words, analyze the firms current financial position from both a comparative and a trend standpoint. Break your analysis down into evaluations of the firms liquidity, asset management, debt, profitability, and market ratios.

c. In between 100 and 200 words, summarize the firms overall financial position on the basis of your findings in Part I.1 and Part I.2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started