Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In our segment on stock valuation, you were exposed to the dividend discount model (DDM) and Free Cash Flow (FCF) method to estimate a stocks

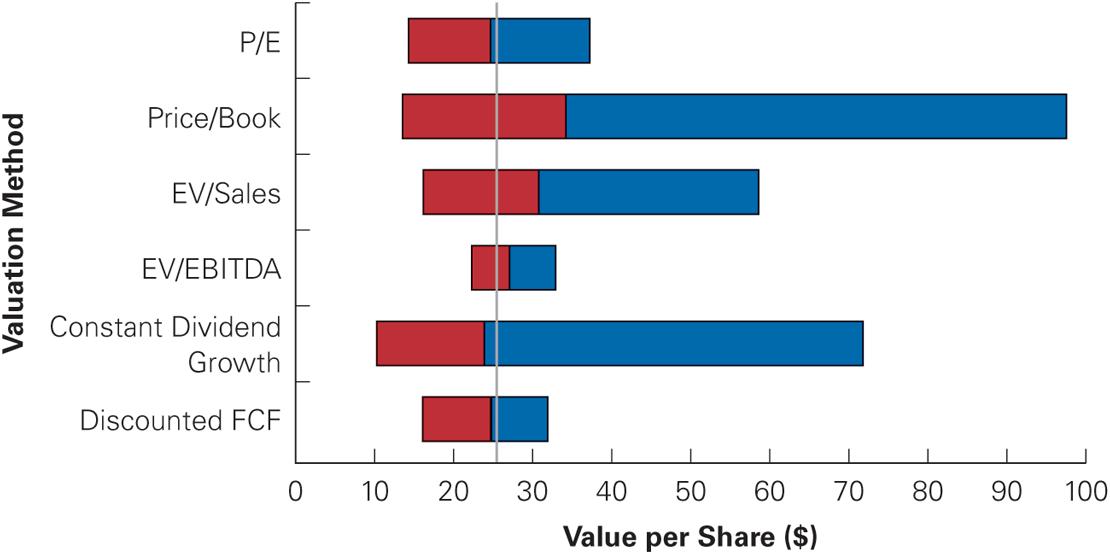

In our segment on stock valuation, you were exposed to the dividend discount model (DDM) and Free Cash Flow (FCF) method to estimate a stock’s price. What about these two methods of equity valuation is different and what about them is the same? Use Figure to compare and contrast the estimates for Kenneth Cole Productions using various methods to estimate the stock price. Which method do you prefer and why? Include at least two citations that support your response.

Valuation Method P/E Price/Book EV/Sales EV/EBITDA Constant Dividend Growth Discounted FCF 0 10 20 30 40 50 60 70 80 90 100 Value per Share ($)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the provided data we can compare and contrast the estimates for Kenneth Cole Productions using various methods to estimate the stock price The same methods 1 All methods use financia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started