Answered step by step

Verified Expert Solution

Question

1 Approved Answer

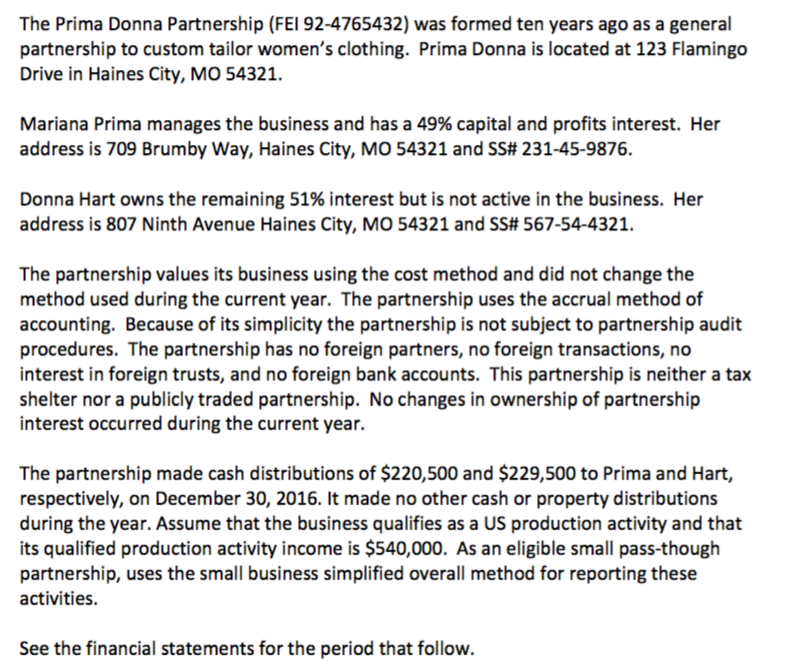

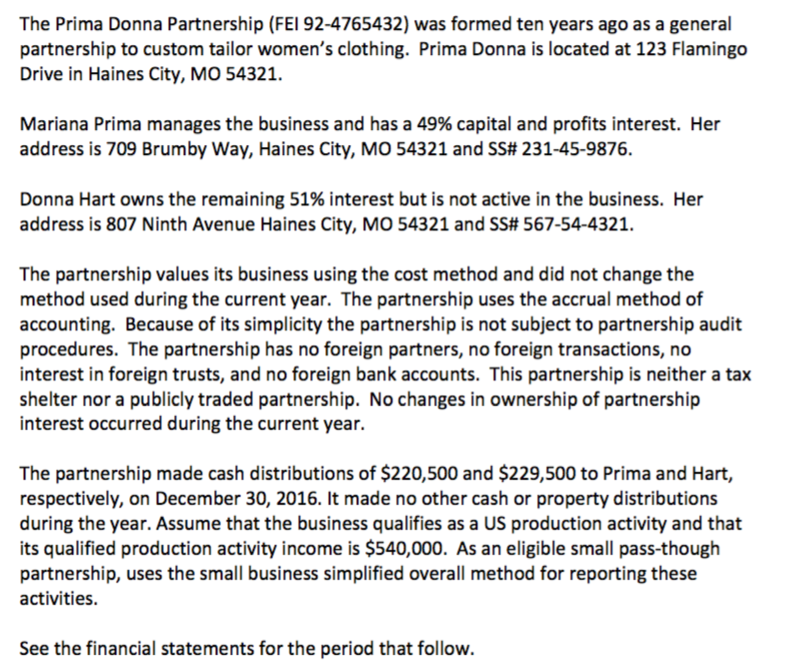

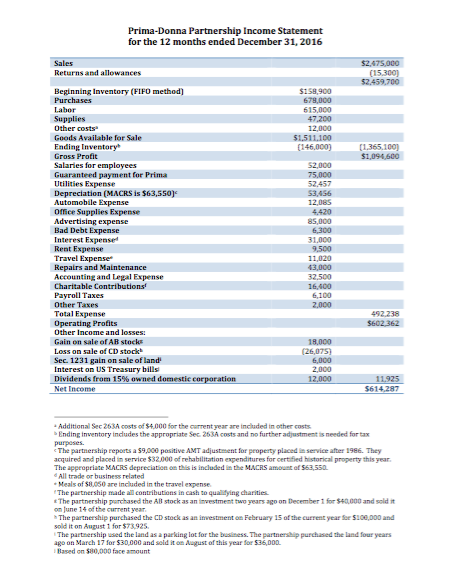

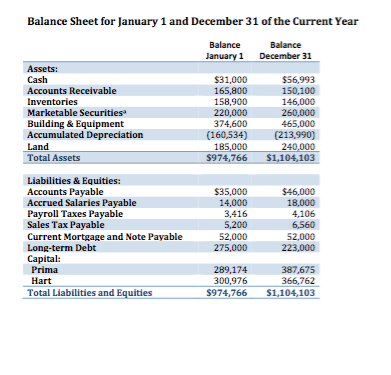

In order to successfully complete this assignment you must: Complete Prima Donna Partnership Form 1065 and all related schedules. Be sure to attach schedules for

In order to successfully complete this assignment you must:

Complete Prima Donna Partnership Form 1065 and all related schedules. Be sure to attach schedules for any line item, which indicates one is required on the 1065. This includes line items that may require you to create a schedule

that identifies the various items that are included in a line on the return these usually indicate "attach schedule." Other lines will indicate specifically which schedule must be included with the return.

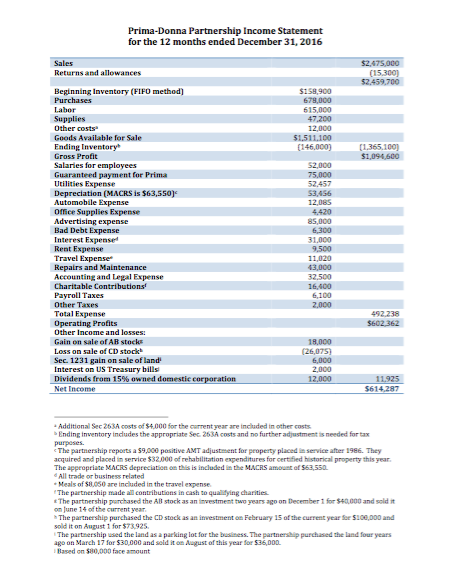

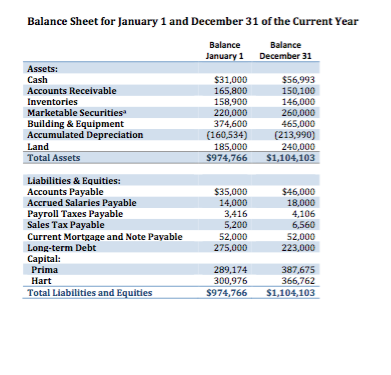

The following assignment is attached.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started