in order to complete your assignment, your boss has told you to make a number of assumptions. They are: A. You are making all projections

in order to complete your assignment, your boss has told you to make a number of assumptions. They are:

A. You are making all projections in December for subsequent years ending December 21.

B. With regard to old branches, assume

1. The 50 old branches employ 4 supervisors and 10 clerical personnel/tellers each.

2. On December 31 (one year hence) 30 teller machines are placed in operation and replace 30 tellers.

3. The bank does not terminate and employees because of the new teller machines. Rather, as tellers quit throughout the year, 30 are not replaced.

4. Turnover is 30 percent for tellers/clerical personnel, and 20 percent for supervisors.

C. With regard to new branches assume

1. New branches are added as follows: 10 in year 1, 12 in year 2 and 16 in year 3.

2. Each new branch employs 14 individuals (4 supervisors and 10 tellers/clerical).

3. New branches are added evenly throughout the year. Thus, for the purpose of calculating turnover on average, there are 5 new branches in year 1 (50^ X 10); 16 in year 2 [10 in year 1 plus 6 (50% x 12)]; and 30 in year 3 [22 plus8(50% x 16)].

4. Turnover is 30 percent for tellers/clerical personnel, and 20 percent for supervisors.

D. With regard to the main office, assume that turnover will be 10 percent per year.

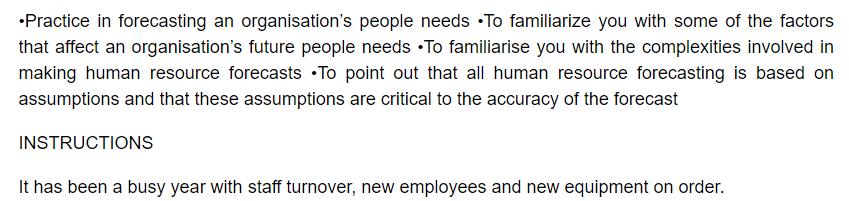

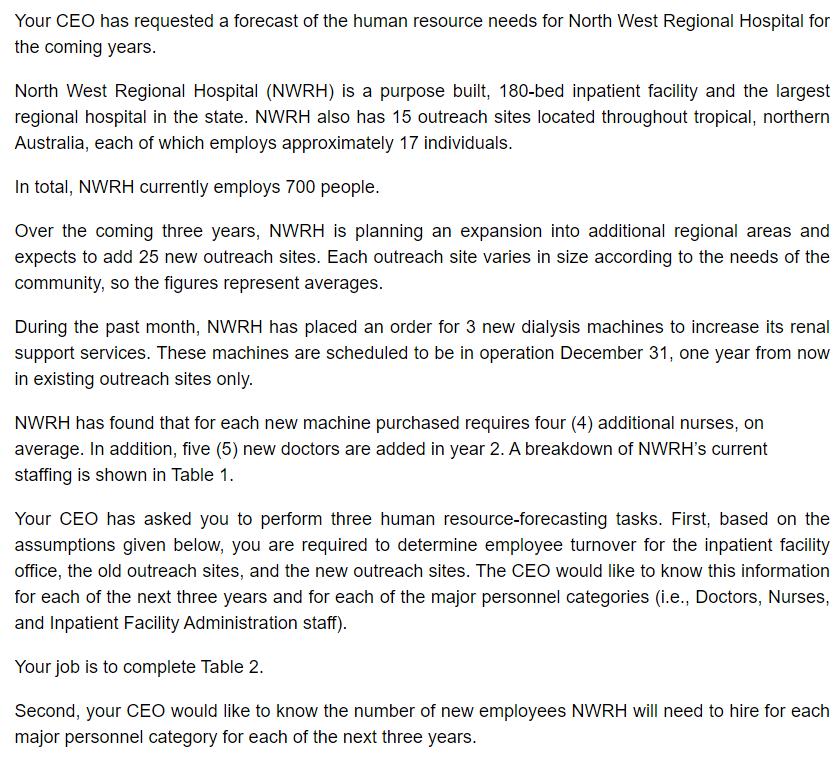

Practice in forecasting an organisation's people needs To familiarize you with some of the factors that affect an organisation's future people needs To familiarise you with the complexities involved in making human resource forecasts To point out that all human resource forecasting is based on assumptions and that these assumptions are critical to the accuracy of the forecast INSTRUCTIONS It has been a busy year with staff turnover, new employees and new equipment on order.

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started